Missouri Phantom Stock Plan of Hercules, Inc.

Description

How to fill out Phantom Stock Plan Of Hercules, Inc.?

Are you currently in the situation in which you require paperwork for sometimes company or individual uses nearly every working day? There are a variety of authorized record web templates available on the Internet, but getting ones you can rely on isn`t straightforward. US Legal Forms delivers a huge number of form web templates, such as the Missouri Phantom Stock Plan of Hercules, Inc., which are written to satisfy federal and state requirements.

If you are already familiar with US Legal Forms web site and get a merchant account, just log in. Afterward, you can acquire the Missouri Phantom Stock Plan of Hercules, Inc. web template.

Should you not come with an profile and need to start using US Legal Forms, follow these steps:

- Find the form you will need and ensure it is for that proper area/state.

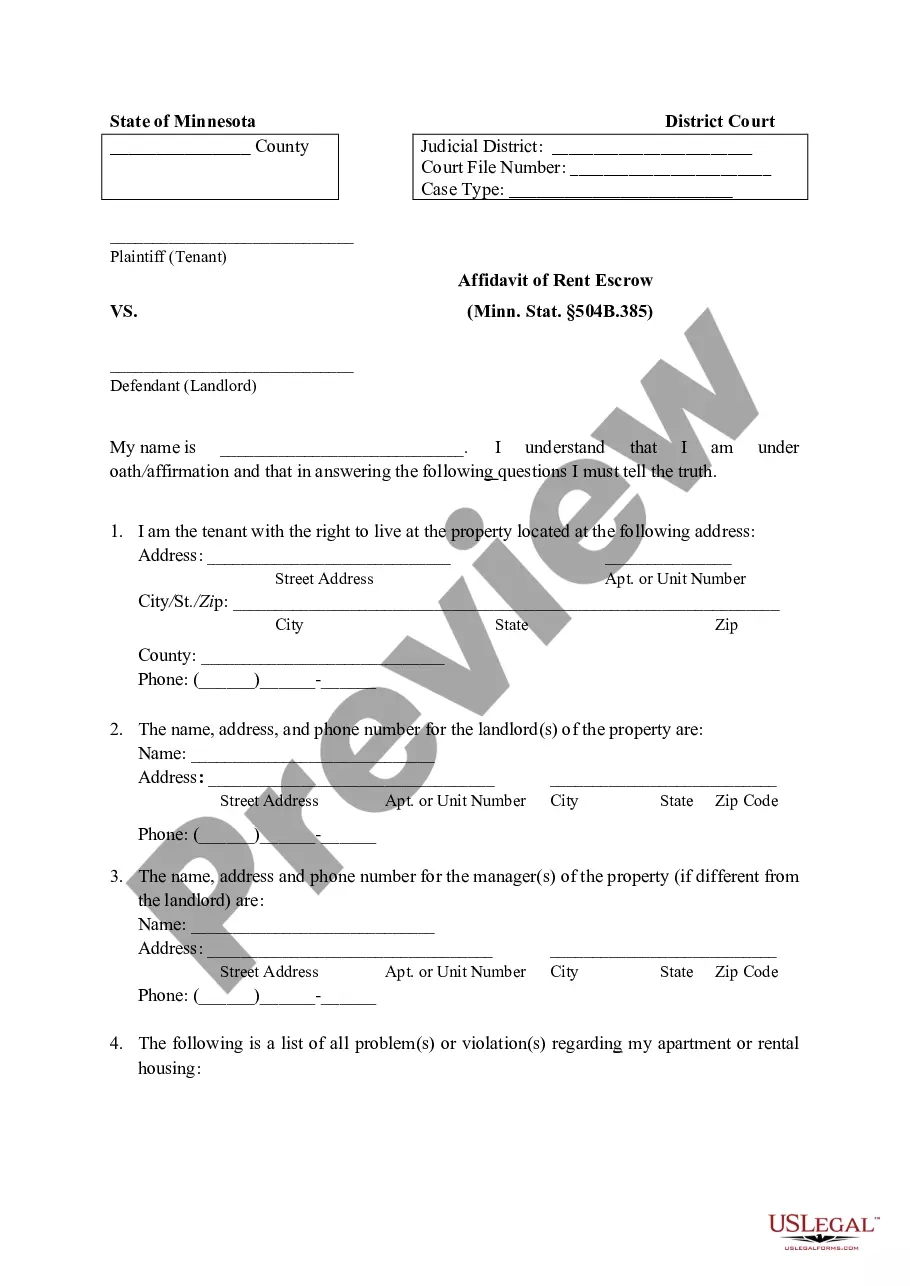

- Utilize the Review option to analyze the shape.

- Look at the description to ensure that you have chosen the appropriate form.

- If the form isn`t what you`re searching for, make use of the Search discipline to discover the form that suits you and requirements.

- Whenever you find the proper form, simply click Get now.

- Choose the rates strategy you desire, complete the required information and facts to generate your money, and purchase an order using your PayPal or bank card.

- Choose a convenient document formatting and acquire your version.

Discover all the record web templates you may have bought in the My Forms menus. You can get a more version of Missouri Phantom Stock Plan of Hercules, Inc. at any time, if possible. Just click the essential form to acquire or print out the record web template.

Use US Legal Forms, one of the most considerable variety of authorized varieties, to save some time and steer clear of faults. The service delivers appropriately manufactured authorized record web templates that you can use for an array of uses. Produce a merchant account on US Legal Forms and begin generating your lifestyle easier.

Form popularity

FAQ

Summary. A phantom stock plan refers to a type of deferred employee compensation plan where plan participants benefit from the upside of a company's share price without actually receiving company shares. In a phantom stock plan, upon redemption of phantom stock, the plan participant receives cash compensation.

Phantom stock is not a good idea if the company is planning on issuing it to most or all employees, especially if the phantom shares will be paid out when the employee leaves the company or retires. In that case, phantom shares may be ruled illegal because of the Employee Retirement Income and Security Act (ERISA).

As a default, this form plan provides for forfeiture of all unvested phantom stock units upon a participant's termination of employment (subject to the terms of the award agreement).

While not stock in the company, phantom stock is worth money just like real stock? its value rises and falls with the company's actual stock (or what the company is valued at, if it's not a publicly traded company). Employees are paid out profits at the end of a pre-determined length of time.

Phantom shares usually get liquid when the company gets acquired or goes public or if the company decides to do a buyback. Any gains from the assets must be reported to tax authorities as ordinary income upon vesting.

Phantom shares are usually paid out when the company gets acquired or IPOes. The phantom shares are paid out in cash for their corresponding value.

The payout to employees who own phantom stock when the company exits is known as a cash settlement. When a liquidity event (such as an IPO or acquisition) occurs, employees are normally paid the cash they're due through payroll.