Missouri Promissory Note

Description

How to fill out Promissory Note?

Have you been inside a placement the place you will need papers for possibly business or individual functions virtually every working day? There are a lot of lawful file web templates available on the Internet, but discovering kinds you can trust is not easy. US Legal Forms gives a large number of kind web templates, much like the Missouri Promissory Note, which are written to satisfy state and federal needs.

In case you are already informed about US Legal Forms internet site and get your account, just log in. After that, you can download the Missouri Promissory Note template.

Unless you have an profile and would like to begin using US Legal Forms, abide by these steps:

- Discover the kind you want and make sure it is for the proper metropolis/region.

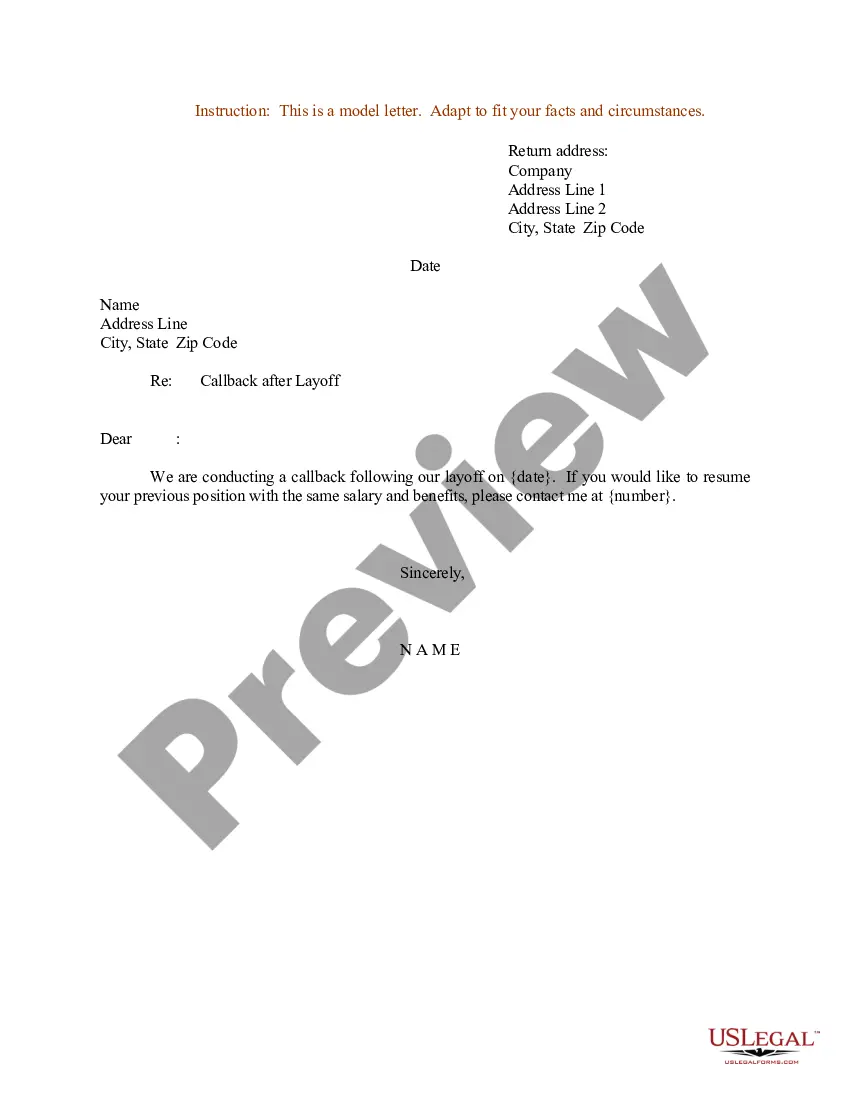

- Use the Preview button to analyze the form.

- Look at the information to ensure that you have selected the proper kind.

- When the kind is not what you are seeking, use the Look for field to get the kind that fits your needs and needs.

- If you obtain the proper kind, just click Acquire now.

- Choose the pricing strategy you want, fill out the necessary information to make your bank account, and pay money for the order utilizing your PayPal or Visa or Mastercard.

- Select a hassle-free data file format and download your backup.

Discover each of the file web templates you might have bought in the My Forms food list. You can get a more backup of Missouri Promissory Note whenever, if needed. Just select the needed kind to download or print the file template.

Use US Legal Forms, by far the most substantial variety of lawful kinds, in order to save time as well as prevent errors. The support gives expertly manufactured lawful file web templates that you can use for a variety of functions. Make your account on US Legal Forms and commence generating your lifestyle easier.

Form popularity

FAQ

Promissory notes don't have to be notarized in most cases. You can typically sign a legally binding promissory note that contains unconditional pledges to pay a certain sum of money. However, you can strengthen the legality of a valid promissory note by having it notarized.

If the borrower does not repay you, your legal recourse could include repossessing any collateral the borrower put up against the note, sending the debt to a collection agency, selling the promissory note (so someone else can try to collect it), or filing a lawsuit against the borrower.

Promissory notes may also be referred to as an IOU, a loan agreement, or just a note. It's a legal lending document that says the borrower promises to repay to the lender a certain amount of money in a certain time frame. This kind of document is legally enforceable and creates a legal obligation to repay the loan.

Promissory notes are legally binding contracts that can hold up in court if the terms of borrowing and repayment are signed and follow applicable laws.

Although it's a legal document, writing a promissory note doesn't have to be difficult. There are even websites online that offer fill-in-the-blank templates, like eForms or .

A promissory note could become invalid if: It isn't signed by both parties. The note violates laws. One party tries to change the terms of the agreement without notifying the other party.

If timely payment is not made by the borrower, the note holder can file an action to recover payment. Depending upon the amount owed and/or specified in the note, a summons and complaint may be filed with the court or a motion in lieu of complaint may be filed for an expedited judgment.