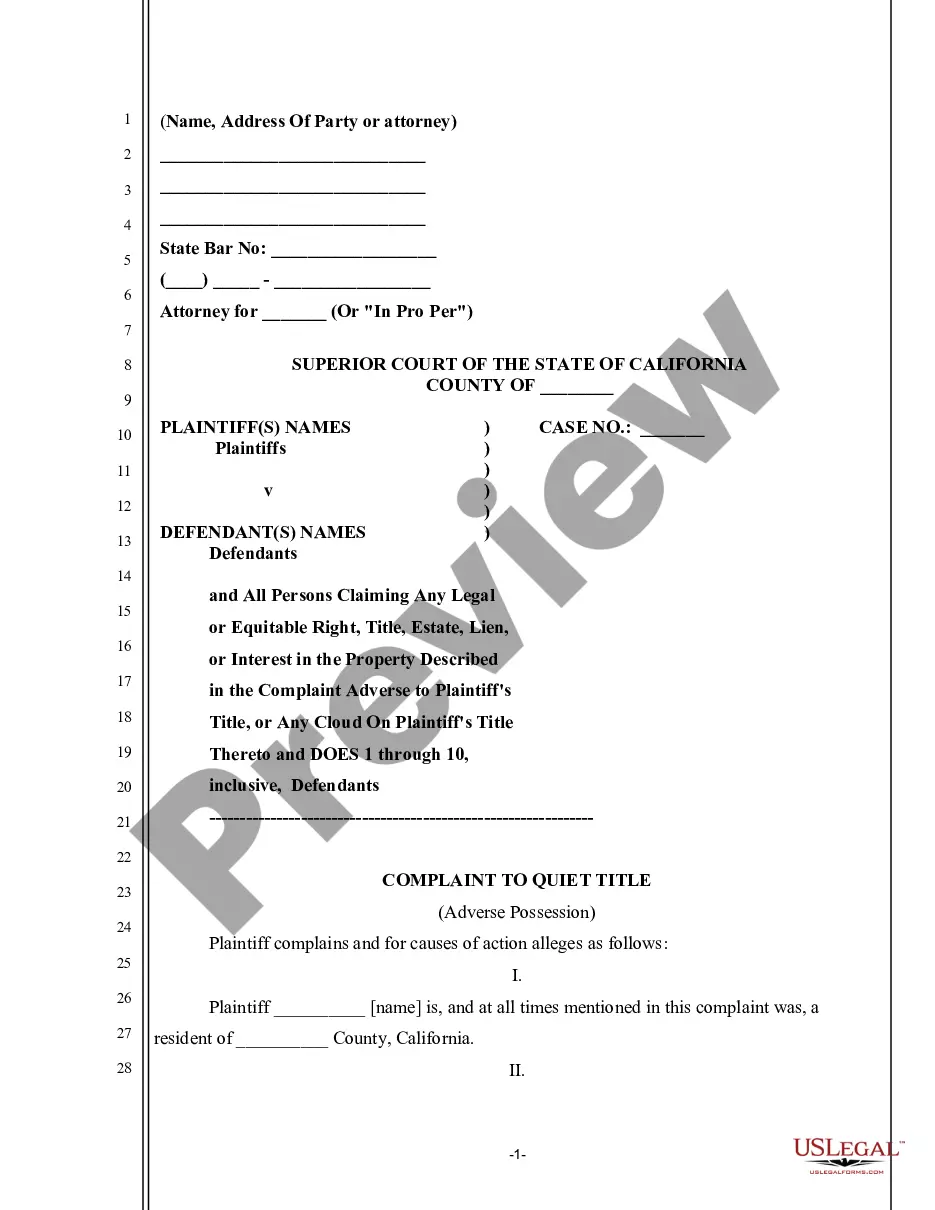

A Missouri Loan Modification Agreement — Multistate is a legal document that outlines the changes made to an existing loan agreement in the state of Missouri. This agreement is designed to assist borrowers who are struggling to make their original loan payments by modifying the terms and conditions to make them more manageable. It aims to prevent foreclosure and help borrowers stay in their homes. The Missouri Loan Modification Agreement — Multistate typically covers various key aspects of the loan, including interest rate adjustments, repayment schedule changes, loan term extensions, and even principal reductions in some cases. The agreement is legally binding and requires the borrower's and lender's consent to alter the initial loan terms. One of the key benefits of a loan modification agreement in Missouri is that it aims to reduce the financial burden on borrowers and provide them with an opportunity to avoid foreclosure. It allows borrowers to negotiate with their lenders to find a solution that works for both parties. There are several types of Missouri Loan Modification Agreements — Multistate, which can include: 1. Interest Rate Modification: This type of modification focuses on reducing the interest rate of the loan. It aims to lower the borrower's monthly mortgage payment, making it more affordable. 2. Term Extension: This modification extends the loan term, spreading the remaining balance over a longer period. It helps to reduce the monthly payment amount, making it more manageable for the borrower. 3. Principal Reduction: In certain cases, lenders may agree to reduce the outstanding principal balance of the loan. This can provide significant relief to borrowers and help them regain financial stability. 4. Forbearance Agreement: A forbearance agreement is another type of loan modification that allows borrowers to temporarily reduce or suspend their mortgage payments for a specific period. This option is usually available to borrowers facing temporary financial hardships. 5. Combination Modifications: Some loan modification agreements in Missouri may involve a combination of the above modifications. Lenders may consider multiple options to reach an agreement that suits both parties. It is essential to note that each loan modification agreement is unique and specific to the individual borrower's circumstances. Borrowers are advised to consult with legal or financial professionals to ensure they fully understand the terms and consequences of the agreement before signing.

