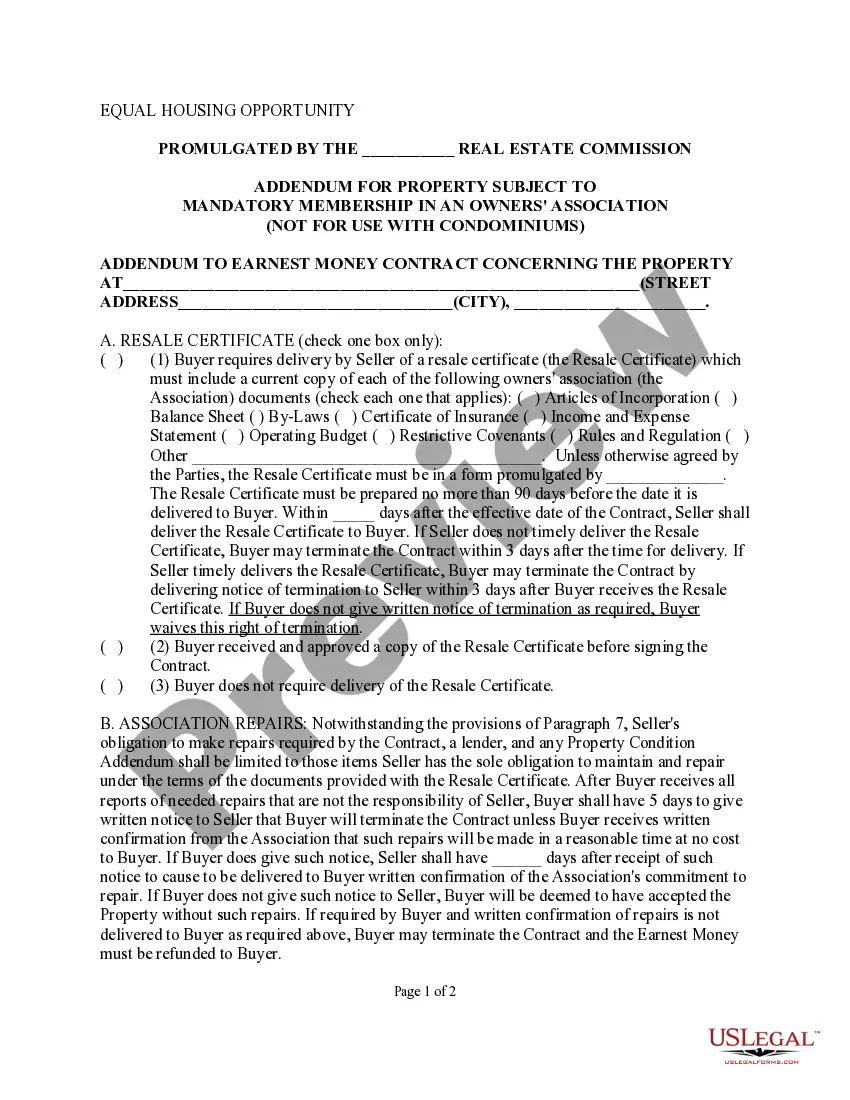

Missouri Stock Exchange Agreement and Plan of Reorganization by Jenkon International, Inc., Multimedia K.I.D. Intelligence in Education, Ltd., and Stockholders

Description

How to fill out Stock Exchange Agreement And Plan Of Reorganization By Jenkon International, Inc., Multimedia K.I.D. Intelligence In Education, Ltd., And Stockholders?

If you need to total, acquire, or printing legal papers web templates, use US Legal Forms, the greatest selection of legal varieties, which can be found on the web. Utilize the site`s simple and practical search to obtain the documents you want. Various web templates for enterprise and specific functions are categorized by classes and claims, or search phrases. Use US Legal Forms to obtain the Missouri Stock Exchange Agreement and Plan of Reorganization by Jenkon International, Inc., Multimedia K.I.D. Intelligence in Education, Ltd., and Stockholders in just a number of mouse clicks.

Should you be currently a US Legal Forms customer, log in to your account and click on the Obtain switch to obtain the Missouri Stock Exchange Agreement and Plan of Reorganization by Jenkon International, Inc., Multimedia K.I.D. Intelligence in Education, Ltd., and Stockholders. You can also entry varieties you earlier saved from the My Forms tab of your account.

Should you use US Legal Forms the first time, refer to the instructions listed below:

- Step 1. Be sure you have chosen the shape for your correct metropolis/land.

- Step 2. Use the Preview option to look through the form`s content. Never overlook to learn the information.

- Step 3. Should you be not satisfied together with the form, utilize the Look for field near the top of the monitor to find other types of your legal form format.

- Step 4. Once you have discovered the shape you want, select the Get now switch. Select the pricing plan you prefer and add your references to register for the account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the formatting of your legal form and acquire it on the product.

- Step 7. Complete, revise and printing or indication the Missouri Stock Exchange Agreement and Plan of Reorganization by Jenkon International, Inc., Multimedia K.I.D. Intelligence in Education, Ltd., and Stockholders.

Each and every legal papers format you get is yours for a long time. You possess acces to every form you saved in your acccount. Click the My Forms area and select a form to printing or acquire again.

Contend and acquire, and printing the Missouri Stock Exchange Agreement and Plan of Reorganization by Jenkon International, Inc., Multimedia K.I.D. Intelligence in Education, Ltd., and Stockholders with US Legal Forms. There are thousands of specialist and state-specific varieties you can use for the enterprise or specific needs.