Missouri Payroll Specialist Agreement - Self-Employed Independent Contractor

Description

How to fill out Missouri Payroll Specialist Agreement - Self-Employed Independent Contractor?

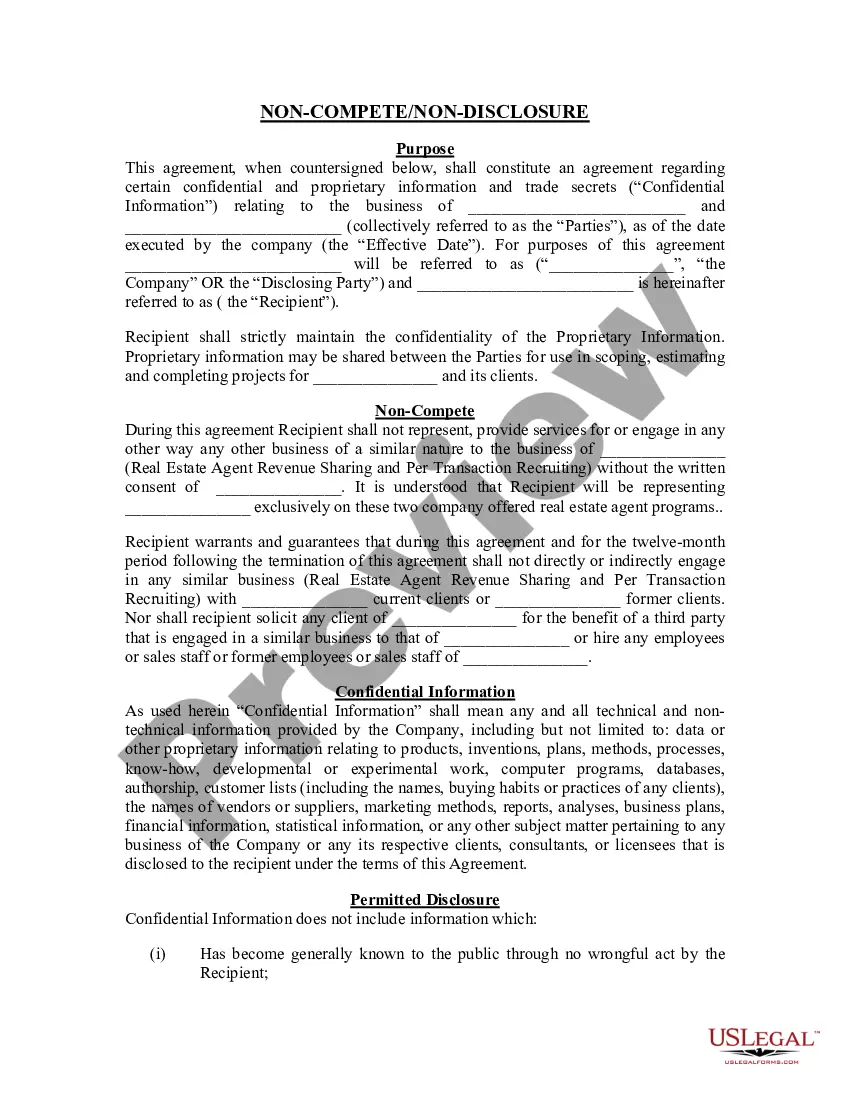

You can commit hrs on the Internet trying to find the authorized record web template that fits the federal and state needs you will need. US Legal Forms provides 1000s of authorized varieties that are examined by pros. You can easily acquire or print out the Missouri Payroll Specialist Agreement - Self-Employed Independent Contractor from your support.

If you already possess a US Legal Forms account, you may log in and then click the Obtain button. Next, you may full, revise, print out, or signal the Missouri Payroll Specialist Agreement - Self-Employed Independent Contractor. Every single authorized record web template you get is your own permanently. To have yet another duplicate for any bought develop, check out the My Forms tab and then click the corresponding button.

If you are using the US Legal Forms internet site the first time, keep to the simple instructions beneath:

- Initial, make sure that you have selected the proper record web template for the state/town that you pick. Read the develop outline to make sure you have picked the proper develop. If readily available, take advantage of the Review button to appear from the record web template as well.

- If you want to locate yet another variation from the develop, take advantage of the Search discipline to get the web template that meets your needs and needs.

- Once you have discovered the web template you would like, simply click Get now to proceed.

- Select the prices plan you would like, enter your references, and register for an account on US Legal Forms.

- Complete the deal. You can use your bank card or PayPal account to purchase the authorized develop.

- Select the formatting from the record and acquire it for your system.

- Make adjustments for your record if possible. You can full, revise and signal and print out Missouri Payroll Specialist Agreement - Self-Employed Independent Contractor.

Obtain and print out 1000s of record layouts using the US Legal Forms site, that provides the greatest variety of authorized varieties. Use skilled and state-distinct layouts to handle your business or person needs.

Form popularity

FAQ

How to Pay 1099 Contractors in PayrollAdd the contractor by going to Payroll > 1099 Contractors > Add Contractor.Enter the 1099 Type and their FEIN or Social Security/Individual Taxpayer ID number.If you have Patriot's Accounting software, be sure the Pay this contractor in payroll box is checked on their record.More items...

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

Here are some steps you may use to guide you when you write an employment contract:Title the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.Employment.More items...?

This means that if you hire 1099 workers, you don't need to pay payroll taxes on their behalf. You also aren't required to provide them standard employee benefits, such as PTO and sick leave, or contribute to their health insurance coverage or retirement plan.

Independent contractors are not classified as employees by the Internal Revenue Service (IRS), so instead of being paid through your payroll system, they're paid separately as a business expense.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

How is an independent contractor paid?Obtain the independent contractor's Form W-9, Request for Taxpayer Identification Number and Certification.Provide compensation for work performed.Remit backup withholding payments to the IRS, if necessary.Complete Form 1099-NEC, Nonemployee Compensation.

Payroll refers to the tasks an employer must execute to ensure employees are paid accurately and on time. An independent contractor is not an employee; therefore, he's not paid through the payroll.

Payroll refers to the tasks an employer must execute to ensure employees are paid accurately and on time. An independent contractor is not an employee; therefore, he's not paid through the payroll.