Missouri Loan Modification Agreement - Multistate

Description

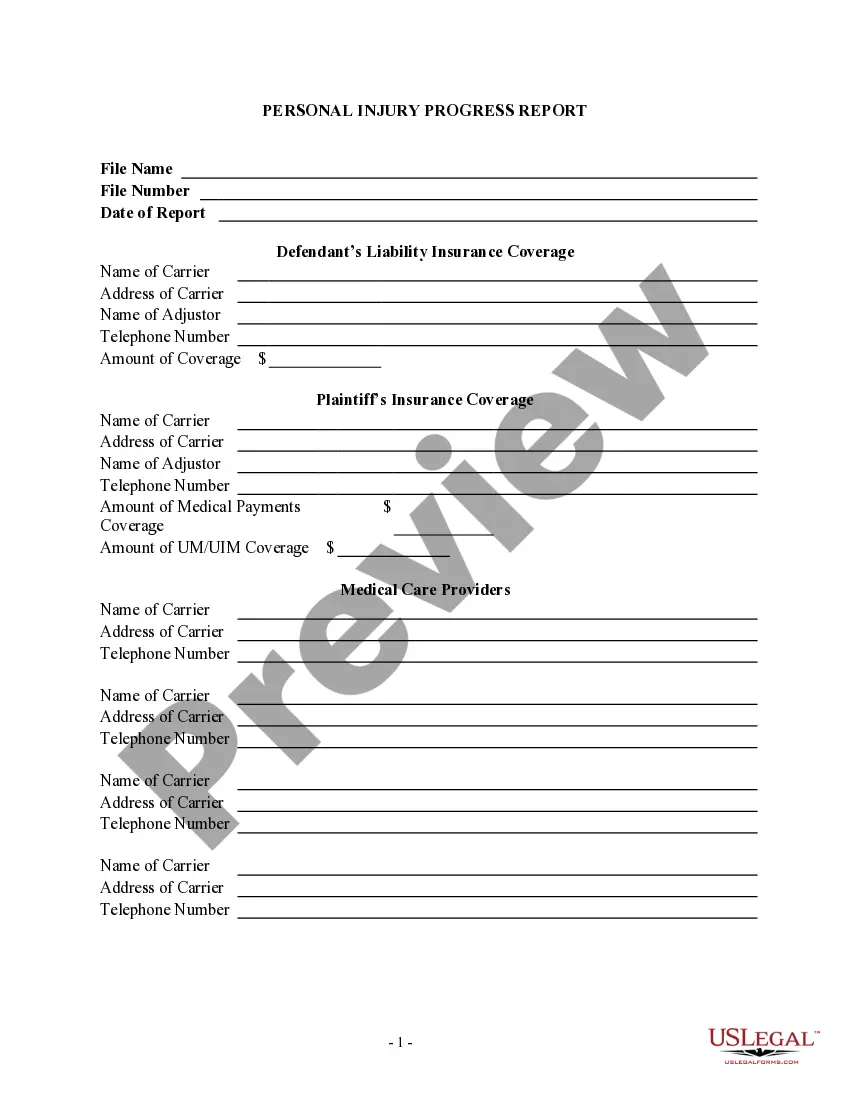

How to fill out Missouri Loan Modification Agreement - Multistate?

US Legal Forms - among the most significant libraries of legitimate forms in the USA - offers a wide array of legitimate record web templates you may download or print. Using the site, you may get a huge number of forms for enterprise and person purposes, categorized by types, claims, or keywords and phrases.You can find the latest versions of forms such as the Missouri Loan Modification Agreement - Multistate in seconds.

If you already have a membership, log in and download Missouri Loan Modification Agreement - Multistate from the US Legal Forms collection. The Obtain option can look on every type you look at. You have accessibility to all earlier delivered electronically forms within the My Forms tab of your own account.

If you wish to use US Legal Forms for the first time, here are basic directions to help you get started out:

- Make sure you have selected the correct type for your metropolis/county. Go through the Preview option to examine the form`s articles. Look at the type outline to actually have selected the proper type.

- If the type doesn`t suit your requirements, make use of the Research discipline near the top of the monitor to get the one which does.

- When you are happy with the form, validate your choice by clicking on the Purchase now option. Then, choose the prices strategy you prefer and provide your qualifications to sign up to have an account.

- Approach the purchase. Make use of charge card or PayPal account to accomplish the purchase.

- Choose the formatting and download the form in your product.

- Make adjustments. Load, edit and print and indicator the delivered electronically Missouri Loan Modification Agreement - Multistate.

Every single design you included with your bank account does not have an expiration day and is also yours forever. So, if you want to download or print yet another version, just check out the My Forms area and click in the type you require.

Gain access to the Missouri Loan Modification Agreement - Multistate with US Legal Forms, one of the most extensive collection of legitimate record web templates. Use a huge number of skilled and status-particular web templates that satisfy your organization or person needs and requirements.

Form popularity

FAQ

Often, a homeowner won't get approved for a loan modification unless there is evidence of one or several missed payments. Those missed payments hurt your credit score. A home loan modification does the same.

During meetings with your lender, you can negotiate the interest rate, the term of the loan, late fees, and any good faith payment you are prepared to make. Remember that you may not be able to negotiate the principal or any amount that you still owe from before you applied for the loan modification.

There are guidelines on the number of potential modification requests you can expect to be granted by certain lenders. People with loans backed by the Federal Housing Association (FHA) can generally expect to receive two to three loan modifications, although the FHA will only modify a loan once every two years.

Loan modification is a change made to the terms of an existing loan by a lender. It may involve a reduction in the interest rate, an extension of the length of time for repayment, a different type of loan, or any combination of the three.

