The Missouri Plan of Merger is a legal agreement between The Trident Group, Inc., Finger Acquisition Corp., and Finger Health Care Says., Inc. It outlines the terms and conditions of the merger process between these entities. This merger plan aims to combine the resources, expertise, and market presence of all three companies to create a stronger and more competitive entity in the healthcare industry. The Trident Group, Inc. is a leading provider of healthcare technology solutions, offering innovative software and services to healthcare organizations. Finger Acquisition Corp. is a financial services company specializing in mergers and acquisitions within the healthcare sector. Finger Health Care Says., Inc. is a healthcare systems provider, offering comprehensive solutions for healthcare management. The Missouri Plan of Merger between these entities is designed to streamline operations, improve efficiency, and enhance the overall quality of healthcare services provided. It encompasses various aspects, including financial arrangements, organizational structure, operational integration, and legal compliance. Under the Missouri Plan of Merger, the parties involved will determine the exchange ratio for the merger, which indicates the number of shares of each company's stock that will be exchanged for the other. This ratio is often based on the companies' respective valuations and financial performance. There are several types of Missouri Plan of Merger that may be implemented between The Trident Group, Inc., Finger Acquisition Corp., and Finger Health Care Says., Inc., depending on the specific goals and objectives of the merger. These types may include: 1. Horizontal Merger: This type of merger occurs when two or more companies operating in the same industry and at the same level of the supply chain combine their operations. The Trident Group, Inc., Finger Acquisition Corp., and Finger Health Care Says., Inc. may opt for a horizontal merger to expand their market presence and consolidate their resources. 2. Vertical Merger: In a vertical merger, companies operating at different stages of the supply chain merge their operations. This type of merger can lead to improved efficiency and cost savings through better coordination and integration of processes. The Missouri Plan of Merger between these entities may involve a vertical merger to leverage synergies and optimize the delivery of healthcare services. 3. Conglomerate Merger: A conglomerate merger occurs when two or more unrelated companies merge to diversify their operations and gain access to new markets. Although it is less likely in this specific case, The Trident Group, Inc., Finger Acquisition Corp., and Finger Health Care Says., Inc. could pursue a conglomerate merger if they identify complementary business opportunities outside their core areas. Overall, the Missouri Plan of Merger between The Trident Group, Inc., Finger Acquisition Corp., and Finger Health Care Says., Inc. aims to create a stronger, more competitive entity in the healthcare industry. It will harness the collective capabilities of these organizations to enhance healthcare management systems and provide superior services to their clients and customers.

Missouri Plan of Merger between The TriZetto Group, Inc., Finserv Acquisition Corp., Finserv Health Care Sys., Inc

