Missouri Employee Evaluation Form for Nonprofit

Description

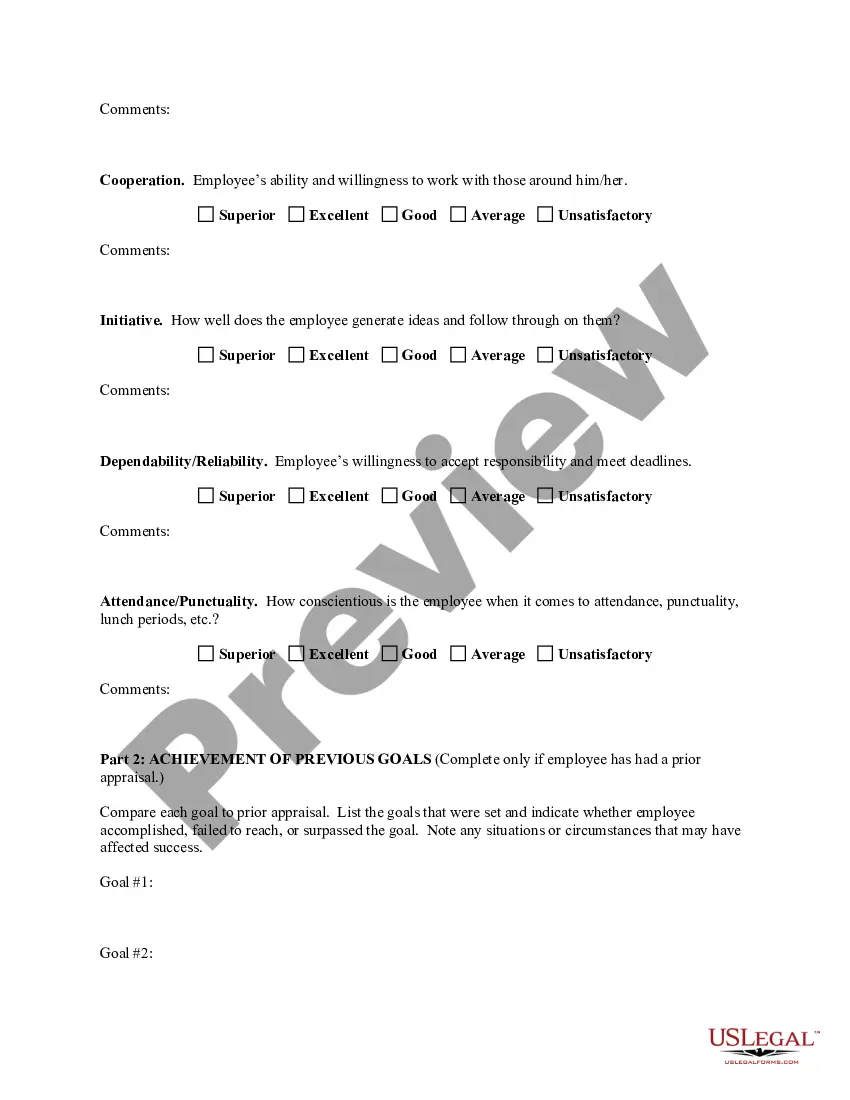

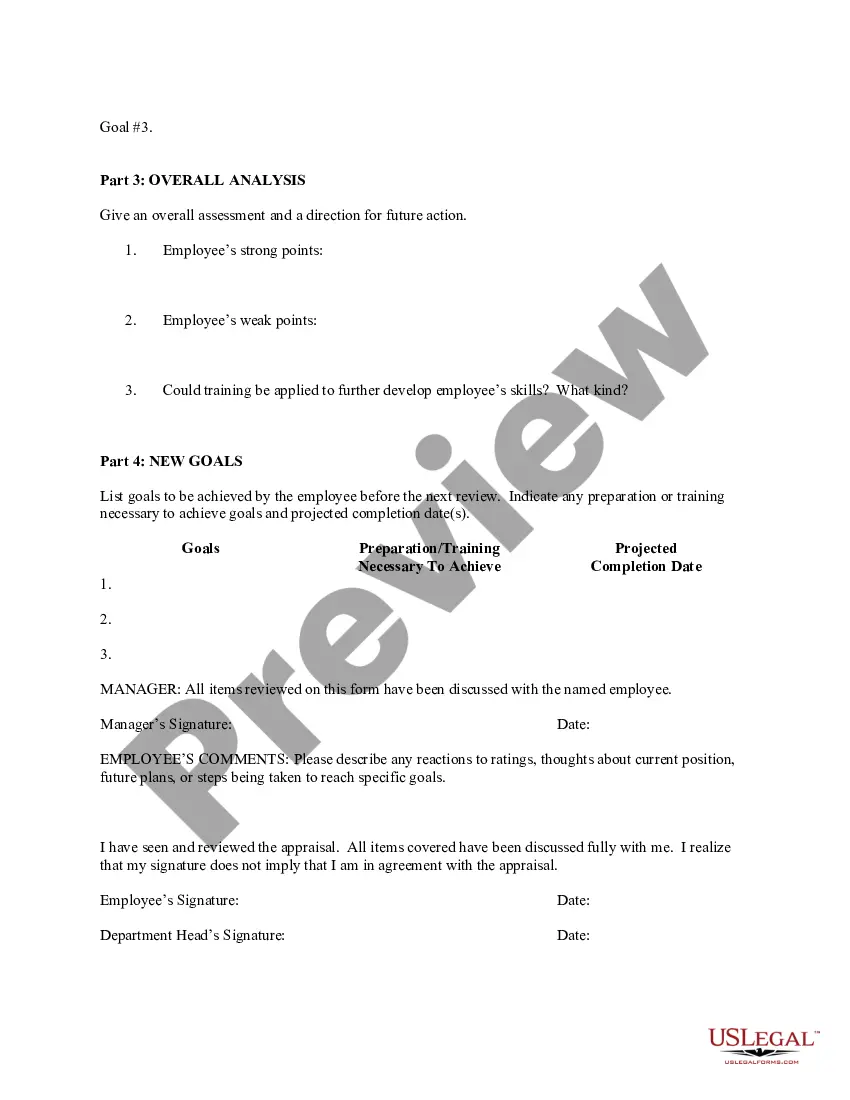

How to fill out Missouri Employee Evaluation Form For Nonprofit?

US Legal Forms - one of the largest libraries of legal varieties in the States - provides a wide range of legal file themes you may obtain or print out. Using the web site, you can get 1000s of varieties for company and individual uses, sorted by classes, claims, or search phrases.You will discover the most recent models of varieties just like the Missouri Employee Evaluation Form for Nonprofit within minutes.

If you have a membership, log in and obtain Missouri Employee Evaluation Form for Nonprofit through the US Legal Forms library. The Acquire option can look on every single form you view. You have accessibility to all previously acquired varieties from the My Forms tab of your account.

If you wish to use US Legal Forms the first time, allow me to share simple guidelines to help you began:

- Ensure you have picked out the correct form for your personal town/area. Click on the Preview option to examine the form`s content. Browse the form information to actually have chosen the appropriate form.

- In the event the form doesn`t satisfy your requirements, utilize the Search area on top of the monitor to get the the one that does.

- If you are pleased with the shape, validate your selection by visiting the Get now option. Then, pick the prices prepare you favor and give your references to register on an account.

- Method the purchase. Utilize your bank card or PayPal account to finish the purchase.

- Select the structure and obtain the shape on your own device.

- Make alterations. Fill out, modify and print out and indicator the acquired Missouri Employee Evaluation Form for Nonprofit.

Each format you put into your bank account lacks an expiration day and is your own property permanently. So, if you wish to obtain or print out an additional version, just check out the My Forms area and then click on the form you will need.

