Missouri Farm Hand Services Contract - Self-Employed

Description

How to fill out Missouri Farm Hand Services Contract - Self-Employed?

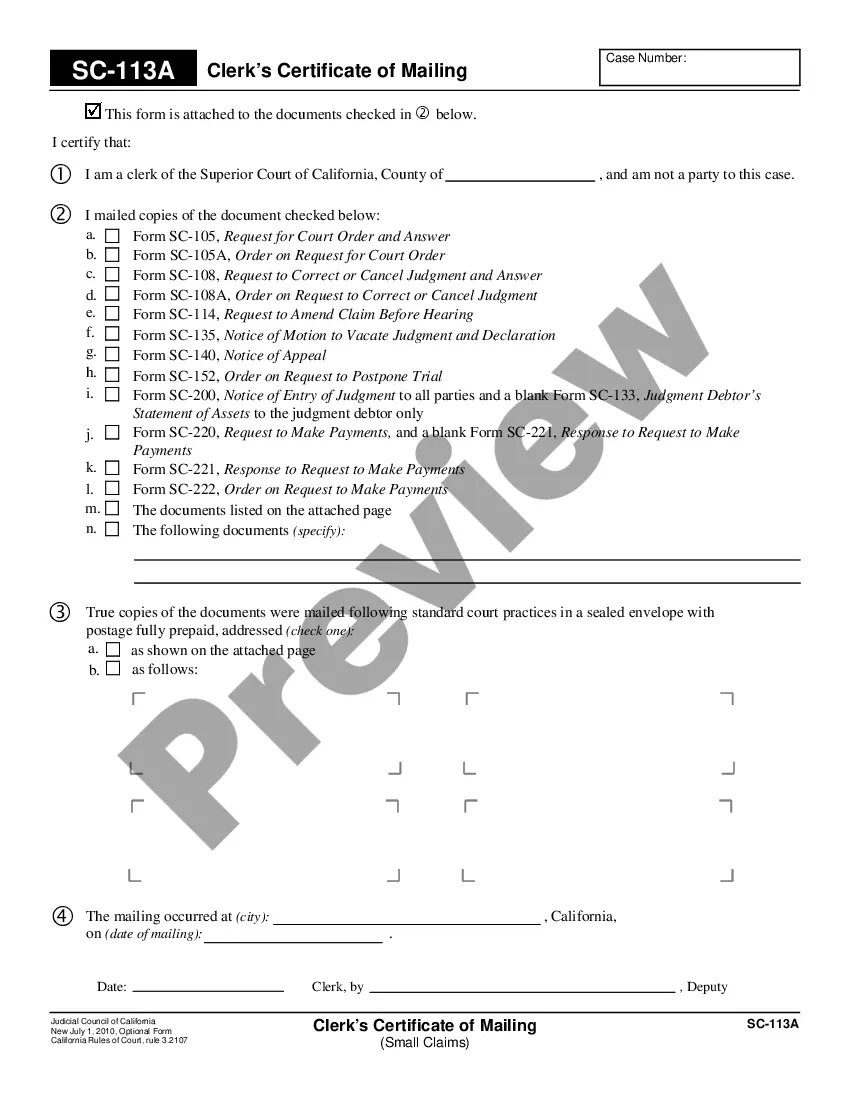

US Legal Forms - one of many greatest libraries of legal types in the United States - gives a wide array of legal file themes you may download or produce. Making use of the site, you can find thousands of types for organization and personal uses, sorted by classes, claims, or key phrases.You will discover the latest models of types such as the Missouri Farm Hand Services Contract - Self-Employed within minutes.

If you currently have a membership, log in and download Missouri Farm Hand Services Contract - Self-Employed through the US Legal Forms catalogue. The Obtain key will appear on every single form you perspective. You gain access to all in the past downloaded types within the My Forms tab of your accounts.

If you wish to use US Legal Forms the first time, listed below are straightforward guidelines to get you began:

- Make sure you have picked the correct form to your metropolis/county. Click the Review key to check the form`s content material. Read the form explanation to actually have chosen the right form.

- In the event the form does not suit your needs, take advantage of the Lookup area towards the top of the display to obtain the one who does.

