The Missouri Plan of Conversion from a state stock savings bank to a federal stock savings bank refers to the process by which a savings institution in Missouri transitions from operating as a state-chartered institution to a federally-chartered institution. This conversion is typically pursued to take advantage of certain benefits and opportunities available to federal savings banks, such as broader lending powers, increased access to capital markets, and federal deposit insurance. The Missouri Plan of Conversion entails several important steps and requirements. Firstly, the bank's board of directors must obtain approval from the institution's shareholders to pursue the conversion. Once approved, the bank must then file a conversion application with the appropriate regulatory bodies. This application includes detailed information about the bank's financials, operations, and management. The bank must also establish a plan of conversion, outlining the specific steps involved in the transition. This plan typically covers aspects such as the treatment of existing shareholders, the allocation of shares in the new federal savings bank, and any changes in governance structure. During the conversion process, the bank must provide notice to its depositors and other stakeholders about the planned conversion and any potential impacts on their accounts or services. This may involve updating account agreements, disclosure documents, and other relevant materials to reflect the new federal charter and associated changes. After completing the required regulatory filings and obtaining the necessary approvals, the bank can finally complete its conversion by officially becoming a federal stock savings bank. At this stage, the bank will need to adhere to federal regulations and oversight, including periodic examinations by federal banking regulators. It is worth noting that there are no particular "types" of the Missouri Plan of Conversion from state stock savings bank to federal stock savings bank. However, banks may choose to pursue conversion for various reasons, such as expanding their operations, attracting new investors, or keeping pace with evolving industry trends. In conclusion, the Missouri Plan of Conversion from state stock savings bank to federal stock savings bank involves a series of steps and requirements for a savings institution to transition from a state charter to a federal charter. This process allows banks to leverage the benefits and opportunities associated with federal charters, providing a broader range of services and increased regulatory oversight.

Missouri Plan of Conversion from state stock savings bank to federal stock savings bank

