Missouri Investment Intent Letter and Appointment of the Representative Agreement regarding issued shares of common stock

Description

How to fill out Investment Intent Letter And Appointment Of The Representative Agreement Regarding Issued Shares Of Common Stock?

If you have to total, acquire, or print out legitimate papers templates, use US Legal Forms, the greatest variety of legitimate forms, that can be found on the Internet. Take advantage of the site`s basic and hassle-free look for to obtain the papers you will need. A variety of templates for organization and individual reasons are categorized by groups and suggests, or search phrases. Use US Legal Forms to obtain the Missouri Investment Intent Letter and Appointment of the Representative Agreement regarding issued shares of common stock in a few clicks.

Should you be previously a US Legal Forms customer, log in in your profile and click on the Acquire switch to get the Missouri Investment Intent Letter and Appointment of the Representative Agreement regarding issued shares of common stock. You can also entry forms you formerly acquired in the My Forms tab of the profile.

Should you use US Legal Forms initially, follow the instructions below:

- Step 1. Ensure you have selected the form for that appropriate city/region.

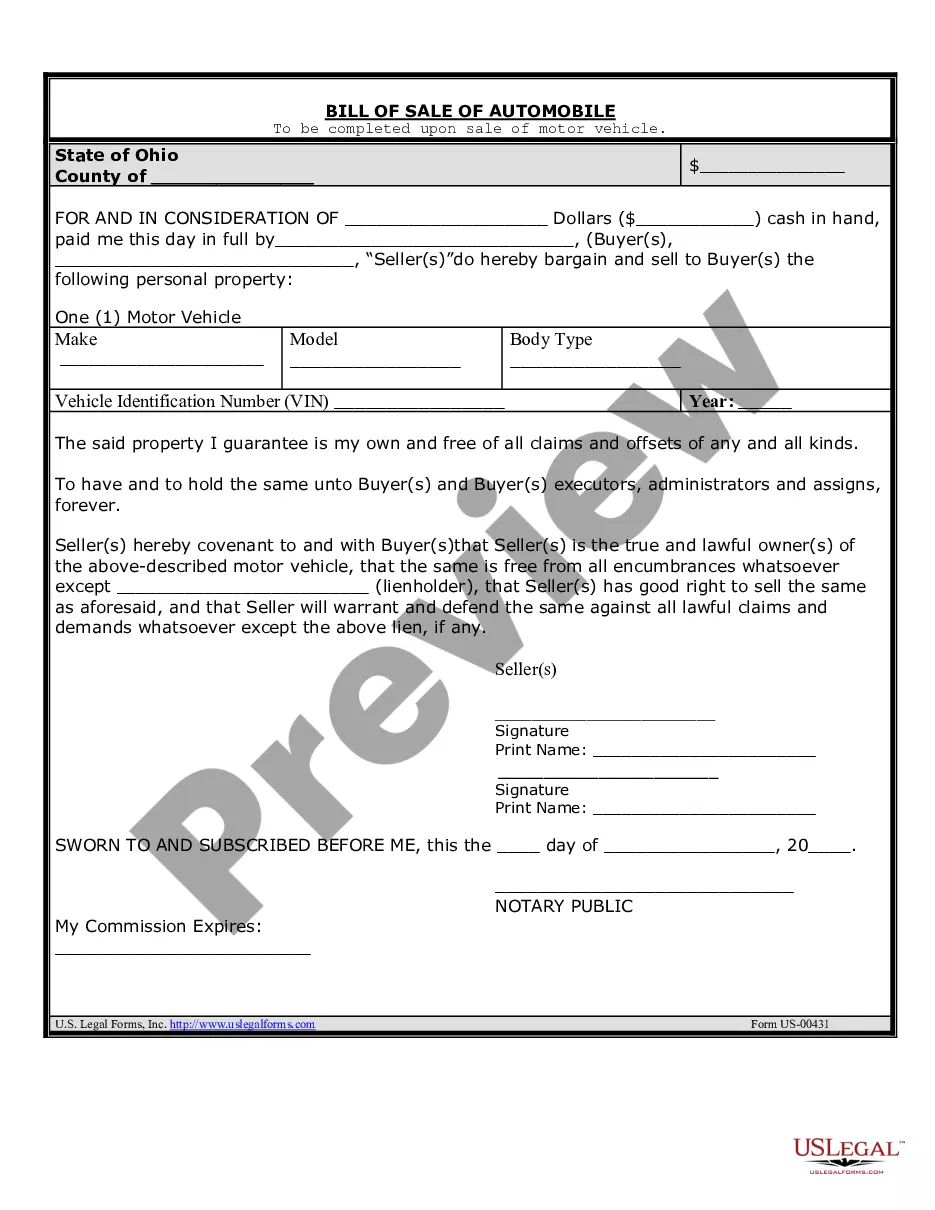

- Step 2. Make use of the Preview solution to check out the form`s information. Don`t forget to read the description.

- Step 3. Should you be unsatisfied with all the develop, use the Search field on top of the screen to find other versions of the legitimate develop web template.

- Step 4. After you have identified the form you will need, select the Get now switch. Opt for the costs plan you prefer and add your qualifications to register to have an profile.

- Step 5. Process the transaction. You can utilize your bank card or PayPal profile to complete the transaction.

- Step 6. Pick the formatting of the legitimate develop and acquire it on your device.

- Step 7. Total, edit and print out or indication the Missouri Investment Intent Letter and Appointment of the Representative Agreement regarding issued shares of common stock.

Every single legitimate papers web template you buy is your own property forever. You may have acces to each develop you acquired within your acccount. Click the My Forms area and decide on a develop to print out or acquire once again.

Contend and acquire, and print out the Missouri Investment Intent Letter and Appointment of the Representative Agreement regarding issued shares of common stock with US Legal Forms. There are millions of skilled and status-particular forms you can utilize for your personal organization or individual demands.