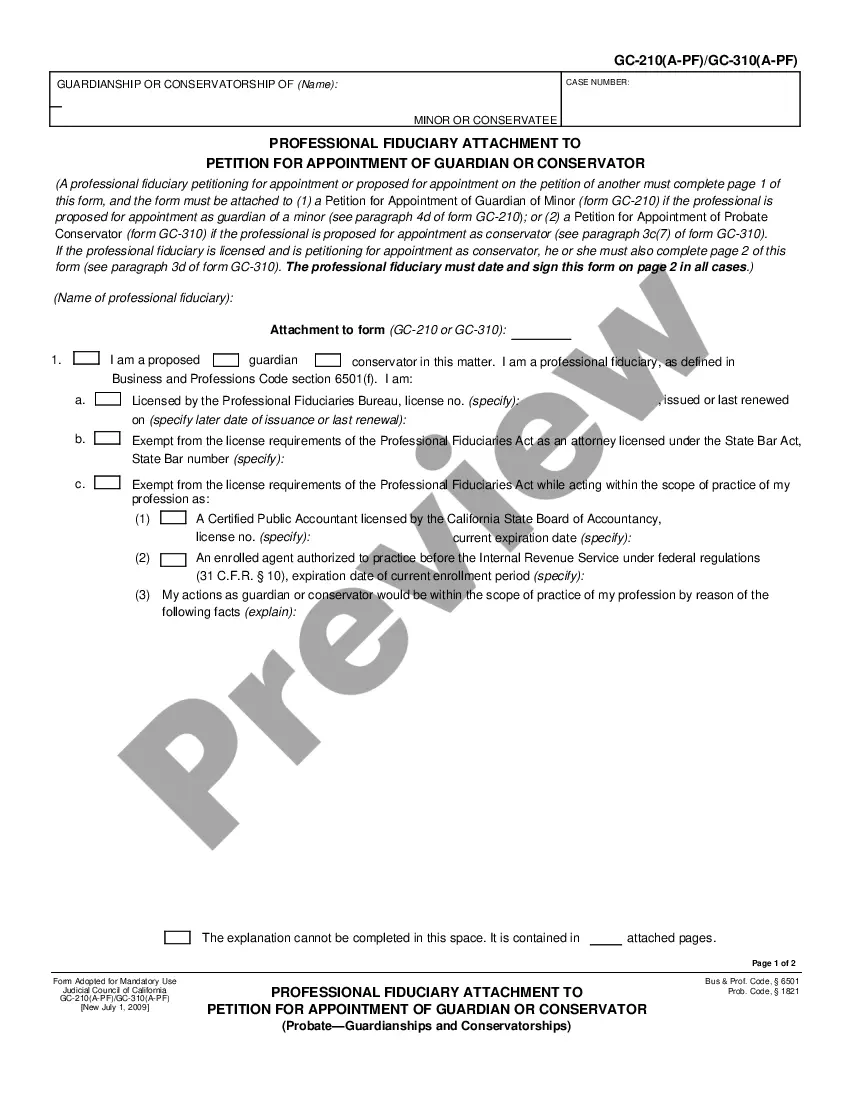

The Missouri Nonemployee Director Stock Option Plan of U.S. Ban corp is a compensation program specifically designed for nonemployee directors of the company who serve on its board. This plan offers stock options as a form of incentive to reward and retain qualified individuals contributing their expertise and guidance to the organization. The Missouri Nonemployee Director Stock Option Plan allows eligible nonemployee directors of U.S. Ban corp based in Missouri to receive stock options as part of their director compensation package. These stock options grant the right to purchase shares of U.S. Ban corp stock at a predetermined price, known as the exercise price, for a specified period of time. By offering stock options, U.S. Ban corp aims to align the interests of its nonemployee directors with those of its shareholders. This incentive encourages directors to make decisions that positively impact the company's performance, driving growth and profitability. As the stock price rises, directors can benefit from the appreciation in value of their stock options. Under the Missouri Nonemployee Director Stock Option Plan, U.S. Ban corp may provide different types of stock options to its nonemployee directors. These types often include: 1. Non-Qualified Stock Options (Nests): These stock options are more commonly granted to nonemployee directors. Nests provide flexibility in terms of timing and tax treatment. Directors have the ability to exercise the options at any time after they vest, subject to certain restrictions. 2. Incentive Stock Options (SOS): Although less common for nonemployee directors, SOS may be offered under this plan. SOS come with potential tax advantages if specific requirements are met, such as holding the stock for a certain period of time before selling. 3. Restricted Stock Units (RSS): In addition to stock options, U.S. Ban corp may also provide RSS to nonemployee directors. RSS represents a contractual right to receive shares of U.S. Ban corp stock in the future, typically upon meeting specific vesting conditions. Through the Missouri Nonemployee Director Stock Option Plan, U.S. Ban corp ensures that its nonemployee directors are recognized and incentivized for their contributions to the company's success. This compensation program allows directors to participate in the company's growth, fostering alignment between their interests and those of shareholders.