Description

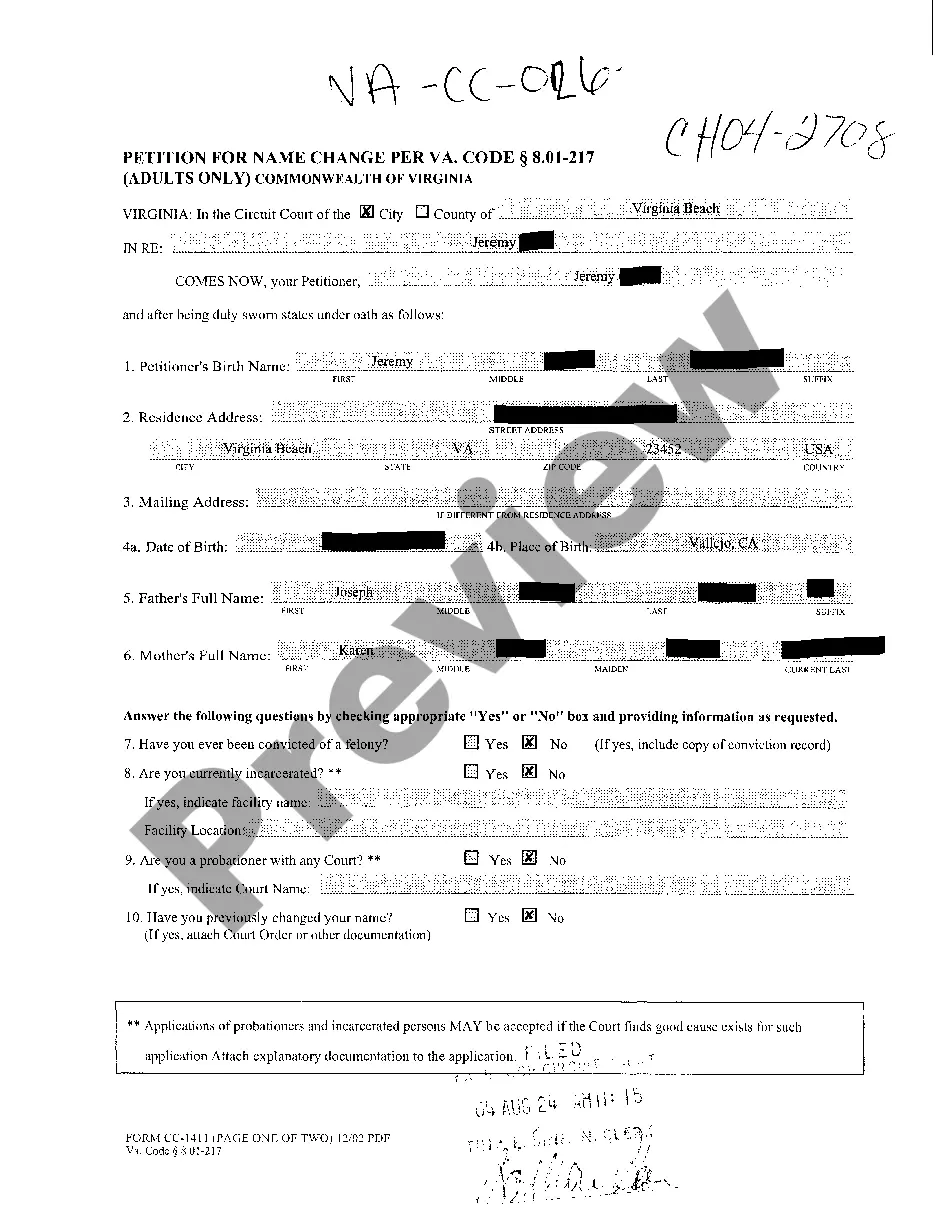

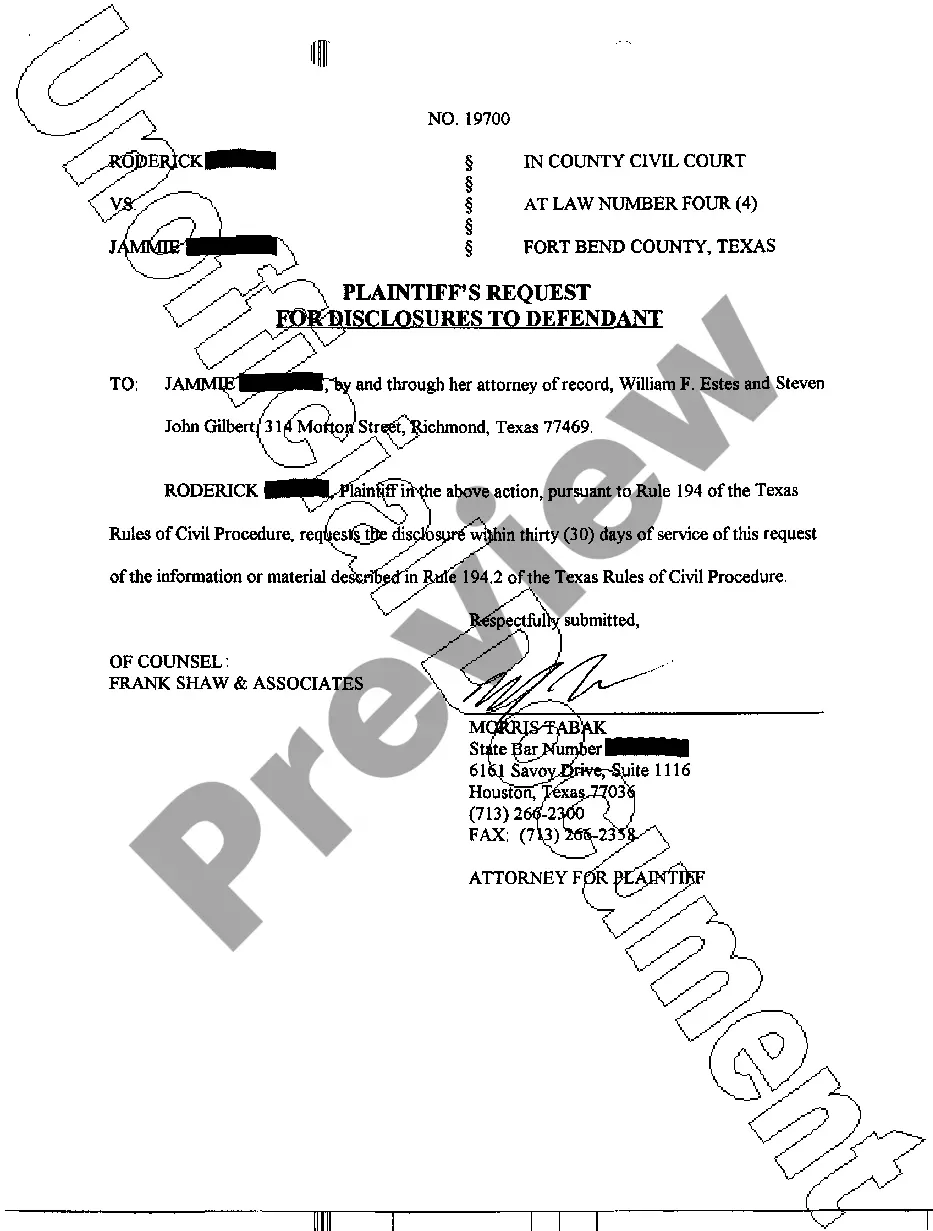

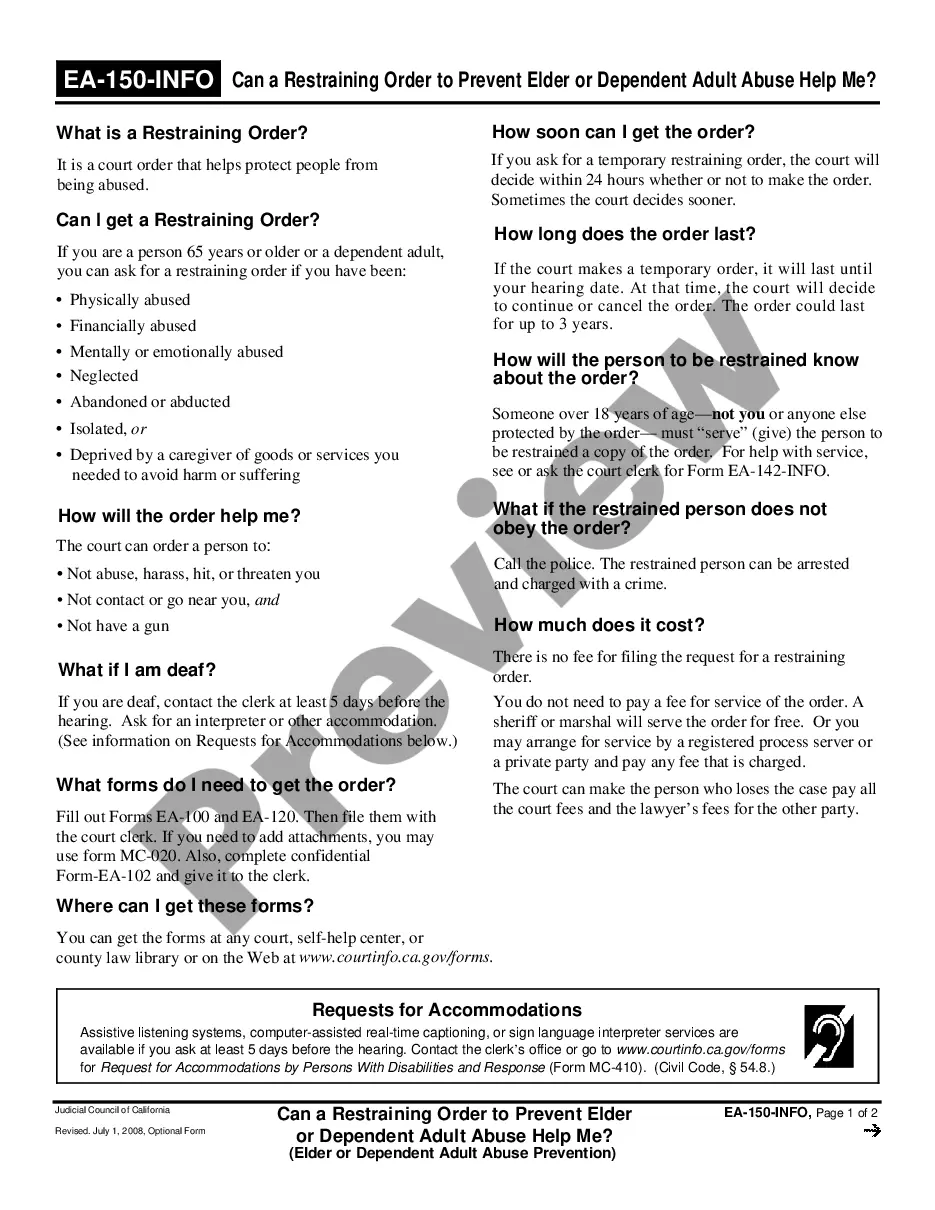

How to fill out Missouri Plan Of Conversion From State Stock Savings Bank To Federal Stock Savings Bank?

US Legal Forms - one of the most significant libraries of lawful varieties in the States - delivers a variety of lawful record templates you may obtain or printing. Using the internet site, you will get a huge number of varieties for enterprise and specific functions, sorted by groups, states, or search phrases.You will find the latest versions of varieties much like the Missouri Plan of Conversion from state stock savings bank to federal stock savings bank in seconds.

If you have a subscription, log in and obtain Missouri Plan of Conversion from state stock savings bank to federal stock savings bank in the US Legal Forms library. The Obtain button can look on each kind you see. You gain access to all formerly downloaded varieties within the My Forms tab of your bank account.

If you wish to use US Legal Forms the first time, here are straightforward instructions to obtain started out:

- Ensure you have selected the right kind to your metropolis/area. Click on the Preview button to check the form`s content. Look at the kind information to actually have selected the right kind.

