Missouri Cook Services Contract - Self-Employed

Description

How to fill out Missouri Cook Services Contract - Self-Employed?

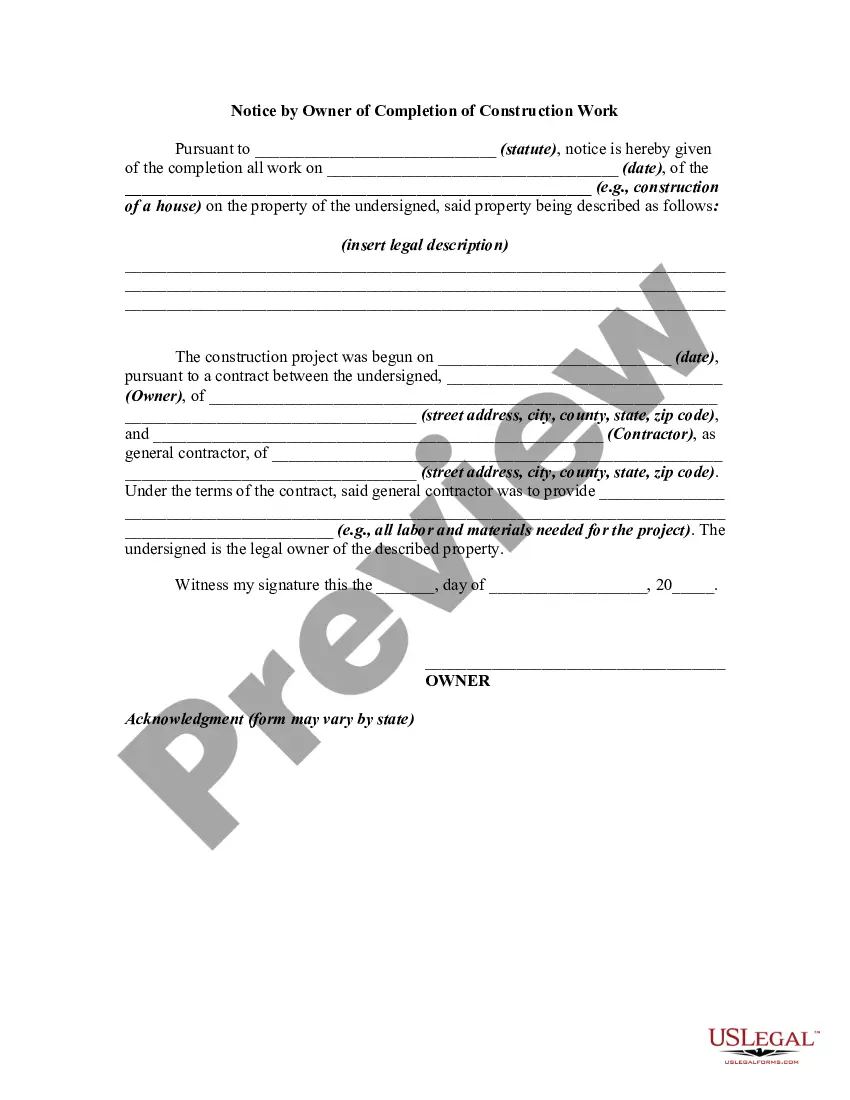

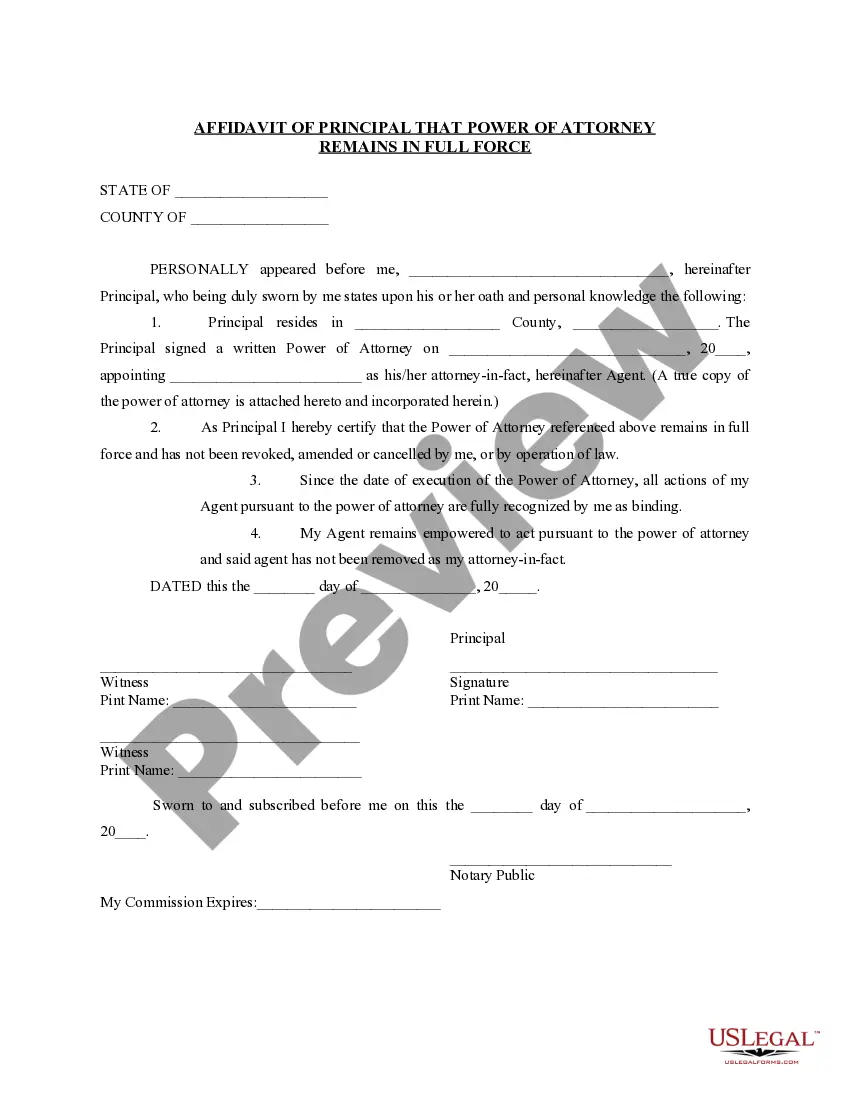

Have you been inside a placement the place you require files for possibly business or personal uses virtually every working day? There are tons of legal papers layouts available online, but locating ones you can rely on is not straightforward. US Legal Forms provides 1000s of type layouts, much like the Missouri Cook Services Contract - Self-Employed, that happen to be written to satisfy federal and state needs.

When you are already informed about US Legal Forms website and get your account, simply log in. Next, it is possible to download the Missouri Cook Services Contract - Self-Employed design.

If you do not come with an accounts and wish to start using US Legal Forms, follow these steps:

- Get the type you will need and ensure it is for that correct metropolis/region.

- Make use of the Review button to check the shape.

- Look at the information to actually have chosen the right type.

- When the type is not what you are looking for, make use of the Lookup area to get the type that meets your needs and needs.

- Once you find the correct type, click Get now.

- Choose the costs program you want, fill out the required information to make your account, and buy an order with your PayPal or Visa or Mastercard.

- Decide on a hassle-free data file structure and download your copy.

Find each of the papers layouts you have purchased in the My Forms menu. You can get a more copy of Missouri Cook Services Contract - Self-Employed whenever, if required. Just select the essential type to download or print out the papers design.

Use US Legal Forms, by far the most substantial assortment of legal forms, to conserve some time and steer clear of faults. The service provides expertly manufactured legal papers layouts that you can use for a selection of uses. Make your account on US Legal Forms and initiate producing your way of life easier.

Form popularity

FAQ

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

10 steps to setting up as a contractor:Research the regulations and responsibilities surrounding contractors.Be prepared to leave your permanent role and set up as a limited company.Consider your tax position and understand IR35.Decide whether to form a limited company or join an umbrella organisation.More items...?

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.

A contract that is used for appointing a genuinely self-employed individual such as a consultant (or a profession or business run by that individual) to carry out services for another party where the relationship between the parties is not that of employer and employee or worker.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

Self-employed people are those who own their own businesses and work for themselves. According to the IRS, you are self-employed if you act as a sole proprietor or independent contractor, or if you own an unincorporated business.