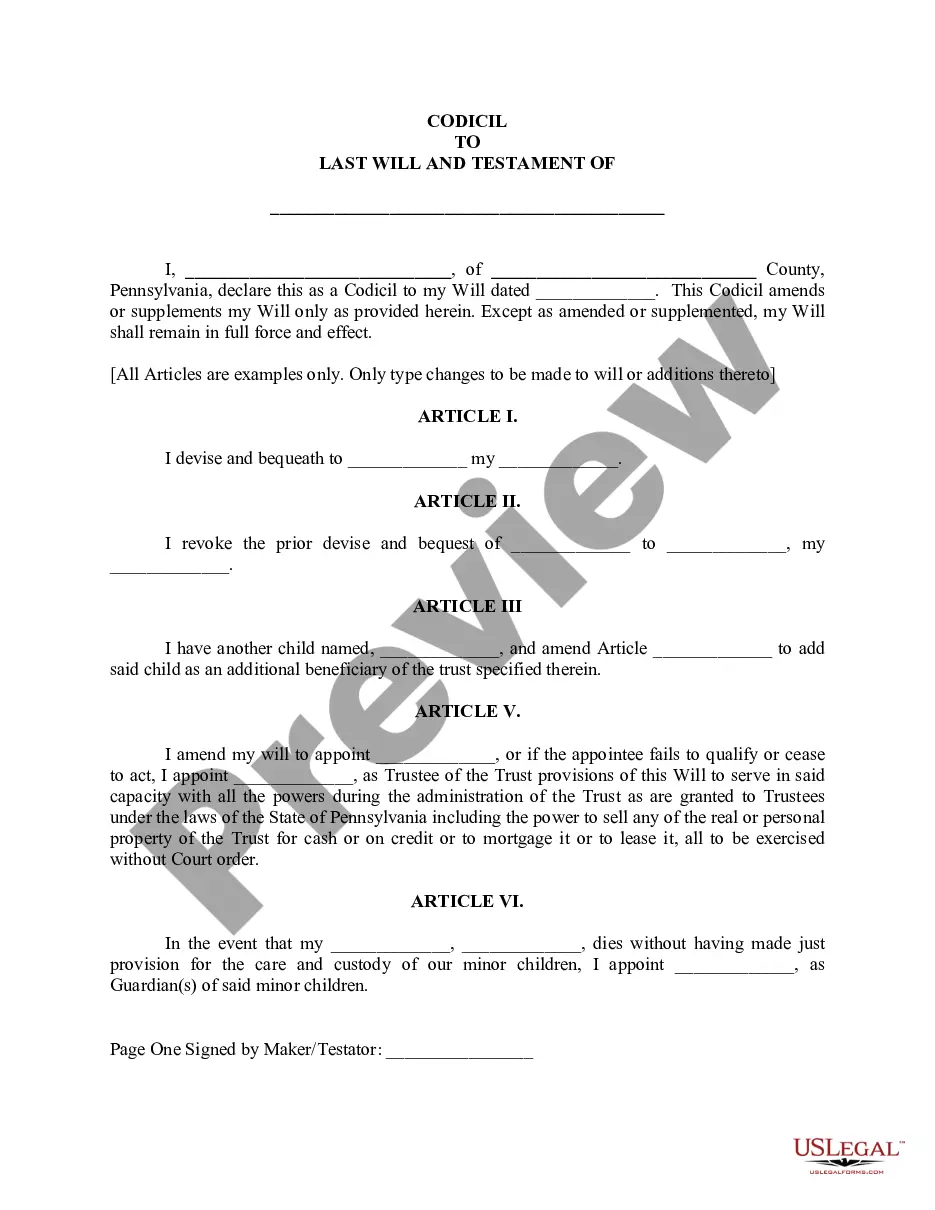

This is an agreement between the firm and a new partner, for compensation based on generating new business. It lists the base draw and the percentage of fees earned by generating new business. It also covers such areas as secretarial help, office space, medical insurance, and malpractice insurance.

Missouri Agreement with New Partner for Compensation Based on Generating New Business

Description

How to fill out Agreement With New Partner For Compensation Based On Generating New Business?

Choosing the best legitimate file template could be a have difficulties. Obviously, there are plenty of themes available on the net, but how would you obtain the legitimate type you want? Take advantage of the US Legal Forms site. The assistance delivers a huge number of themes, like the Missouri Agreement with New Partner for Compensation Based on Generating New Business, which can be used for organization and personal requires. Each of the forms are examined by specialists and fulfill state and federal specifications.

When you are currently authorized, log in in your account and click the Obtain button to find the Missouri Agreement with New Partner for Compensation Based on Generating New Business. Make use of your account to check through the legitimate forms you may have purchased formerly. Proceed to the My Forms tab of your respective account and get an additional version in the file you want.

When you are a whole new user of US Legal Forms, allow me to share straightforward recommendations so that you can follow:

- Initially, make sure you have chosen the proper type to your metropolis/area. You are able to examine the shape making use of the Review button and look at the shape explanation to ensure this is the right one for you.

- When the type will not fulfill your requirements, take advantage of the Seach area to obtain the right type.

- When you are certain the shape is acceptable, go through the Get now button to find the type.

- Pick the rates plan you desire and enter the needed details. Make your account and buy the transaction utilizing your PayPal account or Visa or Mastercard.

- Select the submit format and download the legitimate file template in your device.

- Complete, modify and print and signal the obtained Missouri Agreement with New Partner for Compensation Based on Generating New Business.

US Legal Forms may be the most significant local library of legitimate forms for which you can find various file themes. Take advantage of the service to download skillfully-created files that follow express specifications.

Form popularity

FAQ

In addition to articles of organization, Missouri statute requires all limited liability companies to have an operating agreement.

The filing fee is $50 for online filing, $105 for filing by mail. The application must include a current certificate of good standing/existence from the secretary of state or other similar official in the LLC's home state. It must be dated within 60 calendar days from the date of filing the application.

Registered Agent/Office An agent may be either an individual who is a resident of Missouri and whose business office is identical with the entity's registered office, or it may be a corporation authorized to transact business in Missouri and which has a business office identical with the entity's registered office.

Yes, you can be your own registered agent in Oklahoma. However, after considering the registered agent requirements most business owners elect to hire a registered agent service instead.

MO-2NR Document. Statement of Income Tax Payments for Nonresident Partners or S Corporation Shareholders.

1. Change your Missouri LLC Operating Agreement Drafting an amendment. Holding a meeting of all members. Voting on that amendment. Adopting that amendment (provided all members voted in favor) Updating the operating agreement.

To become the Registered Agent for a new LLC, all you need to do is designate yourself as such in your Articles of Organization. To do this, just enter your name and Missouri street address in the fields requesting your Registered Agent's name and Registered Office address.

No, you cannot use a P.O. box for your business address on your formation documents in Missouri. Missouri law requires LLCs and other business entities to have a physical address within the state, known as a registered office address, where they can receive legal documents, mail, and other official communications.