Missouri Stock Option Plan for Federal Savings Association: A Comprehensive Guide Introduction: Missouri Stock Option Plan for Federal Savings Association (MSOP-FSA) refers to the specific program designed to incentivize and reward employees of Federal Savings Associations (FSA's) in the state of Missouri. These stock option plans allow employees to acquire and own company stocks at a predetermined price, encouraging long-term commitment, motivation, and alignment with the organization's success. This detailed description explores the key aspects, benefits, and different types associated with Missouri Stock Option Plans for Federal Savings Associations. Key Features: 1. Incentive-based Compensation: The MSOP-FSA provides FSA's with a powerful tool to attract and retain talented employees by offering them an ownership stake in the organization. This incentive-based compensation structure helps align the interests of employees with the overall growth and profitability of the FSA. 2. Stock Option Grant: Through the MSOP-FSA, eligible employees are granted the option to purchase company stocks at a specified price, often referred to as the strike or exercise price. These options typically have a predetermined vesting period during which the employee must remain employed to exercise their right to buy the shares. 3. Vesting Schedule: The MSOP-FSA outlines a vesting schedule, specifying the time period over which the employee's stock options become exercisable. This schedule aims to encourage long-term commitment and discourage turnover by gradually granting ownership rights, typically over a few years. 4. Stock Option Exercise: Once vested, employees have the choice to exercise their stock options, allowing them to purchase shares at the predetermined price. This provides the employees with the opportunity to benefit from the appreciation in the stock's value over time. 5. Tax Implications: It is essential to consider the tax implications associated with MSOP-FSAs. The Internal Revenue Service (IRS) has established specific regulations regarding the taxation of stock options, including considerations related to ordinary income tax, capital gains tax, and alternative minimum tax. Types of Missouri Stock Option Plans for Federal Savings Associations: 1. Non-Qualified Stock Options (SOS): These are the most common type of stock options available within MSOP-FSAs. SOS provide employees with the flexibility to buy the company's shares at a predetermined price, regardless of their rank or position. 2. Incentive Stock Options (SOS): SOS are typically offered to key employees or executives. These stock options provide preferential tax treatment (if certain requirements are met) by allowing employees to potentially convert their gains into long-term capital gains, resulting in potential tax savings. 3. Restricted Stock Units (RSS): While not technically stock options, RSS are another form of equity compensation frequently used within MSOP-FSAs. RSS grant employees the right to receive company shares upon vesting, without requiring them to make any upfront purchases or exercise decisions. 4. Employee Stock Purchase Plans (ESPN): ESPN allow employees to purchase company stocks at a discounted price, promoting broader employee ownership and participation in the FSA's success. These plans often have specific eligibility criteria and enrollment periods. Conclusion: Missouri Stock Option Plan for Federal Savings Association (MSOP-FSA) serves as a valuable tool for FSA's based in Missouri to attract, retain, and motivate talented employees. Through various types of stock options, such as SOS, SOS, RSS, and ESPN, employees can acquire ownership stakes, fostering a sense of ownership, alignment, and long-term commitment. Understanding the key features and tax implications associated with these plans is crucial to effectively implement and leverage MSOP-FSAs for organizational success.

