Missouri Authorization to Increase Bonded Indebtedness: Understanding its Types and Importance In the state of Missouri, authorization to increase bonded indebtedness refers to the legal process by which governmental entities seek approval to issue additional bonds or increase their existing debt. This process is designed to allow local governments, such as counties, cities, or school districts, to obtain necessary funds for infrastructure development, public projects, or other essential initiatives. The authorization to increase bonded indebtedness is of paramount significance as it enables these entities to secure funding for vital projects that benefit the community as a whole. There are several types of Missouri Authorization to Increase Bonded Indebtedness, each catering to specific needs and objectives. Let's explore some of these types: 1. General Obligation Bonds (GO Bonds): General Obligation Bonds are backed by the full faith and credit of the issuing municipality, county, or school district. This means that the entity pledges its taxing power to repay the bondholders over a predetermined period. These bonds generally require voter approval as they involve increasing property taxes or sales taxes within the jurisdiction. 2. Revenue Bonds: Revenue Bonds are issued to finance projects that generate revenue, such as toll roads, bridges, airports, or utility systems. Unlike general obligation bonds, revenue bonds are repaid using revenues generated by the specific project or facility being financed. Typically, voter approval is not required for revenue bonds as they do not directly impact taxes. 3. Special Tax Bonds: Special Tax Bonds are secured by a dedicated stream of revenue generated from specific taxes levied within a defined geographic area. These taxes may include sales taxes, hotel taxes, or other special assessments imposed solely to support the bonded indebtedness. Like general obligation bonds, special tax bonds often require voter approval. 4. School Bonds: School districts commonly utilize this type of authorization to increase bonded indebtedness to fund capital improvements, construct new school buildings, or finance technology upgrades. Such bonds can either be general obligation bonds or financed through property tax increases exclusively for school-related purposes. It is important to note that the process of obtaining authorization to increase bonded indebtedness typically involves seeking approval from voters through general or special elections. The entities requesting the authorization must present comprehensive plans outlining the purpose of the debt issuance, repayment terms, and how the borrowed funds will benefit the community. In conclusion, Missouri Authorization to Increase Bonded Indebtedness empowers local governments to secure funding for crucial community projects, infrastructure development, and school improvements. The types of authorization, such as general obligation bonds, revenue bonds, special tax bonds, and school bonds, cater to different needs and require varying levels of voter approval. Through this process, Missouri ensures responsible and transparent borrowing practices while enabling progress and enhancing the quality of life for its residents.