Missouri Nonemployee Director Stock Option Plan of U.S. Bancorp

Description

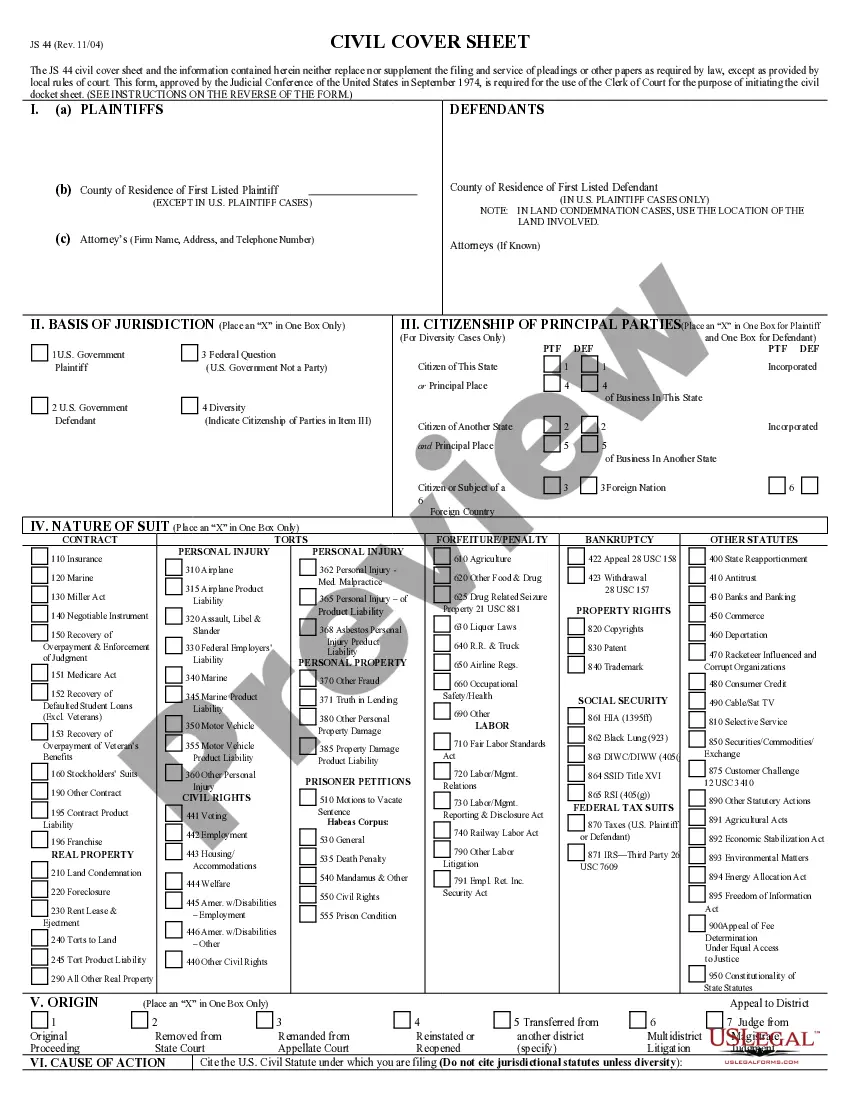

How to fill out Missouri Nonemployee Director Stock Option Plan Of U.S. Bancorp?

Choosing the best lawful record format can be quite a battle. Of course, there are tons of templates accessible on the Internet, but how do you discover the lawful form you need? Take advantage of the US Legal Forms website. The assistance delivers 1000s of templates, such as the Missouri Nonemployee Director Stock Option Plan of U.S. Bancorp, which you can use for business and private requires. Every one of the types are checked by professionals and meet federal and state specifications.

In case you are previously authorized, log in in your bank account and click the Acquire switch to obtain the Missouri Nonemployee Director Stock Option Plan of U.S. Bancorp. Make use of your bank account to appear from the lawful types you might have purchased in the past. Proceed to the My Forms tab of your bank account and get an additional copy in the record you need.

In case you are a whole new customer of US Legal Forms, listed below are easy instructions that you should follow:

- Initially, be sure you have chosen the appropriate form for your metropolis/region. You are able to look over the form making use of the Preview switch and study the form description to make certain it is the best for you.

- In case the form does not meet your preferences, make use of the Seach discipline to get the appropriate form.

- When you are certain that the form is suitable, select the Purchase now switch to obtain the form.

- Opt for the costs strategy you desire and enter in the required info. Design your bank account and buy the transaction utilizing your PayPal bank account or charge card.

- Select the file structure and download the lawful record format in your device.

- Total, revise and printing and indicator the obtained Missouri Nonemployee Director Stock Option Plan of U.S. Bancorp.

