Missouri Involuntary Petition Against a Non-Individual

Description

How to fill out Involuntary Petition Against A Non-Individual?

Are you in a position in which you will need files for both company or person functions nearly every day time? There are a lot of lawful file layouts available online, but getting ones you can rely is not simple. US Legal Forms delivers a large number of form layouts, just like the Missouri Notice to Creditors and Other Parties in Interest - B 205, which can be created to satisfy federal and state specifications.

If you are previously knowledgeable about US Legal Forms web site and possess your account, merely log in. Next, you may down load the Missouri Notice to Creditors and Other Parties in Interest - B 205 web template.

Unless you have an profile and want to start using US Legal Forms, follow these steps:

- Discover the form you need and make sure it is to the proper town/area.

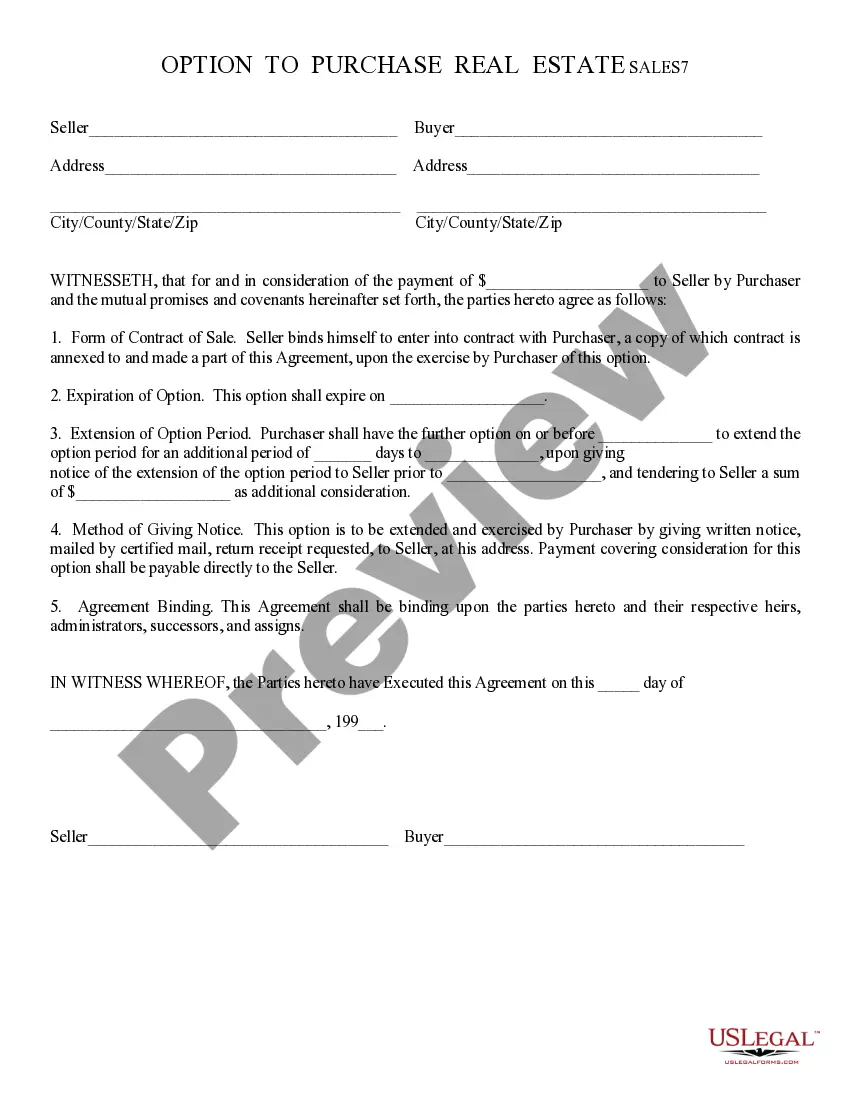

- Use the Preview switch to check the form.

- Look at the information to actually have selected the proper form.

- In case the form is not what you are seeking, take advantage of the Lookup field to obtain the form that suits you and specifications.

- Once you discover the proper form, simply click Buy now.

- Choose the prices prepare you want, fill in the specified info to generate your money, and pay for the transaction making use of your PayPal or bank card.

- Pick a handy data file structure and down load your copy.

Locate every one of the file layouts you have purchased in the My Forms menu. You may get a further copy of Missouri Notice to Creditors and Other Parties in Interest - B 205 at any time, if possible. Just select the required form to down load or produce the file web template.

Use US Legal Forms, by far the most comprehensive selection of lawful varieties, to save lots of time and stay away from blunders. The support delivers expertly created lawful file layouts which can be used for a variety of functions. Make your account on US Legal Forms and start creating your daily life a little easier.

Form popularity

FAQ

Who Is Responsible For Debt When A Person Dies? With very few exceptions, in Missouri the estate of a person is responsible for the debts, but not the individual family members or beneficiaries.

Refusals of Letters One of the most common probate shortcuts is a refusal of letters (?Refusals?), which allows the collection of the Deceased's solely-owned asset(s) when the value of said asset(s) is less than $24,000.

It may come as a relief to find out that, in general, you are not personally liable for your parents' debt. If they pass away with debt, it is repaid out of their estate. However, this means that debt repayment could diminish or eliminate assets and property you could have inherited from your parents.

In Missouri, creditors have 1 year from the decedent's death to file a claim against the estate, or 6 months from the initial publication of the executor appointment notice, whichever comes earlier.

Who Gets What in Missouri? If you die with:here's what happens:spouse but no descendantsspouse inherits everythingspouse and descendants from you and that spousespouse inherits first $20,000 of your intestate property, plus 1/2 of the balance descendants inherit everything else5 more rows

If there's no money in their estate, the debts will usually go unpaid. For survivors of deceased loved ones, including spouses, you're not responsible for their debts unless you shared legal responsibility for repaying as a co-signer, a joint account holder, or if you fall within another exception.

A person having a claim against an estate as a result of a judgment or decree must file his claim within the time specified in § 473.360, RSMo. This may be accomplished by filing a copy of the judgment or decree in the Probate Division within that time. See In re Estate of Wisely, 763 S.W. 2d 691 (Mo.

Upon your death, unsecured debts such as credit card debt, personal loans and medical debt are typically discharged or covered by the estate. They don't pass to surviving family members. Federal student loans and most Parent PLUS loans are also discharged upon the borrower's death.