Missouri Dividend Equivalent Shares are a type of investment product specifically offered in the state of Missouri. These shares allow investors to indirectly participate in the dividends paid by Missouri-based companies without actually purchasing their individual shares. Investing in Missouri Dividend Equivalent Shares provides investors with an opportunity to earn income from both capital appreciation and dividends generated by the underlying portfolio. These shares are typically issued by investment management firms and offer exposure to a diversified selection of Missouri-based companies across various industries. Dividend Equivalent Shares are designed to mirror the performance of an underlying benchmark, such as the Missouri Stock Index, which represents the overall performance of Missouri-based companies. Investors can track the performance of their investment through this benchmark, as it reflects the general trends and movements of the local market. There are generally two types of Missouri Dividend Equivalent Shares available: 1. Broad-based Dividend Equivalent Shares: These shares provide exposure to a wide range of Missouri-based companies across different sectors and industries. This type of investment aims to capture the overall performance of the state's economy and offers investors a diversified portfolio. 2. Sector-specific Dividend Equivalent Shares: These shares concentrate on a specific sector or industry within Missouri. Investors can choose shares that focus on sectors such as technology, healthcare, financial services, or energy, among others. Sector-specific Dividend Equivalent Shares allow investors to target their investments and capitalize on potential growth opportunities within a particular industry. Investors who are interested in Missouri Dividend Equivalent Shares should carefully assess their investment objectives, risk tolerance, and desired level of diversification before deciding on the type of shares to invest in. It is advisable to consult with a financial advisor or investment professional to determine the most suitable investment strategy. In conclusion, Missouri Dividend Equivalent Shares provide investors with the opportunity to indirectly participate in the dividends paid by Missouri-based companies. These shares are available in broad-based or sector-specific forms, offering investors a range of options to tailor their investments to their specific preferences and risk appetite.

