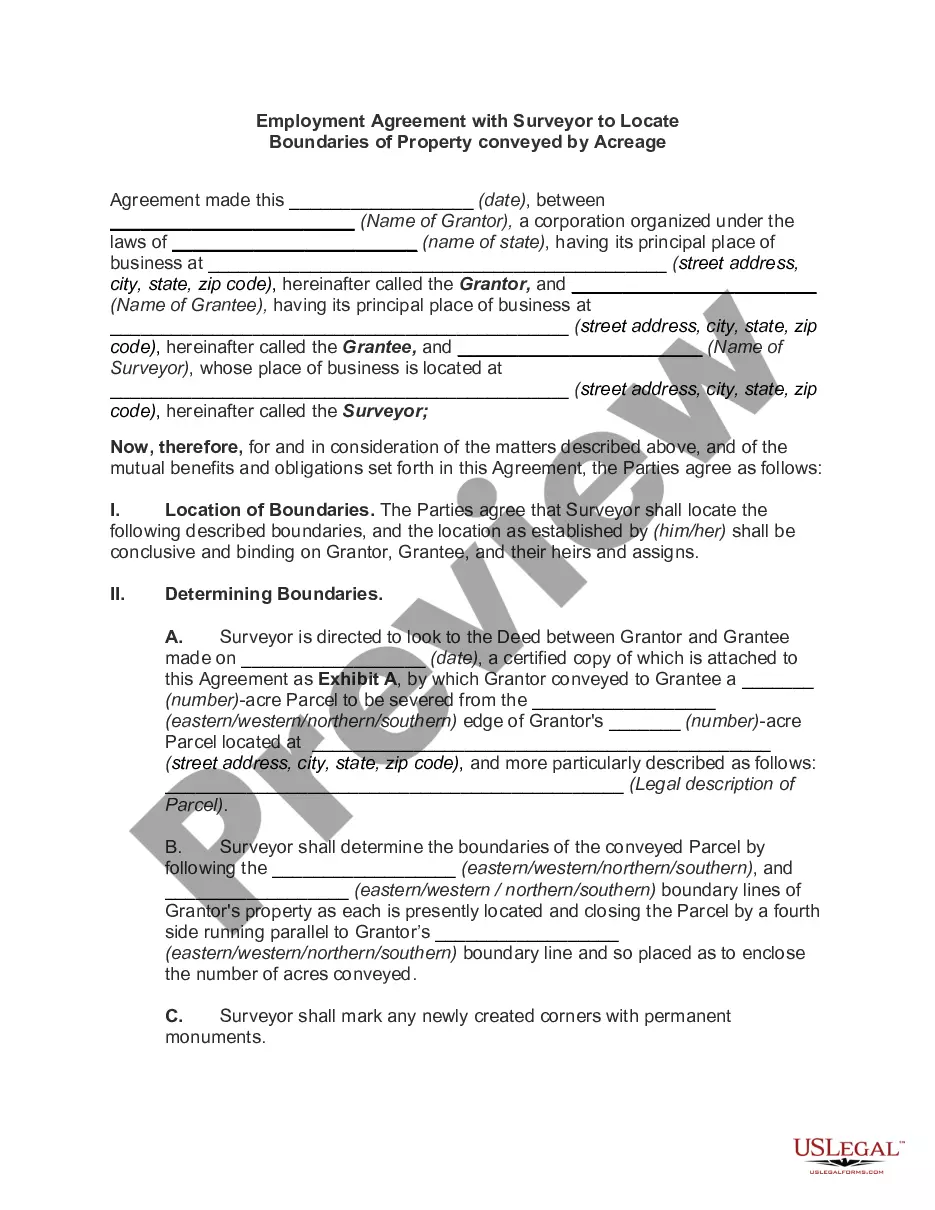

Missouri Merger Agreement between Bay Micro Computers, Inc. and BMC Acquisition Corporation

Description

How to fill out Merger Agreement Between Bay Micro Computers, Inc. And BMC Acquisition Corporation?

Choosing the best legitimate record design can be quite a have a problem. Needless to say, there are plenty of layouts available online, but how will you get the legitimate form you need? Take advantage of the US Legal Forms web site. The services gives thousands of layouts, such as the Missouri Merger Agreement between Bay Micro Computers, Inc. and BMC Acquisition Corporation, which you can use for company and private requirements. All of the kinds are examined by specialists and fulfill state and federal specifications.

Should you be currently registered, log in in your accounts and then click the Acquire button to have the Missouri Merger Agreement between Bay Micro Computers, Inc. and BMC Acquisition Corporation. Utilize your accounts to look with the legitimate kinds you possess ordered previously. Go to the My Forms tab of the accounts and get yet another backup in the record you need.

Should you be a whole new user of US Legal Forms, here are easy directions so that you can follow:

- Initial, make certain you have chosen the proper form to your area/region. It is possible to check out the shape utilizing the Review button and study the shape outline to make sure it is the right one for you.

- In case the form will not fulfill your expectations, take advantage of the Seach field to discover the appropriate form.

- Once you are certain the shape would work, click on the Acquire now button to have the form.

- Opt for the prices plan you would like and type in the necessary details. Create your accounts and purchase the transaction making use of your PayPal accounts or charge card.

- Choose the file structure and obtain the legitimate record design in your system.

- Full, modify and print out and sign the received Missouri Merger Agreement between Bay Micro Computers, Inc. and BMC Acquisition Corporation.

US Legal Forms will be the greatest library of legitimate kinds for which you can see a variety of record layouts. Take advantage of the service to obtain expertly-made documents that follow state specifications.