Missouri Pledge Agreement between ADAC Laboratories and ABN AMRO Bank, N.V.

Description

How to fill out Pledge Agreement Between ADAC Laboratories And ABN AMRO Bank, N.V.?

You are able to spend hours on the Internet attempting to find the lawful papers web template that suits the state and federal needs you want. US Legal Forms supplies a huge number of lawful kinds which can be analyzed by professionals. It is possible to obtain or print the Missouri Pledge Agreement between ADAC Laboratories and ABN AMRO Bank, N.V. from the services.

If you currently have a US Legal Forms bank account, you may log in and click the Obtain switch. Following that, you may complete, modify, print, or indication the Missouri Pledge Agreement between ADAC Laboratories and ABN AMRO Bank, N.V.. Each and every lawful papers web template you acquire is your own property forever. To acquire another version of the bought type, visit the My Forms tab and click the related switch.

If you use the US Legal Forms web site for the first time, follow the straightforward guidelines below:

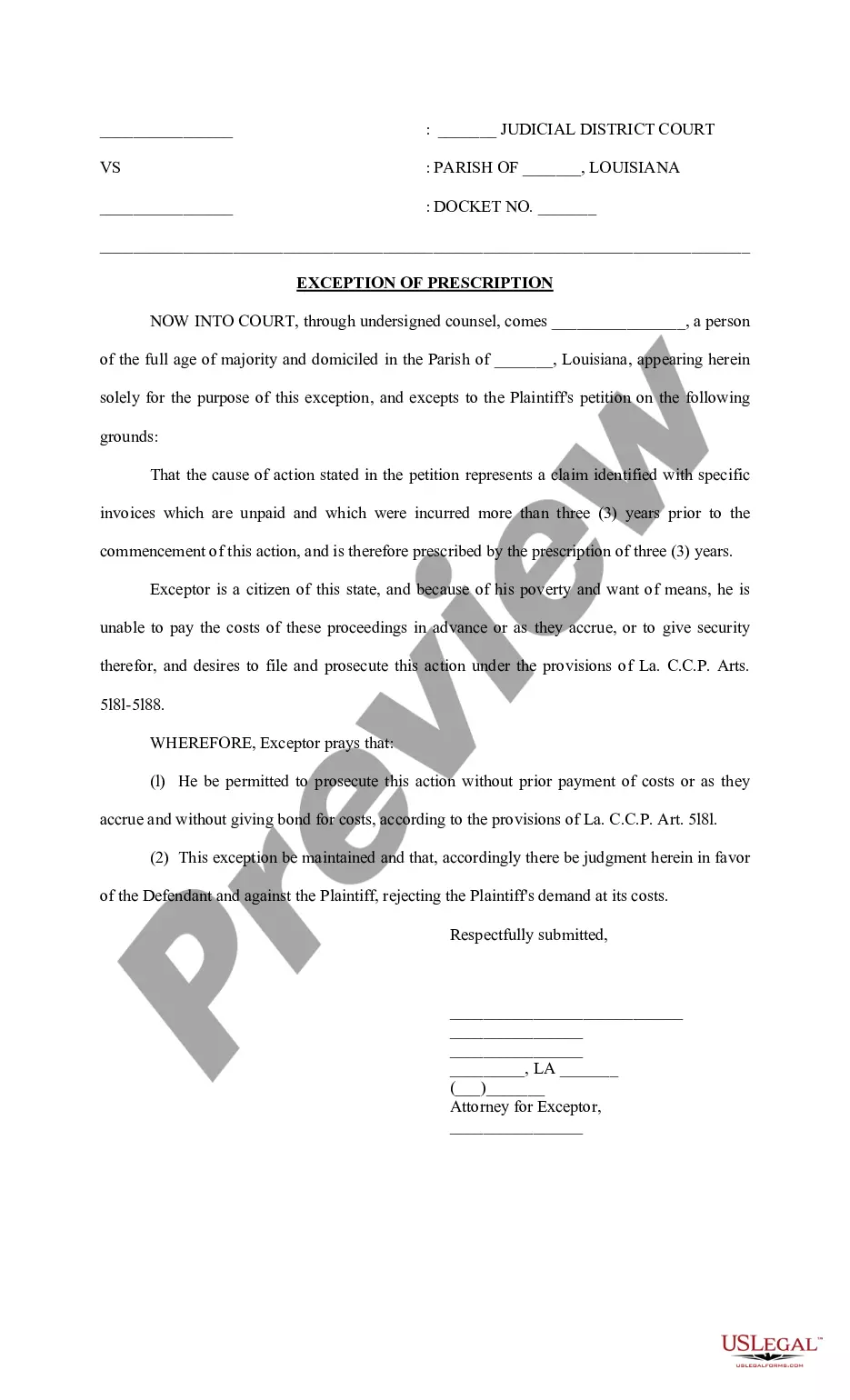

- Initial, be sure that you have chosen the best papers web template for that area/metropolis of your liking. See the type explanation to ensure you have selected the appropriate type. If available, utilize the Review switch to look with the papers web template at the same time.

- If you wish to discover another edition of the type, utilize the Research area to discover the web template that meets your needs and needs.

- After you have located the web template you want, click on Get now to move forward.

- Choose the rates program you want, type your qualifications, and register for a free account on US Legal Forms.

- Total the financial transaction. You should use your bank card or PayPal bank account to pay for the lawful type.

- Choose the structure of the papers and obtain it to the system.

- Make changes to the papers if needed. You are able to complete, modify and indication and print Missouri Pledge Agreement between ADAC Laboratories and ABN AMRO Bank, N.V..

Obtain and print a huge number of papers layouts using the US Legal Forms Internet site, that offers the largest variety of lawful kinds. Use specialist and status-distinct layouts to deal with your organization or personal demands.