Description

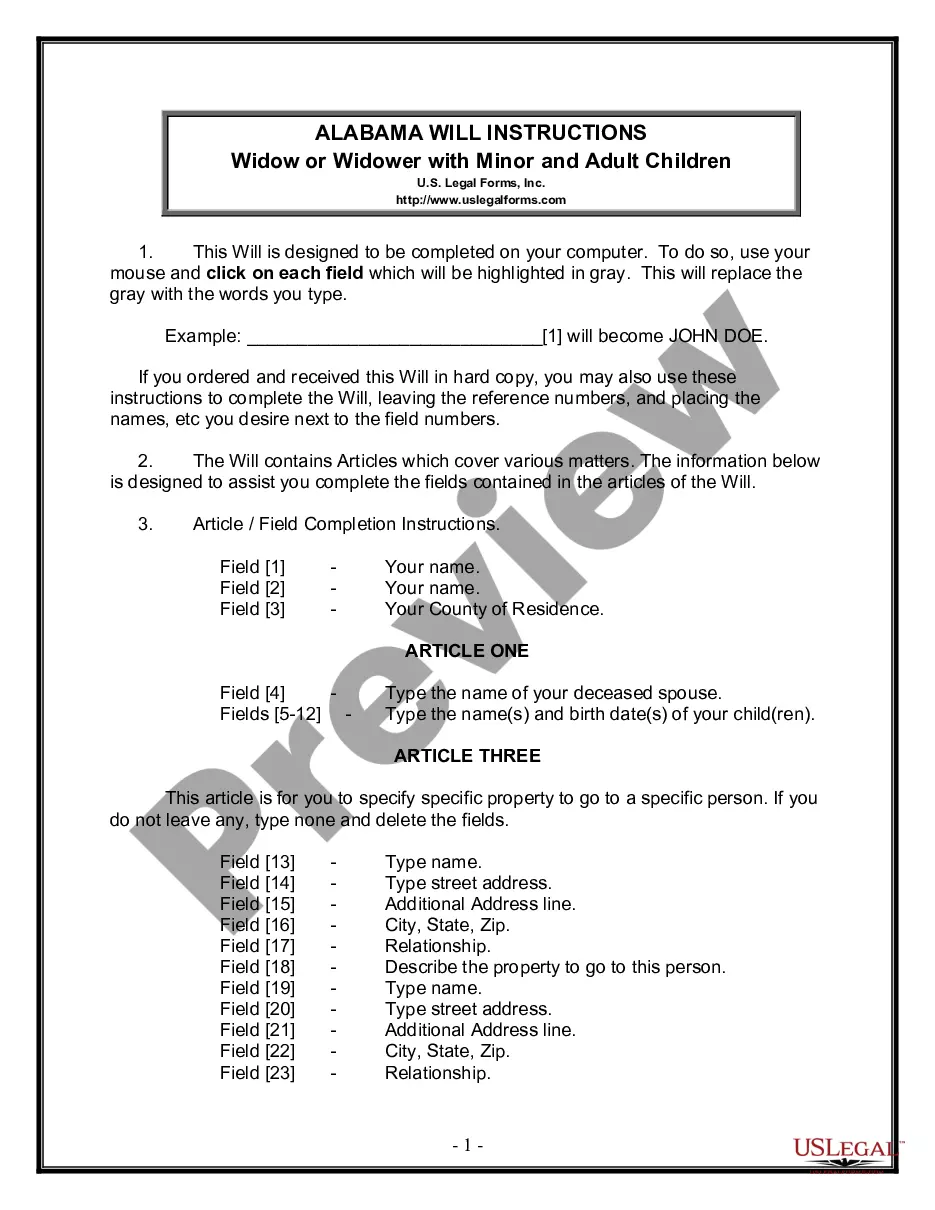

How to fill out Missouri Plan Of Merger Between The TriZetto Group, Inc., Finserv Acquisition Corp., Finserv Health Care Sys., Inc?

Discovering the right authorized file template can be a have difficulties. Needless to say, there are tons of web templates available on the net, but how do you get the authorized form you need? Take advantage of the US Legal Forms web site. The support provides 1000s of web templates, such as the Missouri Plan of Merger between The TriZetto Group, Inc., Finserv Acquisition Corp., Finserv Health Care Sys., Inc, that you can use for business and private demands. Each of the forms are checked out by professionals and meet up with federal and state needs.

When you are currently listed, log in in your account and click on the Acquire switch to get the Missouri Plan of Merger between The TriZetto Group, Inc., Finserv Acquisition Corp., Finserv Health Care Sys., Inc. Make use of your account to appear with the authorized forms you possess acquired formerly. Check out the My Forms tab of your respective account and have yet another backup in the file you need.

When you are a brand new user of US Legal Forms, here are simple recommendations so that you can adhere to:

- Very first, ensure you have chosen the right form for your area/area. You are able to look through the shape utilizing the Preview switch and read the shape outline to ensure this is the best for you.

- When the form fails to meet up with your requirements, make use of the Seach discipline to get the proper form.

- Once you are certain the shape is proper, select the Buy now switch to get the form.

- Opt for the pricing plan you need and enter in the required information and facts. Create your account and pay money for the transaction using your PayPal account or credit card.

- Opt for the document file format and down load the authorized file template in your gadget.

- Total, change and print and signal the received Missouri Plan of Merger between The TriZetto Group, Inc., Finserv Acquisition Corp., Finserv Health Care Sys., Inc.

US Legal Forms is definitely the biggest library of authorized forms that you can see different file web templates. Take advantage of the service to down load expertly-made paperwork that adhere to express needs.

Form popularity

Interesting Questions

More info

... Systems Ltd., a private UK-based company and< ... A-DB has a blend of government and blue-chip corporate clients, with presence in education, health, defense and financial services. The acquisition tightens ...