Title: A Comprehensive Overview of Missouri Approval of Company Employee Stock Purchase Plan (ESPN) Introduction: The Missouri Approval of Company Employee Stock Purchase Plan (ESPN) is a program offered by companies to their employees, uniquely designed to provide advantageous opportunities for investment in the company's stock. This detailed description will explore the significance of ESPN and outline various types of plans approved in Missouri while incorporating relevant keywords throughout. 1. Understanding the Employee Stock Purchase Plan (ESPN) concept: The Employee Stock Purchase Plan (ESPN) allows eligible employees of a company to purchase company stocks at a discounted price, usually through payroll deductions. This provides employees with an opportunity to own a stake in the organization and potentially benefit from its growth. 2. Missouri Approval of Company ESPN Importance: The Missouri Approval of Company ESPN is of utmost significance as it ensures compliance with state laws and regulations governing the implementation and administration of ESPN within the state. This approval ensures that companies abide by the specific legal requirements set forth regarding stock purchase plans, safeguarding employee rights and maintaining transparency. 3. Types of Missouri Approval of Company ESPN: a. Qualified Employee Stock Purchase Plan: The Qualified ESPN meets the eligibility criteria defined under Section 423 of the Internal Revenue Code. It allows employees to acquire company stocks at a discounted rate, typically up to 15% of the market value. Additionally, participation in this plan can offer tax advantages, including tax-deferred contributions and potential capital gains tax treatment. b. Non-Qualified Employee Stock Purchase Plan: The Non-Qualified ESPN does not adhere to the specific requirements outlined in Section 423 of the Internal Revenue Code. While employees still have the opportunity to purchase company stocks at a discount, the benefits of tax advantages associated with the Qualified ESPN may not apply. 4. Missouri ESPN Approval Process: To obtain the Missouri Approval for an ESPN, companies must adhere to specific guidelines, including: — Compliance with state securities laws and regulations. — Providing comprehensive documentation and plan details to state authorities. — Ensuring transparency about the nature of the plan, including eligibility requirements, discount rates, vesting periods, stock purchase periods, and any conditions or limitations. 5. Benefits of Missouri Approved ESPN: a. Employee Engagement and Motivation: ESPN can enhance employee morale, loyalty, and financial engagement with the company, as employees have a personal investment in its success. b. Potential Financial Growth: Participating employees may potentially benefit from the company's stock price appreciation and earn above-average returns on their investments. c. Long-Term Investment: ESPN encourages a long-term investment mindset, as employees are incentivized to hold onto their stocks, fostering loyalty and stability within the company. d. Flexible Contribution Options: Employees typically have the option to set aside a portion of their salary towards the ESPN, allowing them to customize their contributions based on their financial circumstances. e. Financial Education: ESPN often provide employees with financial education resources, guiding them towards making informed investment decisions and enhancing their financial literacy. Conclusion: The Missouri Approval of Company Employee Stock Purchase Plans plays a vital role in ensuring compliance and protection of employee rights. Companies offering ESPN in Missouri have the opportunity to foster employee engagement, provide potential financial growth, and develop a long-term investment mindset among their workforce. Adherence to Missouri's specific guidelines and obtaining approval for either a qualified or non-qualified ESPN allows companies to establish well-rounded programs that benefit both the employees and the organization as a whole.

Missouri Approval of Company Employee Stock Purchase Plan

Description

How to fill out Missouri Approval Of Company Employee Stock Purchase Plan?

US Legal Forms - one of several biggest libraries of legitimate kinds in America - offers a wide array of legitimate record layouts you may download or produce. While using site, you can find a huge number of kinds for business and specific functions, sorted by types, claims, or search phrases.You can get the newest variations of kinds much like the Missouri Approval of Company Employee Stock Purchase Plan in seconds.

If you already have a membership, log in and download Missouri Approval of Company Employee Stock Purchase Plan through the US Legal Forms catalogue. The Acquire button will show up on every single develop you perspective. You have access to all previously delivered electronically kinds from the My Forms tab of your respective profile.

