Missouri Proposal to approve restricted stock plan

Description

How to fill out Proposal To Approve Restricted Stock Plan?

You are able to invest hours on the Internet searching for the legal papers design which fits the state and federal specifications you want. US Legal Forms provides a large number of legal kinds that happen to be examined by specialists. It is possible to download or produce the Missouri Proposal to approve restricted stock plan from my service.

If you already possess a US Legal Forms profile, you are able to log in and click on the Down load option. Following that, you are able to comprehensive, edit, produce, or sign the Missouri Proposal to approve restricted stock plan. Each legal papers design you purchase is your own property permanently. To have yet another version associated with a acquired form, visit the My Forms tab and click on the related option.

If you work with the US Legal Forms internet site the very first time, keep to the simple recommendations listed below:

- First, ensure that you have chosen the best papers design for the state/city of your choice. See the form explanation to ensure you have chosen the right form. If available, make use of the Review option to search through the papers design also.

- In order to get yet another edition of your form, make use of the Lookup discipline to obtain the design that meets your requirements and specifications.

- Once you have found the design you need, just click Get now to carry on.

- Pick the pricing strategy you need, type your qualifications, and register for a merchant account on US Legal Forms.

- Full the deal. You can utilize your bank card or PayPal profile to fund the legal form.

- Pick the structure of your papers and download it in your device.

- Make changes in your papers if necessary. You are able to comprehensive, edit and sign and produce Missouri Proposal to approve restricted stock plan.

Down load and produce a large number of papers templates while using US Legal Forms website, that provides the biggest variety of legal kinds. Use specialist and state-specific templates to tackle your small business or person demands.

Form popularity

FAQ

Wages. Reportable wages include gross payments plus the reasonable cash value of any goods or services which the employee receives for work performed in lieu of money. These are called ?in-kind? wages (meals receive special treatment). Bonuses, commissions, vacation pay, holiday pay and termination pay are wages.

It may come as a surprise, but Missouri has no legal mandate regarding breaks during the workday. This essentially means that employers are not required to provide a break to their employees, even through an entire eight-hour shift. However, this doesn't mean it is not possible.

Deduction. An employer may deduct funds from an employee's wages for cash register shortages, damage to equipment, or for similar reasons. Deductions can be made from an employee's wages as long as the deductions do not take the employee's wages below the required minimum hourly wage rate.

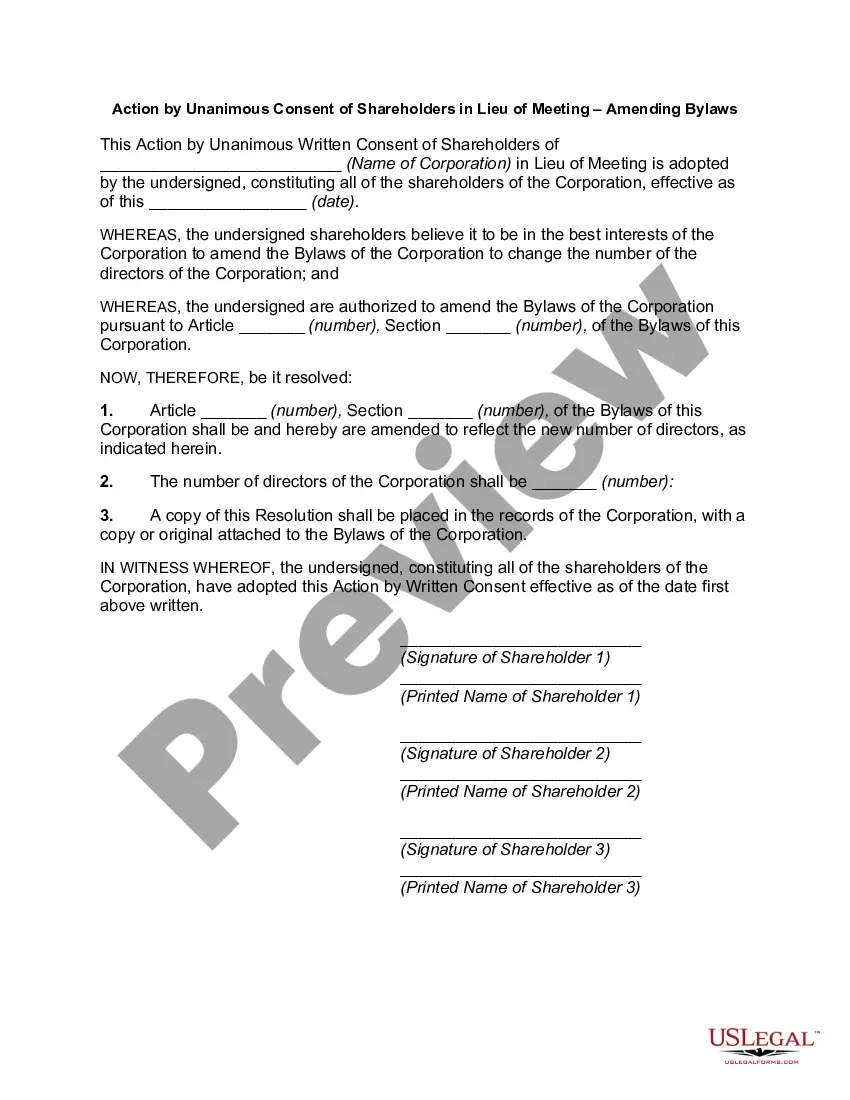

A restricted stock unit (RSU) is a form of equity compensation that companies issue to employees. An RSU is a promise from your employer to give you shares of the company's stock (or the cash equivalent) on a future date?as soon as you meet certain conditions.

It is important to note that Missouri does use at-will employment laws, as do most other states. Most employees will fall under these laws if they do not have a contract. What this means for you, as an employer, is that you can fire employees whenever you wish. They can also quit at will.

Missouri has no minimum or maximum amount of hours you have to work to be considered full-time or part-time. Instead, they leave that up to your employer to decide.

Employers are required to pay a discharged employee all wages due at the time of dismissal. If not paid at that time, the employee should contact his or her former employer by certified mail return receipt requested, requesting wages that are due. The employer has seven days to respond to the written request.

Restricted Stock Units cannot be sold or transferred while they are subject to forfeiture. This means that the employee cannot sell or transfer the units until they are vested.