- In the event the kind doesn`t match your requirements, make use of the Search area on top of the screen to discover the one who does.

- Should you be satisfied with the shape, affirm your option by simply clicking the Purchase now button. Then, select the rates program you favor and offer your accreditations to sign up for the bank account.

- Method the purchase. Utilize your Visa or Mastercard or PayPal bank account to finish the purchase.

- Pick the formatting and obtain the shape in your system.

- Make adjustments. Complete, edit and printing and indicator the downloaded Missouri Plan of Conversion from state stock savings bank to federal stock savings bank.

Each template you included with your bank account does not have an expiration date and is also the one you have eternally. So, in order to obtain or printing an additional duplicate, just check out the My Forms section and click on the kind you require.

Get access to the Missouri Plan of Conversion from state stock savings bank to federal stock savings bank with US Legal Forms, probably the most considerable library of lawful record templates. Use a huge number of expert and express-particular templates that satisfy your small business or specific demands and requirements.

Form popularity

FAQ

Mutual banks are owned by their borrowers and depositors. Ownership and profit sharing are what differentiate mutual banks from stock banks, which are owned and controlled by individual and institutional shareholders that profit from them.

Bank Conversion means conversion of the Bank to the New Bank.

Mutual savings banks also have several disadvantages including being too conservative at times, having no member control, and having the possibility of being acquired or going public.

The Demutualization Process In a demutualization, a mutual company elects to change its corporate structure to a public company, where prior members may receive a structured compensation or ownership conversion rights in the transition, in the form of shares in the company.

A conversion merger is when a mutual institution simultaneously acquires a stock institution at the same time it completes a standard stock conversion. A mutual FSA may acquire another insured institution that is already in the stock form of ownership at the time of its stock conversion transaction.

Mutual banks are owned by their borrowers and depositors. Ownership and profit sharing are what differentiate mutual banks from stock banks, which are owned and controlled by individual and institutional shareholders that profit from them.

A conversion is the exchange of a convertible type of asset into another type of asset?usually at a predetermined price?on or before a predetermined date. The conversion feature is a financial derivative instrument that is valued separately from the underlying security.