Missouri Employee Stock Option Plan of Emulex Corp.

Description

How to fill out Employee Stock Option Plan Of Emulex Corp.?

US Legal Forms - one of many most significant libraries of legitimate types in the United States - delivers a wide array of legitimate record layouts you are able to down load or print out. Utilizing the web site, you can get 1000s of types for company and individual uses, categorized by categories, claims, or search phrases.You can find the latest variations of types just like the Missouri Employee Stock Option Plan of Emulex Corp. within minutes.

If you currently have a monthly subscription, log in and down load Missouri Employee Stock Option Plan of Emulex Corp. through the US Legal Forms local library. The Download switch can look on every form you look at. You have accessibility to all previously saved types within the My Forms tab of your own bank account.

If you want to use US Legal Forms the first time, allow me to share easy guidelines to help you started:

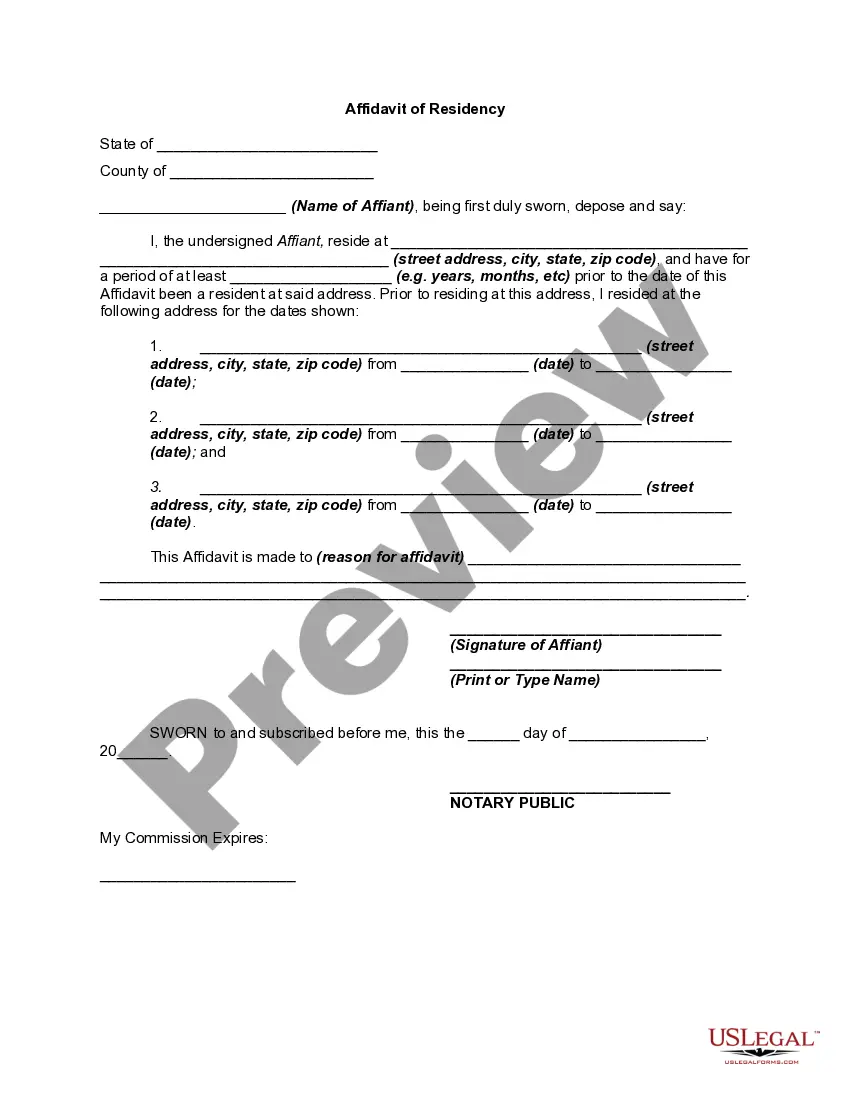

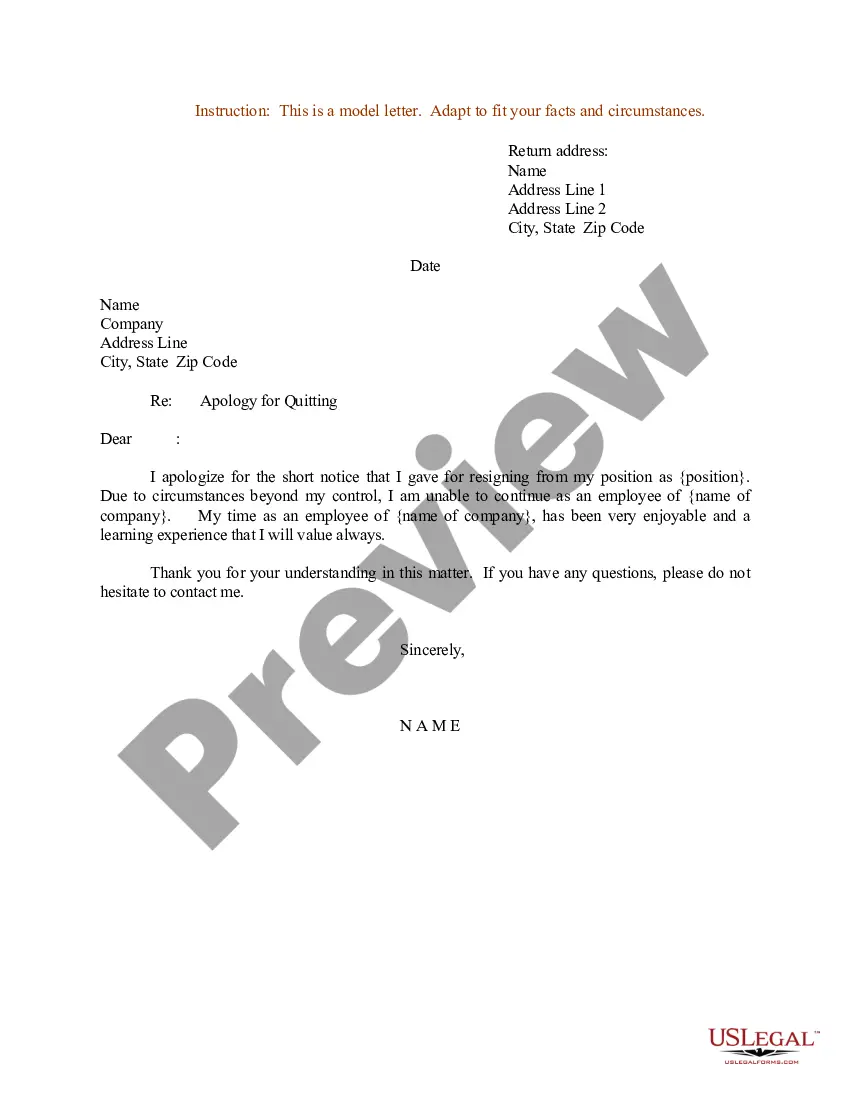

- Ensure you have selected the proper form for your metropolis/state. Go through the Preview switch to review the form`s content. See the form explanation to actually have chosen the proper form.

- In case the form doesn`t suit your requirements, take advantage of the Research industry towards the top of the display screen to find the the one that does.

- When you are happy with the form, validate your option by clicking on the Acquire now switch. Then, pick the rates prepare you want and provide your accreditations to sign up for the bank account.

- Method the deal. Use your credit card or PayPal bank account to finish the deal.

- Find the format and down load the form on your own device.

- Make alterations. Complete, modify and print out and indicator the saved Missouri Employee Stock Option Plan of Emulex Corp..

Each and every web template you included with your bank account lacks an expiry day and it is the one you have forever. So, if you would like down load or print out another copy, just visit the My Forms portion and click around the form you require.

Gain access to the Missouri Employee Stock Option Plan of Emulex Corp. with US Legal Forms, the most substantial local library of legitimate record layouts. Use 1000s of skilled and condition-distinct layouts that fulfill your business or individual demands and requirements.