US Legal Forms will be the biggest local library of lawful types where you will find various record templates. Take advantage of the company to download appropriately-produced papers that follow status specifications.

Form popularity

FAQ

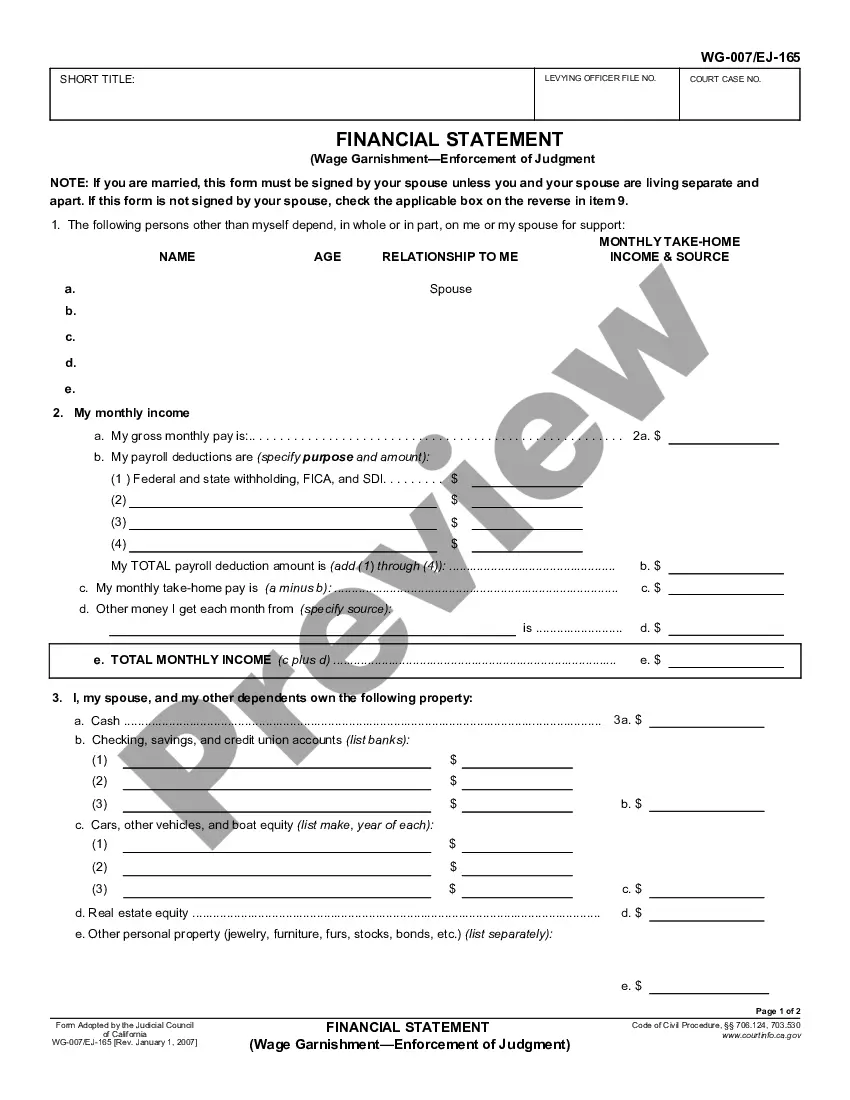

As you can see in the following chart, the majority of U.S. Bancorp's 1.9 billion shares are held by institutional investors. Company insiders, including board members and corporate executives, own a further 0.11% of the outstanding common stock. And the public at large owns the remaining 28%.

If you have questions on your existing CD, call us at 800-872-2657. We accept relay calls.

We're among the increasingly rare companies that offer both a 401(k) and a cash balance pension plan. Funded completely by U.S. Bank, your account grows over time with pay credits based on your age, years of service and pay level, as well as an annual interest credit.

Chip Lupo, Credit Card Writer U.S. Bank is a subsidiary of U.S. Bancorp, a U.S.-based bank holding company headquartered in Minneapolis, Minnesota and founded in 1863. U.S. Bank has been a subsidiary of U.S. Bancorp since it was established as a separate division of the company in 1863.

ICBC is China's largest bank and is 70-percent owned by the government of China. ICBC's total assets are placed at an estimated $2.5 trillion. It is the first large Chinese state-owned lender to acquire control of a US bank.

As Vice Chair and Chief Financial Officer at US BANCORP, Terrance R. Dolan made $6,828,538 in total compensation. Of this total $750,000 was received as a salary, $1,840,500 was received as a bonus, $0 was received in stock options, $4,200,000 was awarded as stock and $38,038 came from other types of compensation.

Your deposits are safe with us. As an FDIC-insured bank, eligible U.S Bank consumer and business deposits are insured unconditionally by the United States government.

And to respond to a question we sometimes hear, U.S. Bank is not part of the U.S. government.