Missouri Summons to Debtor in Involuntary Case — B 250E is a legal document that serves as a notice to a debtor regarding an involuntary case filed against them. This summons is an essential part of the legal process involved in resolving debts and protecting the rights of both creditors and debtors in Missouri. The purpose of the Missouri Summons to Debtor in Involuntary Case — B 250E is to inform the debtor of the legal action being taken against them, providing all the necessary information about the case. The summons outlines the date, time, and location of the court hearing where the debtor must appear to address the allegations and concerns raised by the creditors. Failure to respond or appear in court can have serious consequences for the debtor. Different types of Missouri Summons to Debtor in Involuntary Case — B 250E may vary based on the specificircumstances FNG the case. However, they generally share the same purpose of providing notice to the debtor about their legal obligations and responsibilities. Some variations can include: 1. Standard Summons to Debtor: This is the most commonly used summons in debt-related cases. It notifies the debtor that a lawsuit has been filed against them, detailing the allegations and specifying the court appearance requirements. 2. Service Summons to Debtor: In certain situations, the court may issue a service summons, which requires a third-party process server to deliver the notice to the debtor in person. This ensures that the debtor receives the summons personally, eliminating any ambiguity or confusion in the delivery. 3. Amended Summons to Debtor: If there are any changes or updates to the original summons, an amended summons may be issued. This document informs the debtor of any modifications in the case or court proceedings, ensuring they remain fully informed throughout the legal process. It is important for debtors to understand that the Missouri Summons to Debtor in Involuntary Case — B 250E is a serious legal document that demands their attention. Ignoring or neglecting the summons can result in adverse outcomes, such as default judgments or further legal consequences. Consequently, debtors should consult with an attorney to discuss their options and formulate an appropriate response to the summons, protecting their interests and ensuring fair resolution of the underlying debt-related issues.

