Missouri Finance Master Lease Agreement

Description

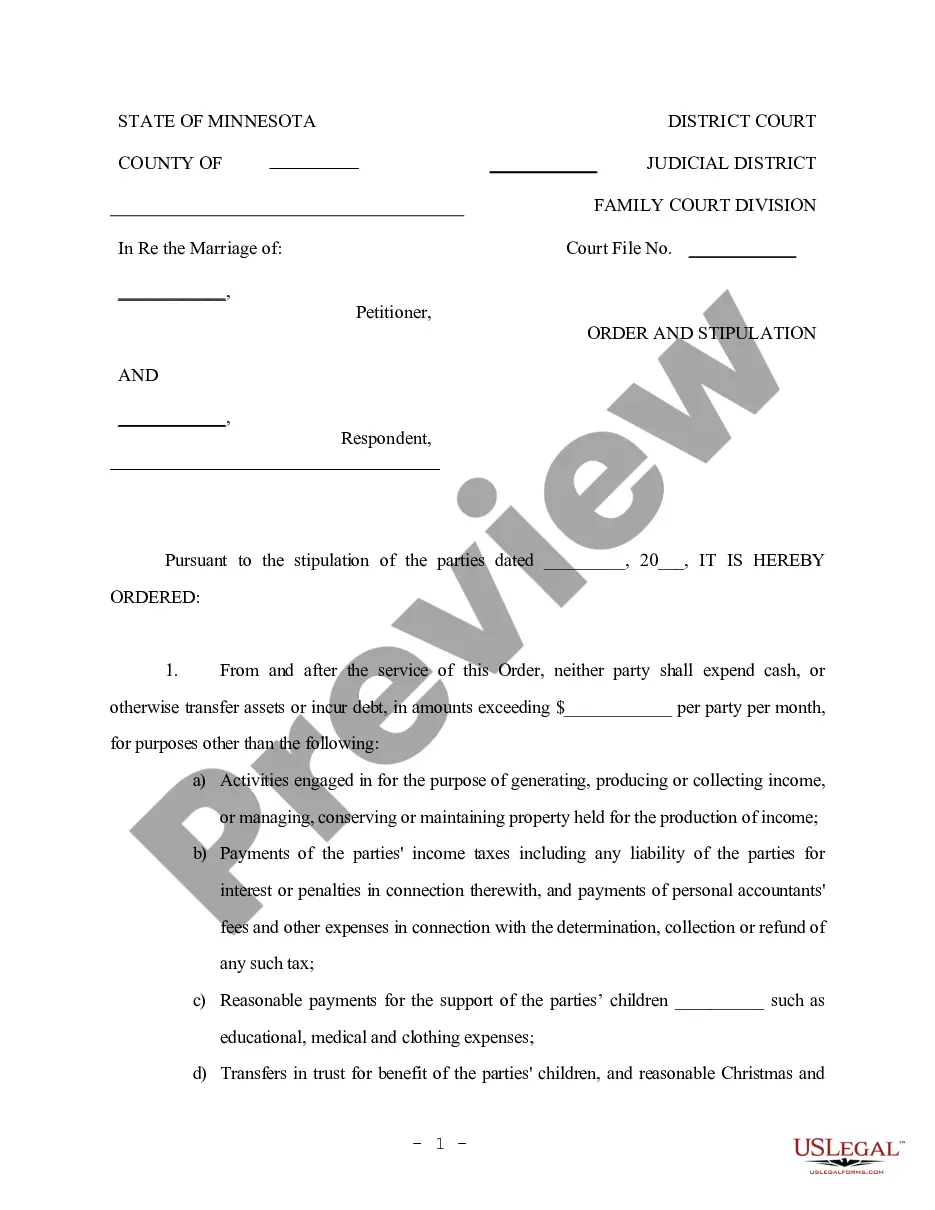

How to fill out Finance Master Lease Agreement?

US Legal Forms - among the most significant libraries of authorized types in America - gives an array of authorized file templates you can acquire or produce. Using the internet site, you may get thousands of types for business and personal functions, sorted by classes, says, or keywords.You will find the most recent types of types just like the Missouri Finance Master Lease Agreement within minutes.

If you currently have a subscription, log in and acquire Missouri Finance Master Lease Agreement in the US Legal Forms library. The Obtain key will show up on every type you see. You have accessibility to all formerly downloaded types in the My Forms tab of the accounts.

If you wish to use US Legal Forms initially, allow me to share straightforward recommendations to help you get started out:

- Ensure you have selected the proper type for your personal metropolis/state. Go through the Preview key to check the form`s articles. See the type explanation to ensure that you have chosen the right type.

- If the type doesn`t suit your requirements, make use of the Search discipline near the top of the monitor to get the the one that does.

- If you are content with the form, confirm your selection by visiting the Get now key. Then, select the costs prepare you prefer and give your references to sign up on an accounts.

- Method the deal. Make use of credit card or PayPal accounts to complete the deal.

- Select the file format and acquire the form on the device.

- Make alterations. Fill out, change and produce and indicator the downloaded Missouri Finance Master Lease Agreement.

Every single template you put into your money does not have an expiry day and it is your own eternally. So, if you want to acquire or produce one more backup, just proceed to the My Forms segment and then click about the type you need.

Gain access to the Missouri Finance Master Lease Agreement with US Legal Forms, probably the most comprehensive library of authorized file templates. Use thousands of specialist and status-particular templates that meet up with your small business or personal requirements and requirements.

Form popularity

FAQ

A Missouri rent-to-own lease agreement is a document that rents property to a qualified tenant and gives an option to buy. The landlord will commonly screen the tenant and require proof of funds to purchase the property.

In essence, the difference between an offer to lease and a lease is that a signed offer to lease is a tenant and landlord saying, ?we agree to terms on a lease.? Some landlords and tenants in fact treat an offer to lease as a final lease.

A Florida rent-to-own lease agreement allows the tenant an option to purchase the property under pre-determined terms. Similar to a standard lease, the landlord will request a financial background check on the tenant. If approved, the landlord will sign a lease and establish the terms for purchasing the property.

A purchase lease option gives property investors the chance to rent a property and generate income from it, with the right, but not necessarily the obligation, to buy it at a later stage.

To be contrasted with a lease contract for a single transaction involving a specific unit of equipment, a Master Lease is essentially a line of credit to draw from over time in order to purchase equipment.

A Missouri rent-to-own lease agreement is a document that rents property to a qualified tenant and gives an option to buy. The landlord will commonly screen the tenant and require proof of funds to purchase the property.