Get access to the Missouri Employee Evaluation Form for Nonprofit with US Legal Forms, the most considerable library of legal file themes. Use 1000s of skilled and state-particular themes that meet up with your small business or individual requirements and requirements.

Form popularity

FAQ

The Individual Income Tax Return (Form MO-1040) is Missouri's long form. It is a universal form that can be used by any taxpayer. If you do not have any of the special filing situations described below and you choose to file a paper tax return, try filing a short form.

Form MO-1040A Missouri Individual Income Tax Short Form.

Form MO-1040A Missouri Individual Income Tax Short Form.

1. The Missouri adjusted gross income of a resident individual shall be the taxpayer's federal adjusted gross income subject to the modifications in this section.

Form MO-A, Part 1, computes Missouri modifications to federal adjusted gross income. Modifications on Lines 1, 2, 3, 4 and 5 include income that is exempt from federal tax, but taxable for state tax purposes.

A is longer and a bit more complex, and Form is the most detailed and challenging of the lot. While anyone can file Form , you must meet certain requirements to use the shorter EZ or A forms. Here's a quick rundown to help you choose the correct form for your situation.

How Income Taxes Are CalculatedFirst, we calculate your adjusted gross income (AGI) by taking your total household income and reducing it by certain items such as contributions to your 401(k).Next, from AGI we subtract exemptions and deductions (either itemized or standard) to get your taxable income.More items...?

Louis Refund? It is a Form used when part of the previous year's state refund is in your federal income. So if you entered a 1099-G in your federal 1040 for a state refund you received last year, this forms subtracts it out for the state return.

Form MO-1040A Missouri Individual Income Tax Short Form.

If you earn more than $1,200 you must file Form MO-1040. If your home of record is Missouri and you are stationed in Missouri due to military orders, all of your income, including your military pay, is taxable to Missouri.