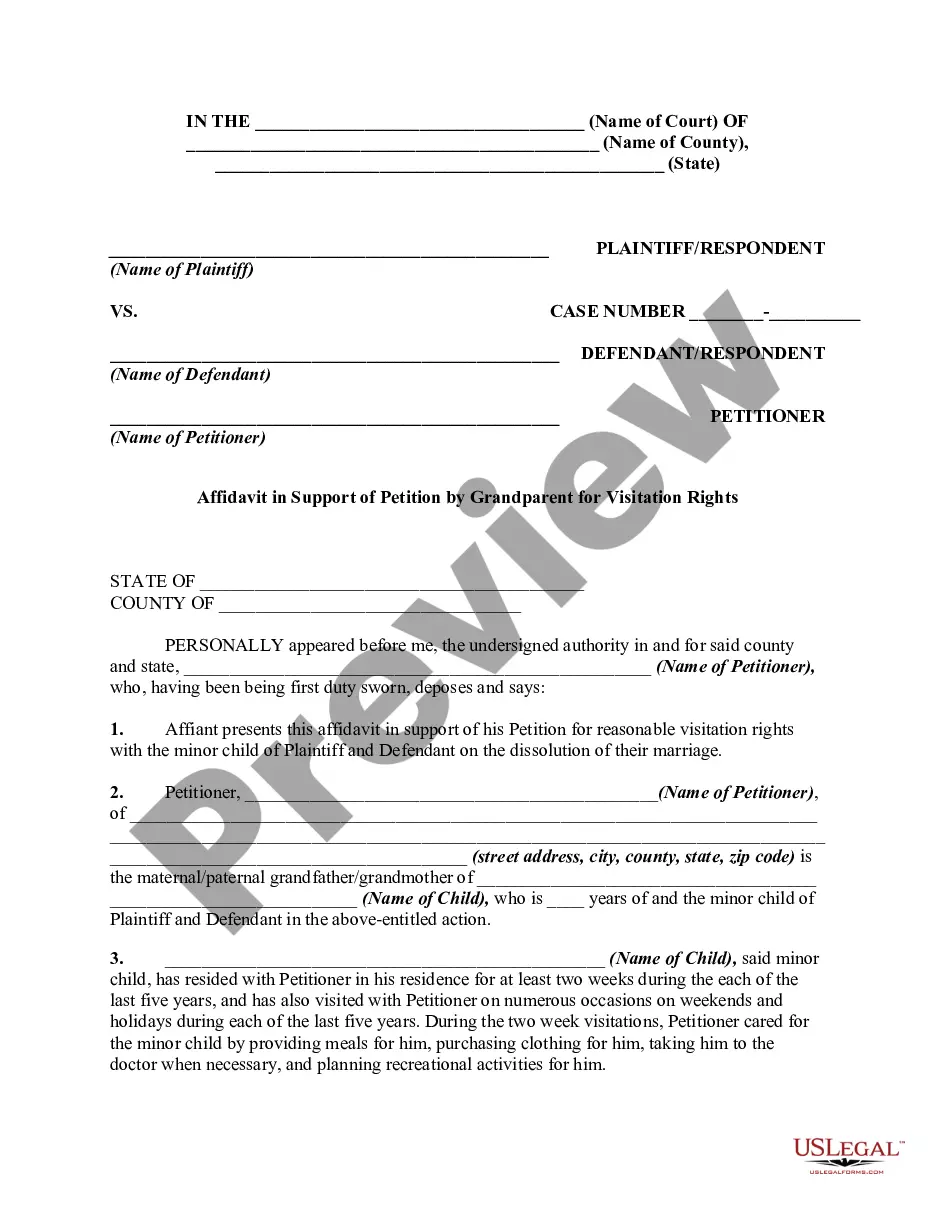

Because these represent mutual agreements, they should be signed by both the borrowers and the plaintiff (who may or may not be the lender or servicer but may be an assignee of the mortgage). There is no doubt that foreclosing plaintiffs understand that they need to sign those mortgage modification agreements.

How to Get a Mortgage Modification Gather Initial Paperwork. ... Get in Touch With Your Loan Servicer. ... Complete and Submit a Formal Application. ... Complete Trial Payments. ... Await a Final Mortgage Modification Decision.

Conventional loan modification ? For conventional mortgages owned by Fannie or Freddie, you can pursue the Flex Modification program, which can reduce monthly payments by up to 20 percent, extend the loan term up to 40 years and potentially lower the interest rate.

Modifications may involve extending the number of years you have to repay the loan, reducing your interest rate, and/or forbearing or reducing your principal balance.