Missouri Stockholders Agreement between Unilab Corp., Kelso Investment Associates VI, LLP, KEP VI, LLC, EOS Partners, LP, Pequot Scout Fund, LP, and Rollover Investors

Description

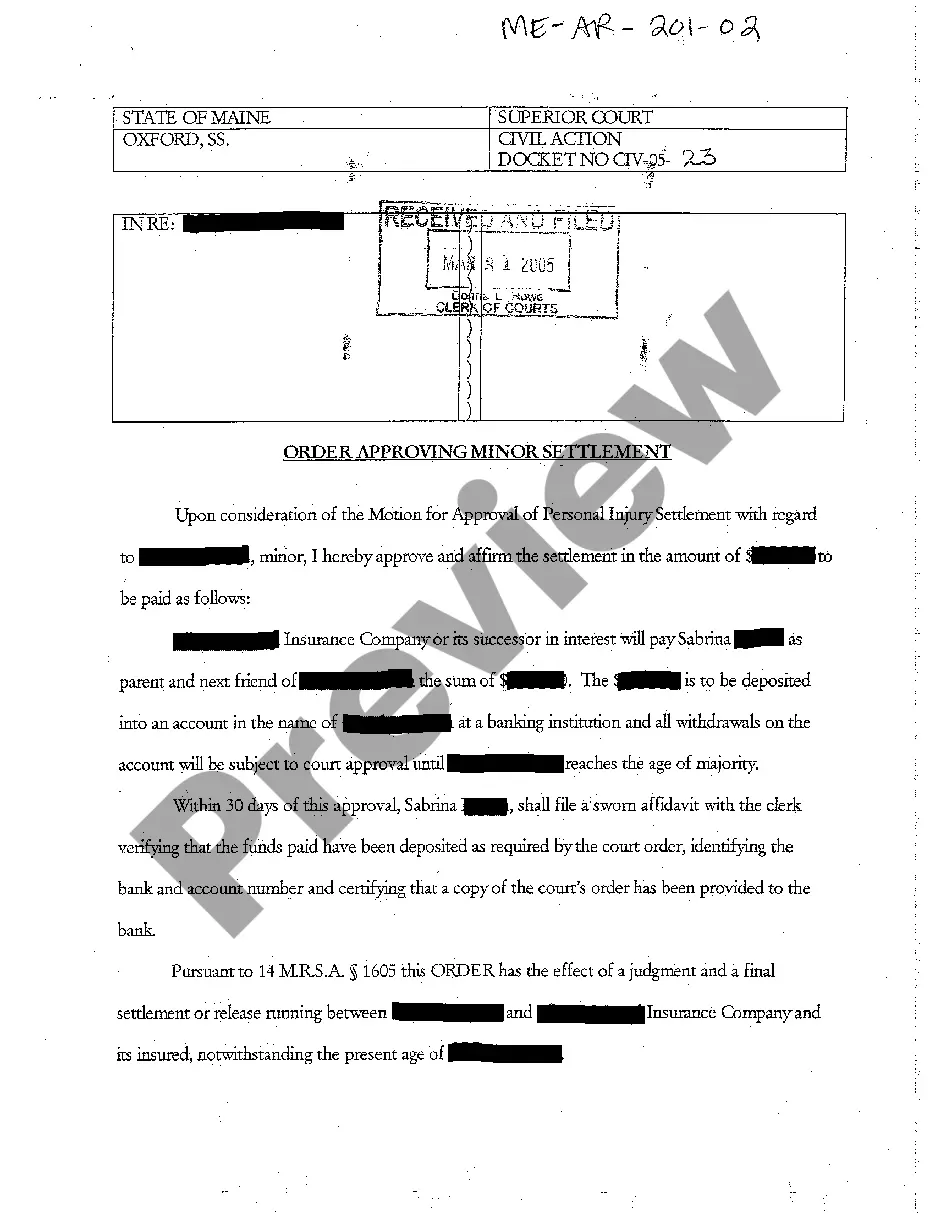

How to fill out Stockholders Agreement Between Unilab Corp., Kelso Investment Associates VI, LLP, KEP VI, LLC, EOS Partners, LP, Pequot Scout Fund, LP, And Rollover Investors?

If you need to total, down load, or print out lawful document web templates, use US Legal Forms, the greatest variety of lawful forms, that can be found on the web. Use the site`s simple and easy hassle-free look for to find the paperwork you want. Different web templates for business and personal reasons are categorized by classes and says, or keywords and phrases. Use US Legal Forms to find the Missouri Stockholders Agreement between Unilab Corp., Kelso Investment Associates VI, LLP, KEP VI, LLC, EOS Partners, LP, Pequot Scout Fund, LP, and Rollover Investors with a few mouse clicks.

In case you are currently a US Legal Forms buyer, log in for your bank account and click on the Download switch to obtain the Missouri Stockholders Agreement between Unilab Corp., Kelso Investment Associates VI, LLP, KEP VI, LLC, EOS Partners, LP, Pequot Scout Fund, LP, and Rollover Investors. Also you can access forms you in the past acquired in the My Forms tab of the bank account.

If you are using US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Make sure you have chosen the shape to the proper area/region.

- Step 2. Use the Preview solution to check out the form`s content. Never overlook to learn the information.

- Step 3. In case you are not happy using the type, use the Research area towards the top of the monitor to discover other models of your lawful type template.

- Step 4. After you have identified the shape you want, select the Acquire now switch. Opt for the rates strategy you like and put your credentials to sign up for an bank account.

- Step 5. Process the financial transaction. You can use your bank card or PayPal bank account to accomplish the financial transaction.

- Step 6. Pick the format of your lawful type and down load it on your own device.

- Step 7. Total, revise and print out or indicator the Missouri Stockholders Agreement between Unilab Corp., Kelso Investment Associates VI, LLP, KEP VI, LLC, EOS Partners, LP, Pequot Scout Fund, LP, and Rollover Investors.

Each and every lawful document template you get is your own forever. You have acces to each and every type you acquired inside your acccount. Go through the My Forms segment and choose a type to print out or down load once again.

Contend and down load, and print out the Missouri Stockholders Agreement between Unilab Corp., Kelso Investment Associates VI, LLP, KEP VI, LLC, EOS Partners, LP, Pequot Scout Fund, LP, and Rollover Investors with US Legal Forms. There are millions of skilled and condition-distinct forms you can use for your business or personal requires.