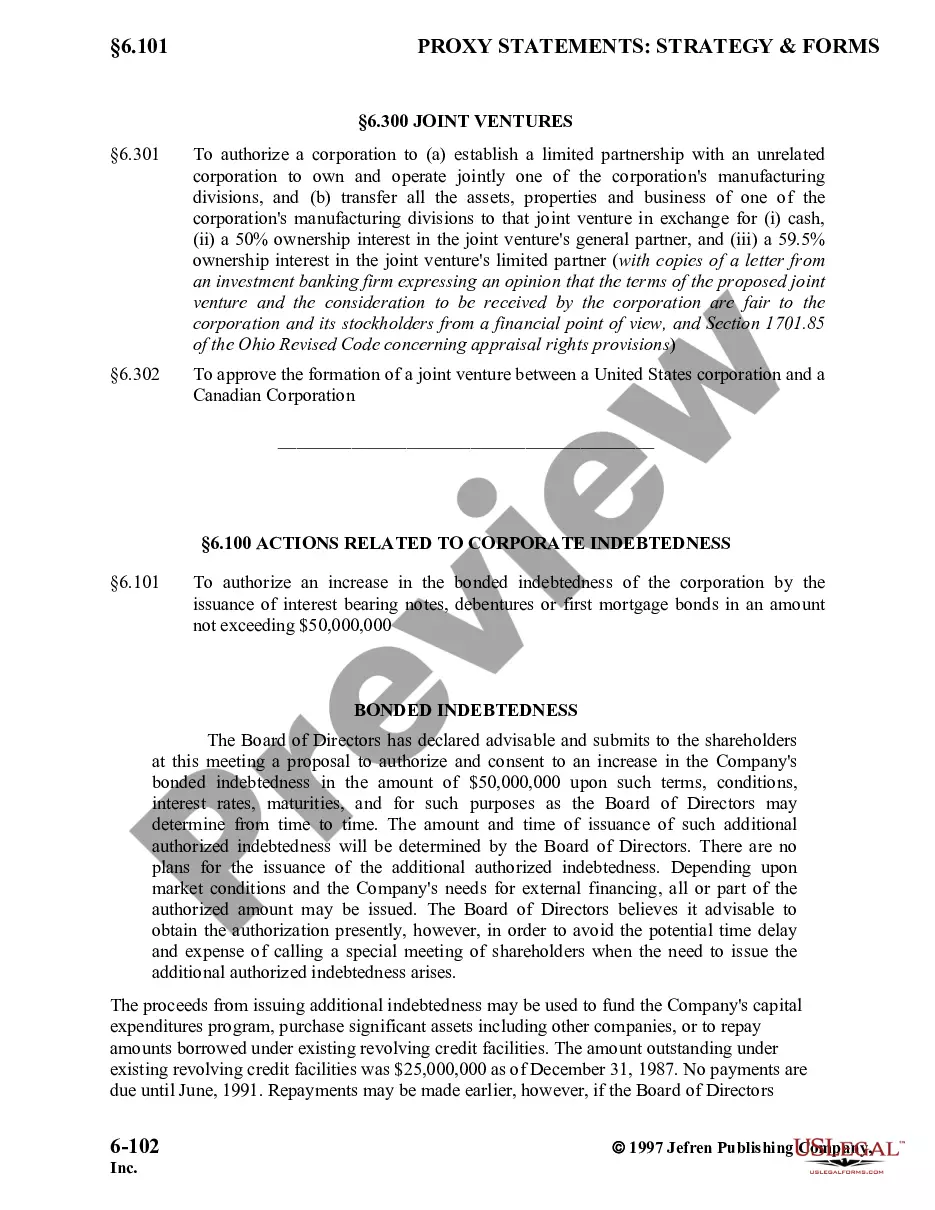

Missouri Authorization to increase bonded indebtedness

Description

How to fill out Missouri Authorization To Increase Bonded Indebtedness?

You can devote hrs on the web attempting to find the legal file format that suits the federal and state demands you require. US Legal Forms offers 1000s of legal types which are analyzed by specialists. It is possible to acquire or produce the Missouri Authorization to increase bonded indebtedness from your service.

If you already have a US Legal Forms accounts, you may log in and click on the Acquire key. Following that, you may total, modify, produce, or signal the Missouri Authorization to increase bonded indebtedness. Every legal file format you get is your own forever. To get one more backup for any bought form, visit the My Forms tab and click on the corresponding key.

If you work with the US Legal Forms web site for the first time, follow the basic instructions under:

- Initial, ensure that you have chosen the best file format for that state/area of your choice. See the form information to ensure you have picked the correct form. If accessible, utilize the Preview key to search with the file format also.

- If you would like find one more edition from the form, utilize the Look for discipline to find the format that fits your needs and demands.

- Upon having identified the format you want, click on Buy now to carry on.

- Select the costs prepare you want, key in your credentials, and sign up for your account on US Legal Forms.

- Total the financial transaction. You can utilize your bank card or PayPal accounts to pay for the legal form.

- Select the formatting from the file and acquire it for your device.

- Make changes for your file if required. You can total, modify and signal and produce Missouri Authorization to increase bonded indebtedness.

Acquire and produce 1000s of file templates making use of the US Legal Forms web site, which offers the biggest selection of legal types. Use professional and express-particular templates to deal with your organization or specific requires.