Missouri Stock Option Plan For Federal Savings Association

Description

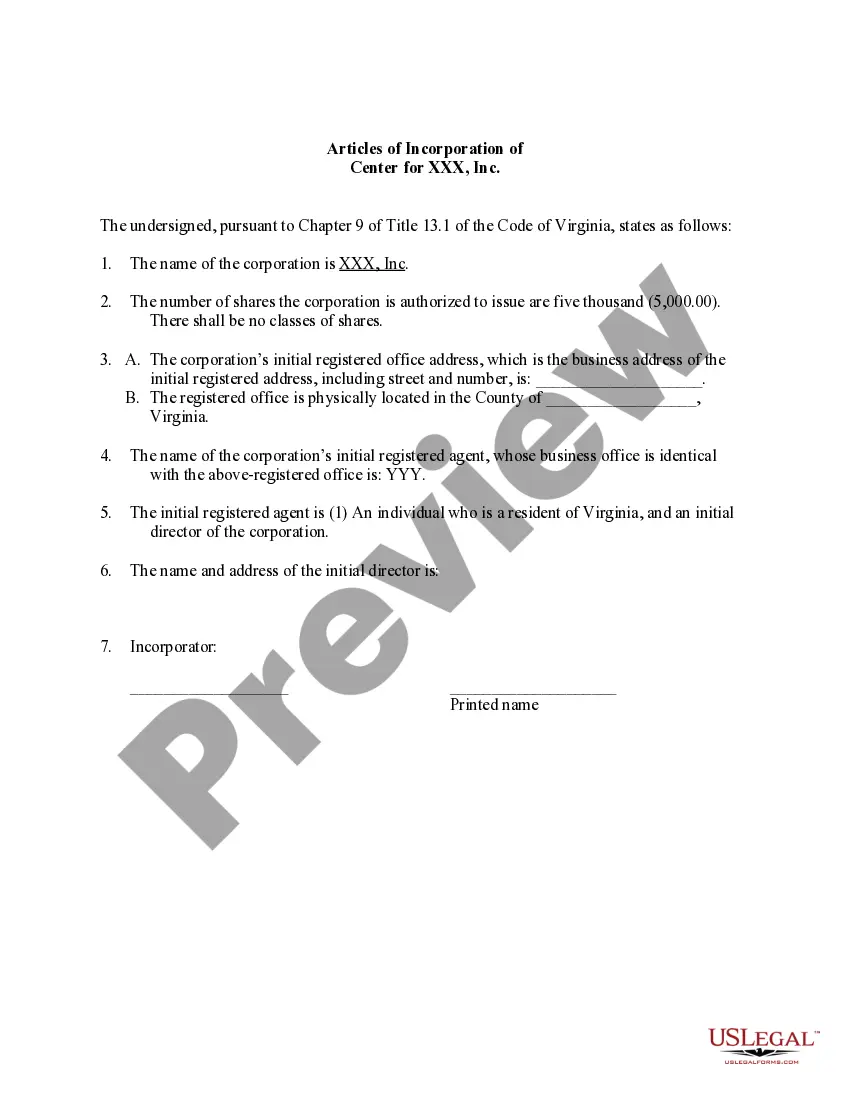

How to fill out Missouri Stock Option Plan For Federal Savings Association?

If you want to complete, down load, or print authorized document web templates, use US Legal Forms, the greatest collection of authorized kinds, that can be found on the Internet. Use the site`s simple and hassle-free search to find the paperwork you need. A variety of web templates for organization and person purposes are categorized by categories and says, or keywords. Use US Legal Forms to find the Missouri Stock Option Plan For Federal Savings Association with a number of click throughs.

If you are presently a US Legal Forms consumer, log in in your account and then click the Obtain button to have the Missouri Stock Option Plan For Federal Savings Association. You can even accessibility kinds you previously downloaded in the My Forms tab of your account.

If you work with US Legal Forms the first time, refer to the instructions under:

- Step 1. Be sure you have chosen the form for your correct area/country.

- Step 2. Use the Review option to look over the form`s content. Never neglect to read through the explanation.

- Step 3. If you are unsatisfied with the type, utilize the Look for field towards the top of the display to discover other variations of your authorized type template.

- Step 4. Upon having found the form you need, click on the Purchase now button. Choose the prices plan you favor and add your accreditations to register on an account.

- Step 5. Process the deal. You should use your charge card or PayPal account to perform the deal.

- Step 6. Pick the formatting of your authorized type and down load it on your gadget.

- Step 7. Full, edit and print or sign the Missouri Stock Option Plan For Federal Savings Association.

Every authorized document template you acquire is your own forever. You may have acces to each and every type you downloaded inside your acccount. Go through the My Forms segment and select a type to print or down load yet again.

Be competitive and down load, and print the Missouri Stock Option Plan For Federal Savings Association with US Legal Forms. There are many skilled and status-specific kinds you can utilize for your personal organization or person needs.