Missouri Credit Agreement between Southwest Royalties, Inc. and Bank One Texas

Description

How to fill out Credit Agreement Between Southwest Royalties, Inc. And Bank One Texas?

Choosing the best lawful file web template could be a battle. Of course, there are tons of themes available on the Internet, but how will you find the lawful develop you want? Utilize the US Legal Forms web site. The assistance gives a large number of themes, for example the Missouri Credit Agreement between Southwest Royalties, Inc. and Bank One Texas, which can be used for organization and personal needs. All the kinds are inspected by professionals and meet federal and state needs.

Should you be already listed, log in in your accounts and then click the Obtain switch to have the Missouri Credit Agreement between Southwest Royalties, Inc. and Bank One Texas. Use your accounts to check throughout the lawful kinds you may have bought previously. Go to the My Forms tab of your own accounts and have yet another copy in the file you want.

Should you be a fresh customer of US Legal Forms, here are simple instructions that you should stick to:

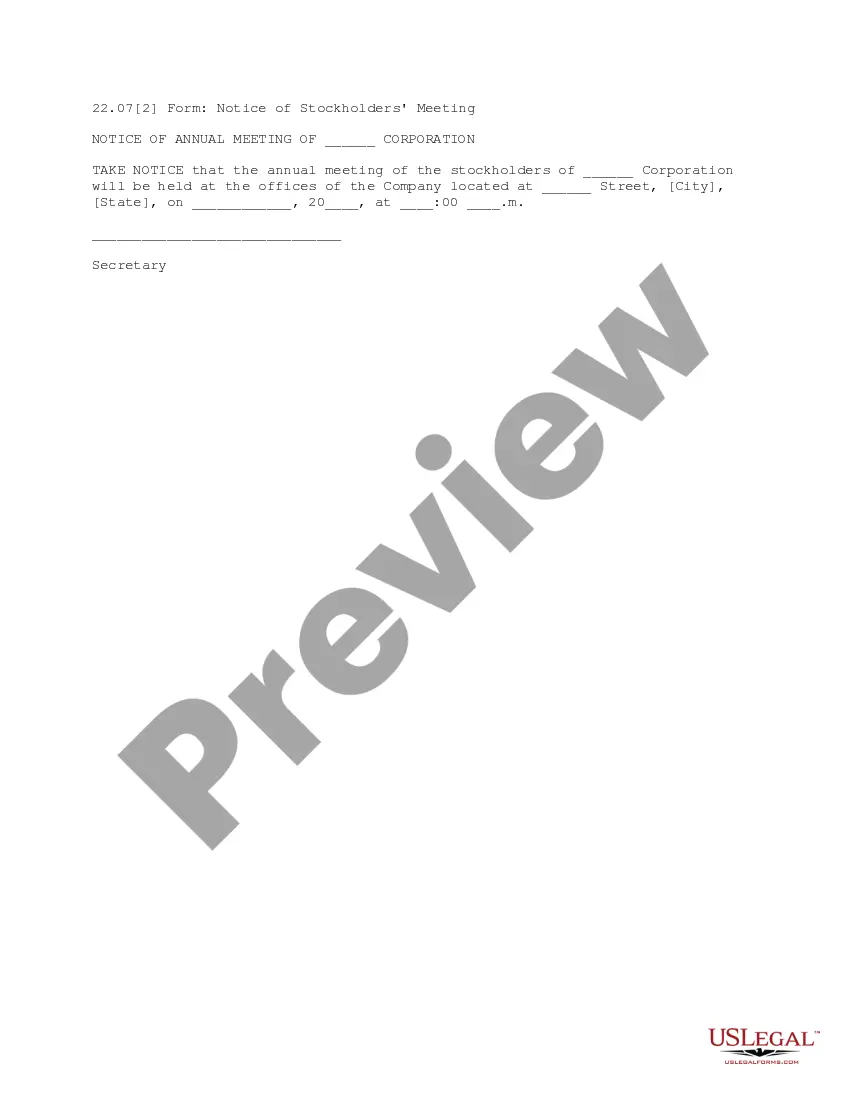

- Initially, make sure you have selected the proper develop to your city/county. You can examine the form utilizing the Preview switch and browse the form outline to ensure it is the best for you.

- If the develop does not meet your preferences, take advantage of the Seach area to obtain the proper develop.

- Once you are sure that the form is proper, click on the Buy now switch to have the develop.

- Choose the rates prepare you want and enter the necessary details. Create your accounts and pay money for the order making use of your PayPal accounts or credit card.

- Pick the file file format and acquire the lawful file web template in your system.

- Total, change and produce and indication the acquired Missouri Credit Agreement between Southwest Royalties, Inc. and Bank One Texas.

US Legal Forms may be the most significant catalogue of lawful kinds where you can find various file themes. Utilize the company to acquire professionally-made files that stick to status needs.