Missouri Development Agreement is a legal contract between a property developer and a local government entity in Missouri, outlining the terms and conditions for a specific development project. This agreement serves as a tool to promote economic growth, job creation, and infrastructure development within the state. The Missouri Development Agreement typically includes multiple components aimed at facilitating and incentivizing the development process. These may encompass financial assistance, tax incentives, land grants, and regulatory flexibility. The primary objective is to encourage private investment in certain areas or industries that can spur economic activity and bring positive change to the region. In Missouri, there are several types of development agreements that cater to different needs and circumstances. Some commonly encountered types include: 1. Tax Increment Financing (TIF) Agreements: TIF agreements are designed to fund public infrastructure improvements within a designated development area. Under this agreement, a portion of future property tax revenue generated by the development is redirected to finance infrastructure projects, such as roads, utilities, or parking facilities. 2. Chapter 100 Agreements: Chapter 100 agreements facilitate the issuance of industrial development revenue bonds by local authorities. These tax-exempt bonds allow businesses to finance major capital projects, such as constructing or expanding manufacturing facilities, at a lower interest rate than conventional financing. 3. Community Improvement District (CID) Agreements: Community Improvement District agreements establish special districts within a municipality or county. The district imposes an additional sales tax or property tax on the district's businesses or residents. The generated revenue is then dedicated to various improvements within the district, such as security, marketing, landscaping, or other enhancements. 4. Enhanced Enterprise Zone (EEA) Agreements: EEA agreements aim to stimulate economic development in economically distressed areas by providing state tax credits and other incentives to qualified businesses that create new jobs or make significant investments in those areas. 5. Public-Private Partnership (P3) Agreements: Public-Private Partnership agreements involve collaboration between governmental entities and private companies to jointly develop, finance, and operate projects. These agreements often span across various sectors, including transportation, real estate development, infrastructure, and more. These are just a few examples of the diverse range of Missouri Development Agreements. Each specific agreement type caters to different development needs and is tailored to achieve economic growth and community improvement in accordance with the state's targeted goals.

Missouri Development Agreement

Description

How to fill out Missouri Development Agreement?

Have you been inside a placement in which you require documents for sometimes company or personal purposes almost every time? There are plenty of legitimate papers templates available on the Internet, but locating kinds you can rely isn`t straightforward. US Legal Forms gives a large number of kind templates, much like the Missouri Development Agreement, that are published to meet state and federal needs.

If you are already informed about US Legal Forms site and also have a free account, basically log in. After that, you can obtain the Missouri Development Agreement design.

Should you not provide an bank account and need to begin using US Legal Forms, abide by these steps:

- Discover the kind you will need and make sure it is for your correct metropolis/county.

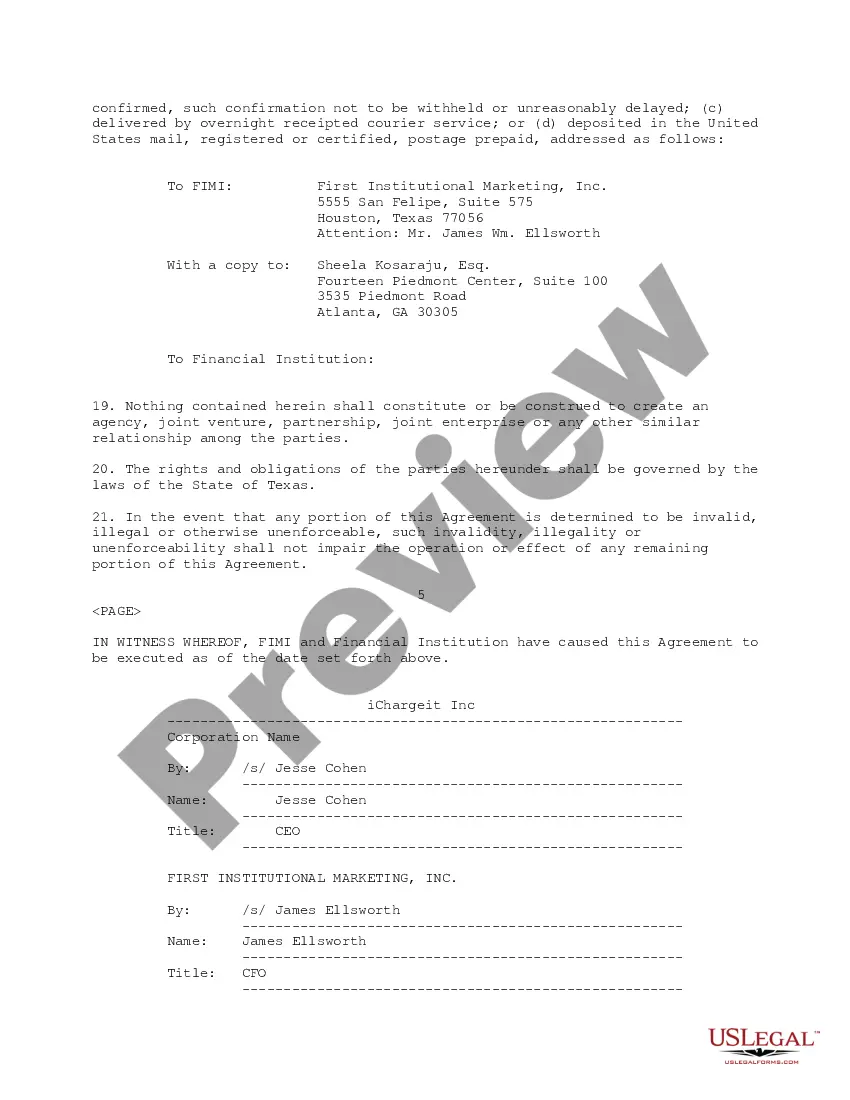

- Make use of the Review key to analyze the shape.

- Look at the information to actually have chosen the appropriate kind.

- In case the kind isn`t what you`re trying to find, take advantage of the Research discipline to discover the kind that fits your needs and needs.

- Once you obtain the correct kind, simply click Purchase now.

- Select the prices program you need, complete the required info to generate your money, and pay for the order making use of your PayPal or bank card.

- Decide on a practical document format and obtain your backup.

Discover each of the papers templates you have bought in the My Forms menu. You can get a extra backup of Missouri Development Agreement any time, if necessary. Just select the needed kind to obtain or printing the papers design.

Use US Legal Forms, one of the most comprehensive selection of legitimate types, to save lots of efforts and prevent errors. The assistance gives skillfully created legitimate papers templates that you can use for a range of purposes. Produce a free account on US Legal Forms and initiate making your daily life a little easier.