- Should you be pleased with the shape, validate your selection by visiting the Purchase now key. Then, pick the pricing program you favor and offer your references to register to have an accounts.

- Procedure the financial transaction. Make use of your Visa or Mastercard or PayPal accounts to perform the financial transaction.

- Find the file format and download the shape on the gadget.

- Make alterations. Complete, edit and produce and indicator the downloaded Missouri Farm Hand Services Contract - Self-Employed.

Every single web template you included with your account does not have an expiration day and is also yours eternally. So, if you wish to download or produce an additional version, just check out the My Forms section and then click around the form you will need.

Gain access to the Missouri Farm Hand Services Contract - Self-Employed with US Legal Forms, probably the most comprehensive catalogue of legal file themes. Use thousands of specialist and condition-distinct themes that satisfy your company or personal demands and needs.

Form popularity

FAQ

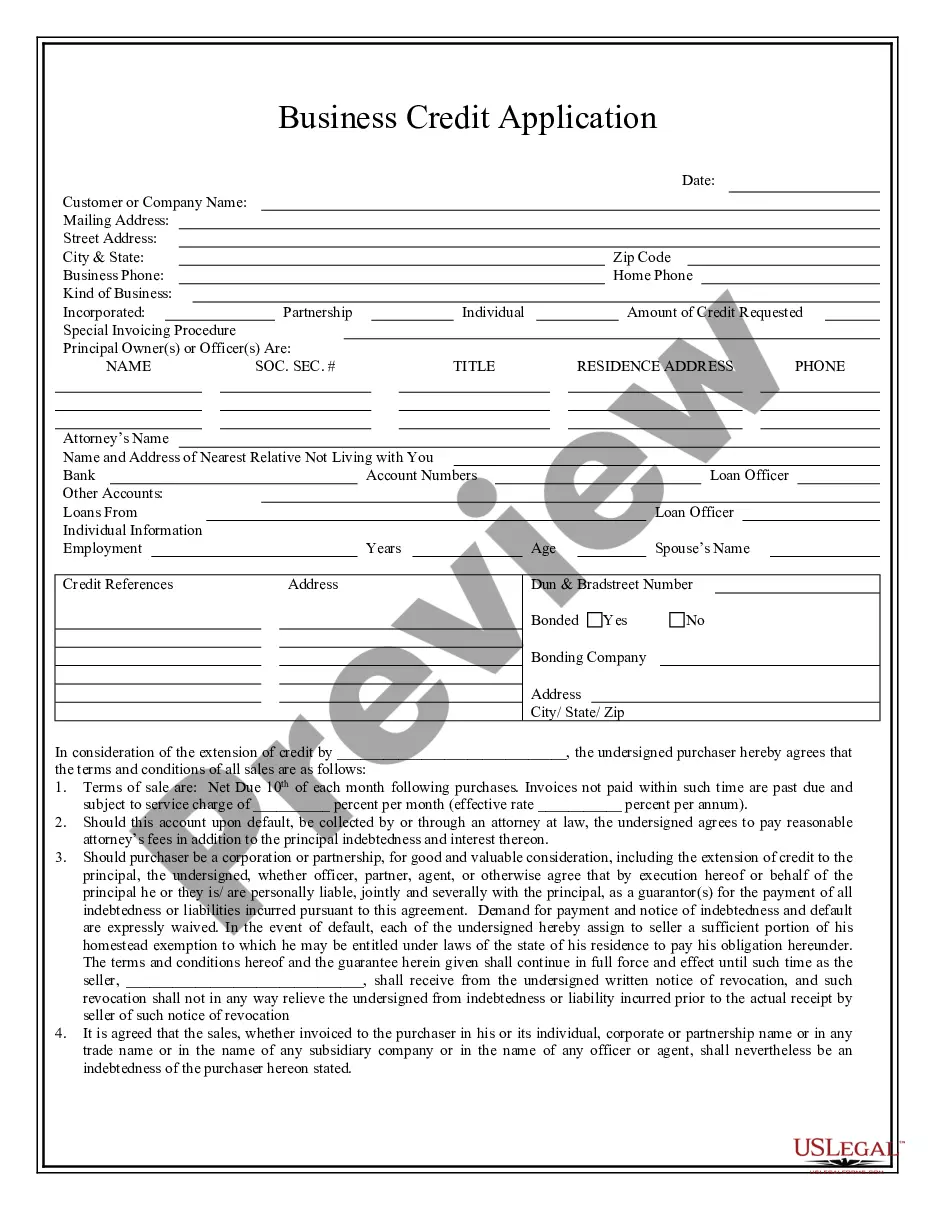

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

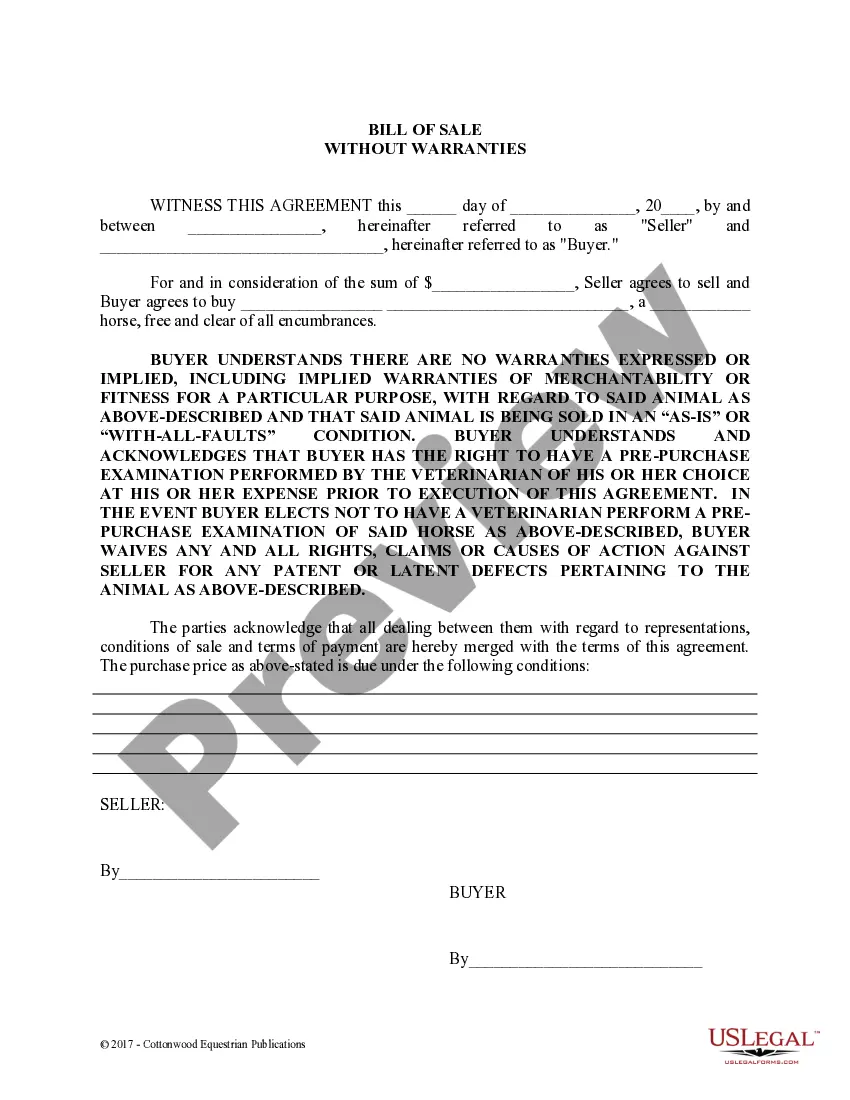

All work required of the contract is performed by the independent contractor and employees. Independent contractors are not typically considered employees of the principal. A "general contractor" is an entity with whom the principal/owner directly contracts to perform certain jobs.

The Missouri Supreme Court has defined an independent contractor as "one who, exercising an independent employment, contracts to do a piece of work according to his own methods, without being subject to the control of his employer, except as to the result of his work" (Vaseleou v. St.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Business registrationMissouri doesn't make contractors carry licenses, but it does make businesses register with the Secretary of State. Sole proprietorships and general partnerships are exempt, but all other businesses (including any business operating under a fictitious name) must register.

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

Independent contractors provide goods or services according to the terms of a contract they have negotiated with an employer. Independent contractors are not employees, and therefore they are not covered under most federal employment statutes.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.