Missouri Summons to Debtor in Involuntary Case - B 250E

Description

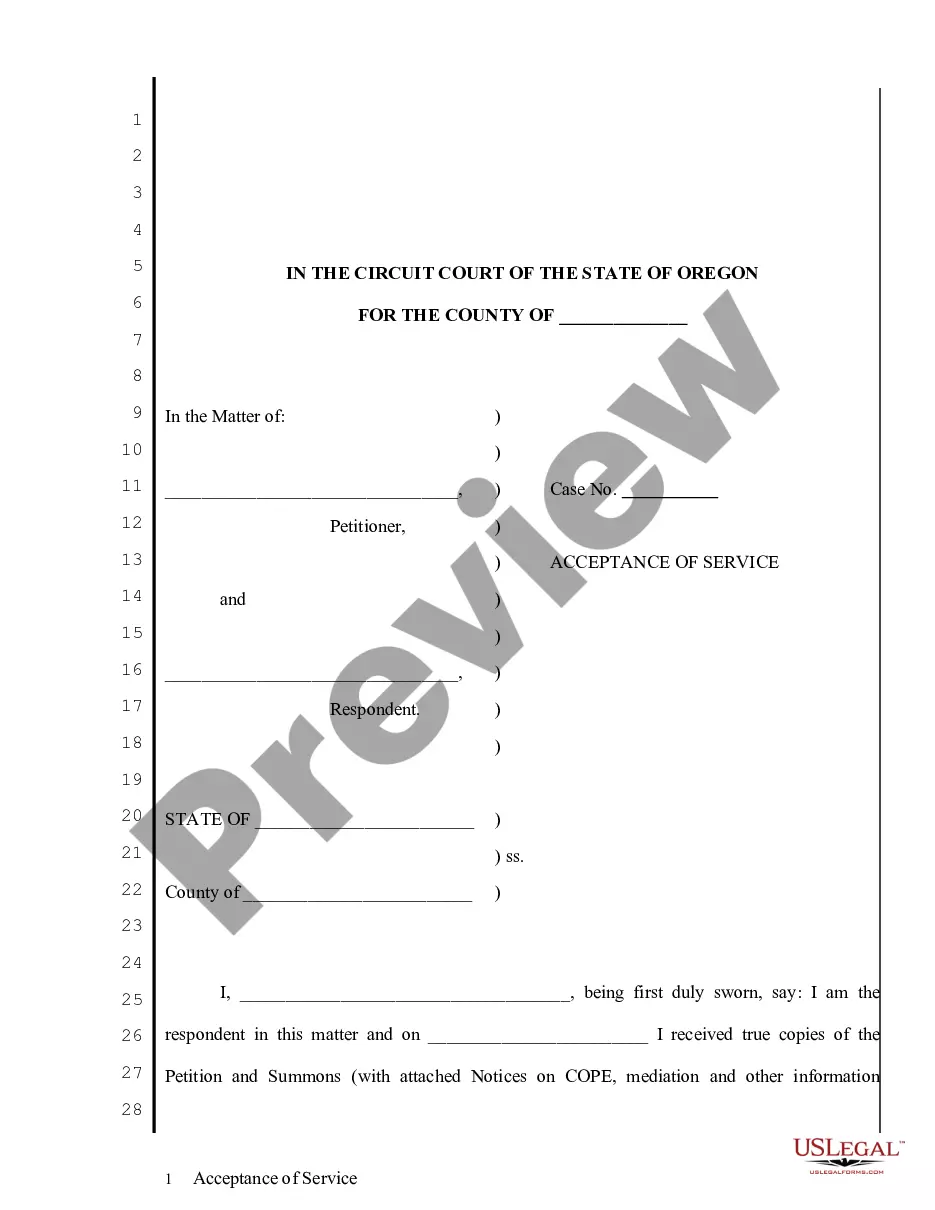

How to fill out Missouri Summons To Debtor In Involuntary Case - B 250E?

US Legal Forms - one of the biggest libraries of legal kinds in the United States - provides an array of legal papers web templates you may download or print. Making use of the internet site, you may get thousands of kinds for organization and specific functions, sorted by categories, states, or keywords and phrases.You can get the newest variations of kinds much like the Missouri Summons to Debtor in Involuntary Case - B 250E in seconds.

If you already possess a registration, log in and download Missouri Summons to Debtor in Involuntary Case - B 250E in the US Legal Forms local library. The Down load option will appear on every type you view. You have accessibility to all in the past acquired kinds inside the My Forms tab of the profile.

If you wish to use US Legal Forms initially, allow me to share basic guidelines to help you get began:

- Be sure you have selected the correct type for your town/region. Click on the Review option to review the form`s articles. Look at the type description to actually have chosen the right type.

- If the type does not match your needs, take advantage of the Look for field near the top of the monitor to find the the one that does.

- Should you be pleased with the form, affirm your decision by clicking the Acquire now option. Then, choose the pricing prepare you like and supply your qualifications to sign up to have an profile.

- Process the purchase. Make use of bank card or PayPal profile to complete the purchase.

- Choose the formatting and download the form on your own system.

- Make adjustments. Fill out, change and print and indication the acquired Missouri Summons to Debtor in Involuntary Case - B 250E.

Every format you added to your bank account does not have an expiry day and it is your own permanently. So, in order to download or print another copy, just visit the My Forms portion and click in the type you require.

Obtain access to the Missouri Summons to Debtor in Involuntary Case - B 250E with US Legal Forms, the most considerable local library of legal papers web templates. Use thousands of professional and express-particular web templates that meet your small business or specific requires and needs.

Form popularity

FAQ

Most bankruptcy cases pass through the bankruptcy process with little objection by creditors. Because the bankruptcy system is encoded into U.S. law and companies can prepare for some debts to discharge through it, creditors usually accept discharge and generally have little standing to contest it.

Limitations on Involuntary Bankruptcy If the debtor has more than 12 unsecured creditors, meanwhile, at least three of them must participate in the bankruptcy petition, and they must meet a threshold amount of unsecured debt as a group, which also increases periodically.

An involuntary case may be commenced only under chapter 7 or 11 of this title, and only against a person, except a farmer, family farmer, or a corporation that is not a moneyed, business, or commercial corporation, that may be a debtor under the chapter under which such case is commenced.

A debtor in possession (DIP) is an individual or corporation that has filed for bankruptcy protection under Chapter 11 of the Bankruptcy Code and holds property or assets which can be used to satisfy creditor claims.