Missouri Dividend Equivalent Shares

Description

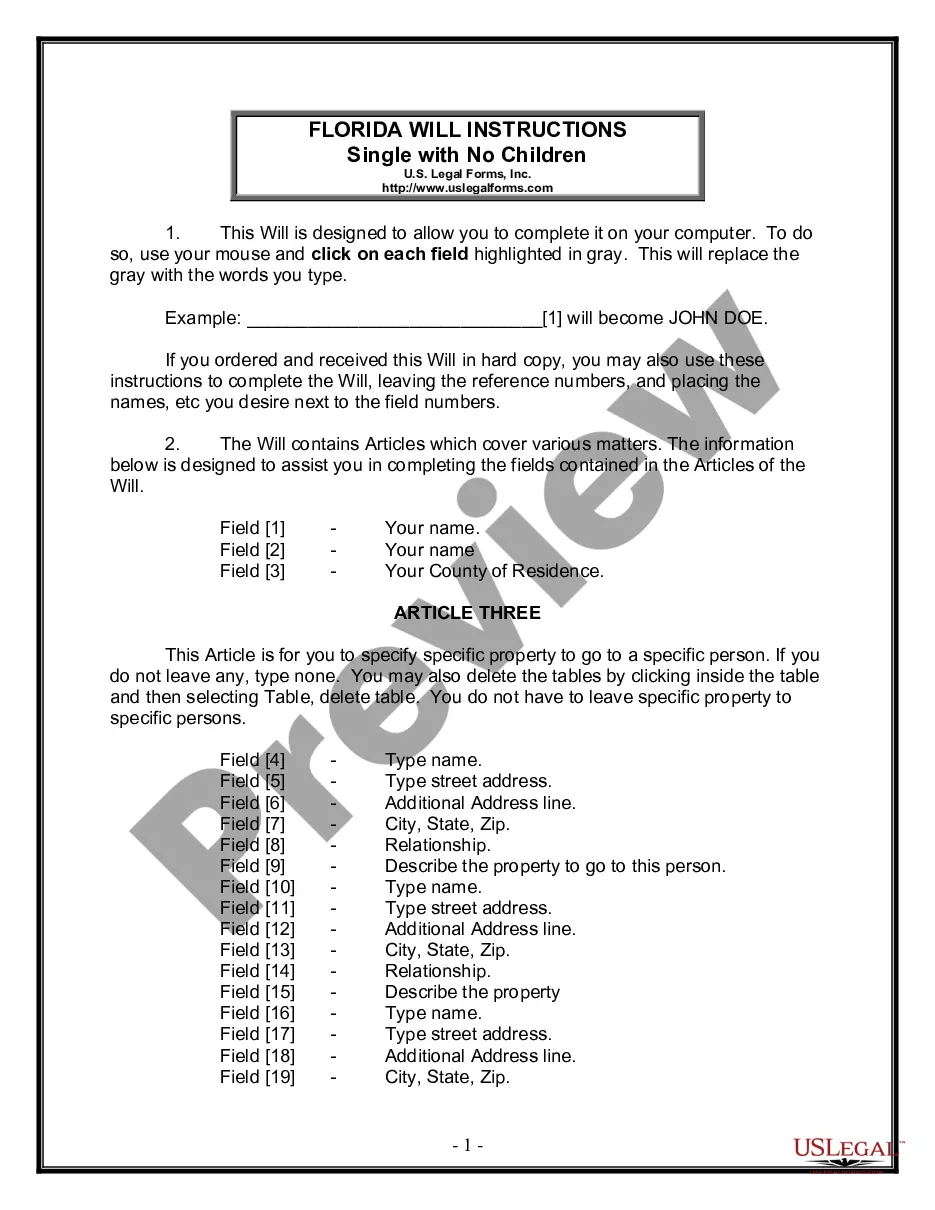

How to fill out Missouri Dividend Equivalent Shares?

US Legal Forms - one of several largest libraries of authorized varieties in America - provides an array of authorized record layouts you are able to down load or produce. Using the website, you may get a huge number of varieties for enterprise and individual functions, sorted by classes, suggests, or key phrases.You can get the most up-to-date models of varieties like the Missouri Dividend Equivalent Shares in seconds.

If you already possess a monthly subscription, log in and down load Missouri Dividend Equivalent Shares through the US Legal Forms catalogue. The Download option can look on every single kind you see. You gain access to all formerly downloaded varieties in the My Forms tab of the bank account.

If you would like use US Legal Forms the first time, here are easy instructions to get you started:

- Be sure you have selected the best kind to your city/county. Go through the Preview option to analyze the form`s articles. See the kind outline to ensure that you have chosen the proper kind.

- In case the kind does not fit your needs, utilize the Look for industry near the top of the screen to obtain the one which does.

- If you are satisfied with the shape, confirm your selection by visiting the Acquire now option. Then, pick the pricing prepare you like and offer your references to sign up to have an bank account.

- Method the purchase. Utilize your credit card or PayPal bank account to complete the purchase.

- Find the formatting and down load the shape on your own system.

- Make adjustments. Fill out, change and produce and sign the downloaded Missouri Dividend Equivalent Shares.

Every format you included in your money does not have an expiration day and it is the one you have for a long time. So, if you wish to down load or produce yet another copy, just proceed to the My Forms segment and then click about the kind you require.

Obtain access to the Missouri Dividend Equivalent Shares with US Legal Forms, one of the most extensive catalogue of authorized record layouts. Use a huge number of specialist and state-specific layouts that satisfy your company or individual demands and needs.

Form popularity

FAQ

Dividend Data Altria Group, Inc.'s ( MO ) dividend yield is 9.75%, which means that for every $100 invested in the company's stock, investors would receive $9.75 in dividends per year. Altria Group, Inc.'s payout ratio is 76.84% which means that 76.84% of the company's earnings are paid out as dividends.

MO Dividend Safety Grade TypeGradeMODividend Payout Ratio (FY1) (Non GAAP)view ratings77.17%Cash Flow Payout Ratio (TTM)view ratings58.41%Cash Flow Payout Ratio (FY1)view ratings82.46%Free Cash Flow Yield to Dividend Yield Ratio (TTM)view ratings1.65%23 more rows

(NYSE: MO) today announced that our Board of Directors voted to increase our regular quarterly dividend by 4.3% to $0.98 per share versus the previous rate of $0.94 per share. The quarterly dividend is payable on October 10, 2023 to shareholders of record as of September 15, 2023.

The NOL deduction cannot exceed the corporation's taxable income (after special deductions). An NOL deduction cannot be used to increase a loss in a loss year or to create a loss in a profit year.

A 40% payout ratio would be favorable for an investor because a payout ratio below 50% gives a company enough flexibility to reward shareholders while reinvesting in new projects.

Dividends: Dividends to the extent included in federal taxable income are subtracted in determining Missouri taxable income. Dividends from a Missouri payor are apportioned and then subtracted from apportioned income.

Altria Group (NYSE:MO) 5-Year Dividend Growth Rate. Altria Group's Dividends per Share for the three months ended in Sep. 2023 was $0.98. During the past 12 months, Altria Group's average Dividends Per Share Growth Rate was 4.40% per year.

(NYSE: MO) today announced that our Board of Directors voted to increase our regular quarterly dividend by 4.3% to $0.98 per share versus the previous rate of $0.94 per share. The quarterly dividend is payable on October 10, 2023 to shareholders of record as of September 15, 2023.