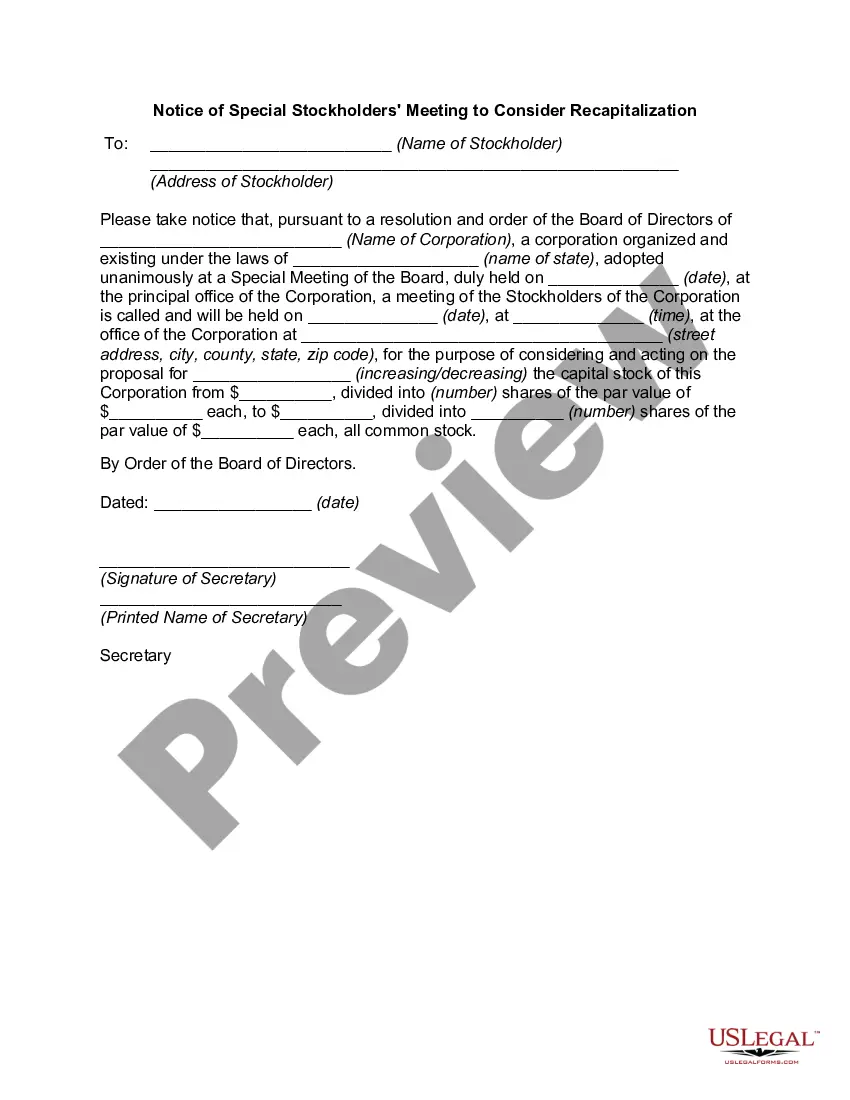

Missouri Letter to Board of Directors regarding recapitalization proposal

Description

How to fill out Letter To Board Of Directors Regarding Recapitalization Proposal?

Are you presently inside a position the place you need paperwork for possibly company or specific reasons virtually every time? There are a lot of legal file themes available online, but getting versions you can rely on is not straightforward. US Legal Forms gives 1000s of kind themes, just like the Missouri Letter to Board of Directors regarding recapitalization proposal, that are created to fulfill state and federal demands.

In case you are presently acquainted with US Legal Forms site and get a merchant account, basically log in. Afterward, you are able to down load the Missouri Letter to Board of Directors regarding recapitalization proposal template.

If you do not provide an accounts and want to start using US Legal Forms, follow these steps:

- Find the kind you need and make sure it is to the appropriate area/area.