In order to use US Legal Forms the first time, listed here are straightforward directions to get you began:

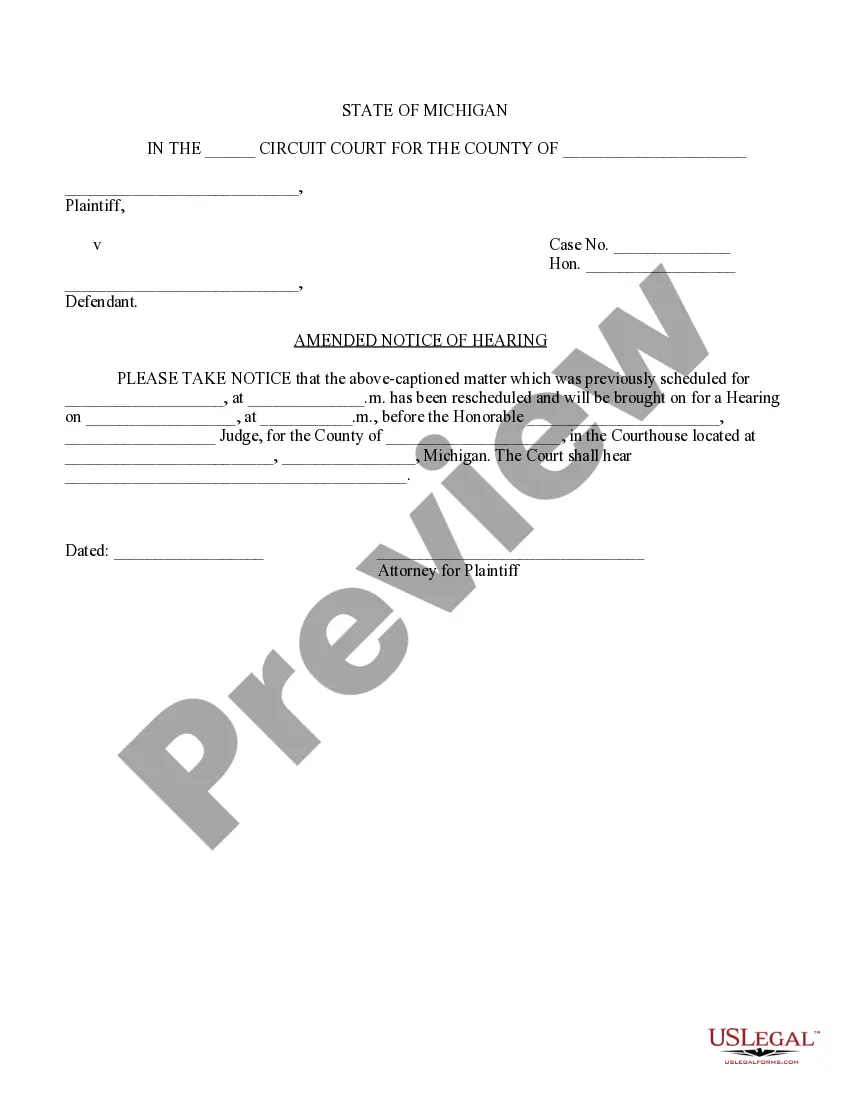

- Be sure to have picked the right develop for your area/state. Click the Review button to examine the form`s articles. Read the develop outline to actually have selected the appropriate develop.

- If the develop doesn`t suit your specifications, utilize the Research area towards the top of the display screen to discover the the one that does.

- When you are satisfied with the form, affirm your option by clicking on the Buy now button. Then, select the prices strategy you favor and supply your credentials to register on an profile.

- Process the purchase. Use your bank card or PayPal profile to accomplish the purchase.

- Find the formatting and download the form on your own system.

- Make modifications. Complete, modify and produce and indicator the delivered electronically Missouri Approval of Company Employee Stock Purchase Plan.

Every single template you included with your bank account does not have an expiry day and is your own property eternally. So, in order to download or produce an additional backup, just proceed to the My Forms area and click on in the develop you need.

Obtain access to the Missouri Approval of Company Employee Stock Purchase Plan with US Legal Forms, by far the most considerable catalogue of legitimate record layouts. Use a huge number of expert and state-distinct layouts that satisfy your organization or specific needs and specifications.

Form popularity

FAQ

That's why you'll find that most employers will only share the following information about former employees in references: job title. responsibilities. dates of employment. overall job performance. professional conduct. reason for leaving.

For the purpose of this subsection, "safety-sensitive positions" shall mean public employment involving the performance of duties which have a direct and immediate impact on the safety of the public and other public employees. (L. 1993 S.B. 67 §§ 8, 9)

Federal law doesn't prohibit employers from sharing the reasons for terminating an employee. Some state laws regulate what employers can say about former employees. Check with the state department of labor for restrictions in your location.

Under California law, an employer is not obligated to provide a reference for a former employee, but should it choose to do so, the employer may provide information about job performance, qualifications, and eligibility for rehire.

What Employers Want to Know Dates of employment. Educational degrees and dates. Job title. Job description. Why the employee left the job. Whether the employee was terminated for cause. Whether there were any issues with the employee regarding absenteeism or tardiness. Whether the employee is eligible for rehire.

Disclosure of the nature and character of service rendered by the current or former employee to the disclosing employer and the duration thereof. A truthful statement of the cause, if any, of discharge or cessation of employment.