Form popularity

FAQ

Holders of share purchase rights may or may not buy an agreed number of shares of stock at a pre-determined price, but only if they are an existing stockholder. Options, on the other hand, are the right to buy or sell stocks at a pre-set price called the strike price.

Stock options give employees the option to buy a certain number of shares at a predetermined price within a specified period. Equity, on the other hand, gives employees actual shares of the company, either outright or subject to vesting conditions.

The difference between an ESOP and a stock option is that while ESOP allows owners of tightly held businesses to sell to an ESOP and reinvest the revenues tax-free, as long as the ESOP controls at least 30% of the business, as well as certain requirements, are met.

An ESOP is an employee benefit plan that enables employees to own part or all of the company they work for. ESOPs are most commonly used to facilitate succession planning, allowing a company owner to sell his or her. shares and transition flexibly out of the business.

Your ESPP will have set offering and purchase periods, while a stock option grant has a set term in which you can exercise the options after they vest. The purchase price of stock under a tax-qualified Section 423 ESPP is typically discounted in some way from the market price at purchase.

Procedure to Issue ESOP A draft needs to be prepared of the ESOP ing to the companies,2013 and Rules. A board meeting notice along with the draft resolution that is to be passed in the board meeting is to be made. The notice of the board meeting is to be sent seven days before the meeting to all the directors.

Disadvantages of Employee Stock Purchase Plans Ensuring the ESPP follows security and tax law guidelines can be challenging. A large amount of HR functions goes into administering the stock purchase plan. There are legal, tax, and administrative issues that go into setting up the plan.

The most notable difference between an ESOP vs ESPP is in how the employee receives the stock and when they can sell the stock. ESOPs provide the stock or shares at no cost to employees. ESPPs require participants to contribute funds to purchase shares of stock, though at a discounted rate.