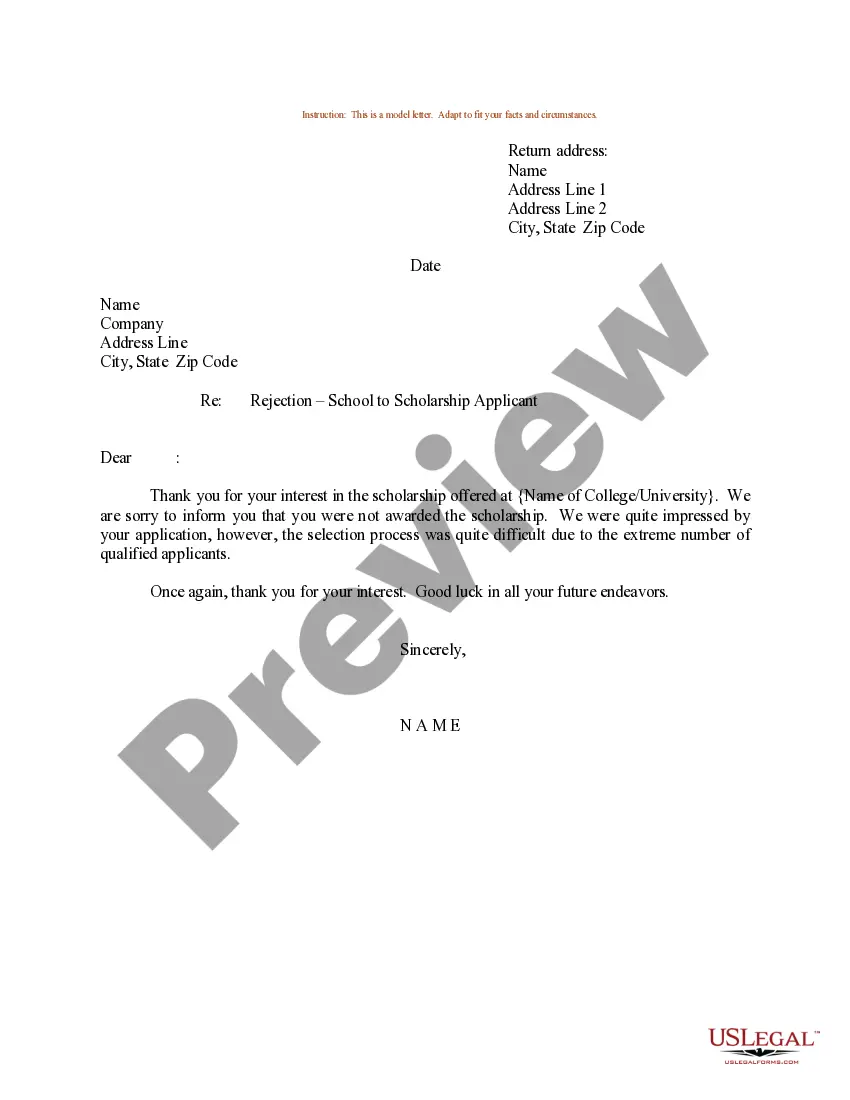

- Use the Preview key to review the form.

- Browse the explanation to actually have selected the appropriate kind.

- When the kind is not what you`re looking for, take advantage of the Research industry to obtain the kind that meets your requirements and demands.

- Whenever you get the appropriate kind, click Get now.

- Choose the prices prepare you desire, fill in the specified information to produce your bank account, and pay money for your order utilizing your PayPal or charge card.

- Select a handy data file structure and down load your version.

Get every one of the file themes you may have bought in the My Forms menus. You can obtain a additional version of Missouri Letter to Board of Directors regarding recapitalization proposal at any time, if necessary. Just click the essential kind to down load or print the file template.

Use US Legal Forms, the most extensive collection of legal forms, to conserve time as well as prevent errors. The services gives appropriately created legal file themes which can be used for a variety of reasons. Generate a merchant account on US Legal Forms and start generating your lifestyle a little easier.

Form popularity

FAQ

Essential, your business proposal can follow this format: Title. Table of contents. Executive summary. The problem statement. The proposed solution. Qualifications. The timeline. Pricing, billing and legal.

How to write a proposal letter Introduce yourself and provide background information. State your purpose for the proposal. Define your goals and objectives. Highlight what sets you apart. Briefly discuss the budget and how funds will be used. Finish with a call to action and request a follow-up.

You can divide a proposal letter into three main sections, the problem, its solution and your qualifications for solving the issue. Consider the problem to be your "why." This is the purpose or reasoning for the proposed project. The problem is the issue or task you hope to solve.

In summary, being compliant, competent, and comprehensive are essential qualities in proposal management. By being compliant, you ensure that your proposal meets all the specified requirements. You demonstrate your skills and expertise in managing the proposal development process by being competent.

How to write a project proposal Write an executive summary. The executive summary serves as the introduction to your project proposal. ... Explain the project background. ... Present a solution. ... Define project deliverables and goals. ... List what resources you need. ... State your conclusion. ... Know your audience. ... Be persuasive.