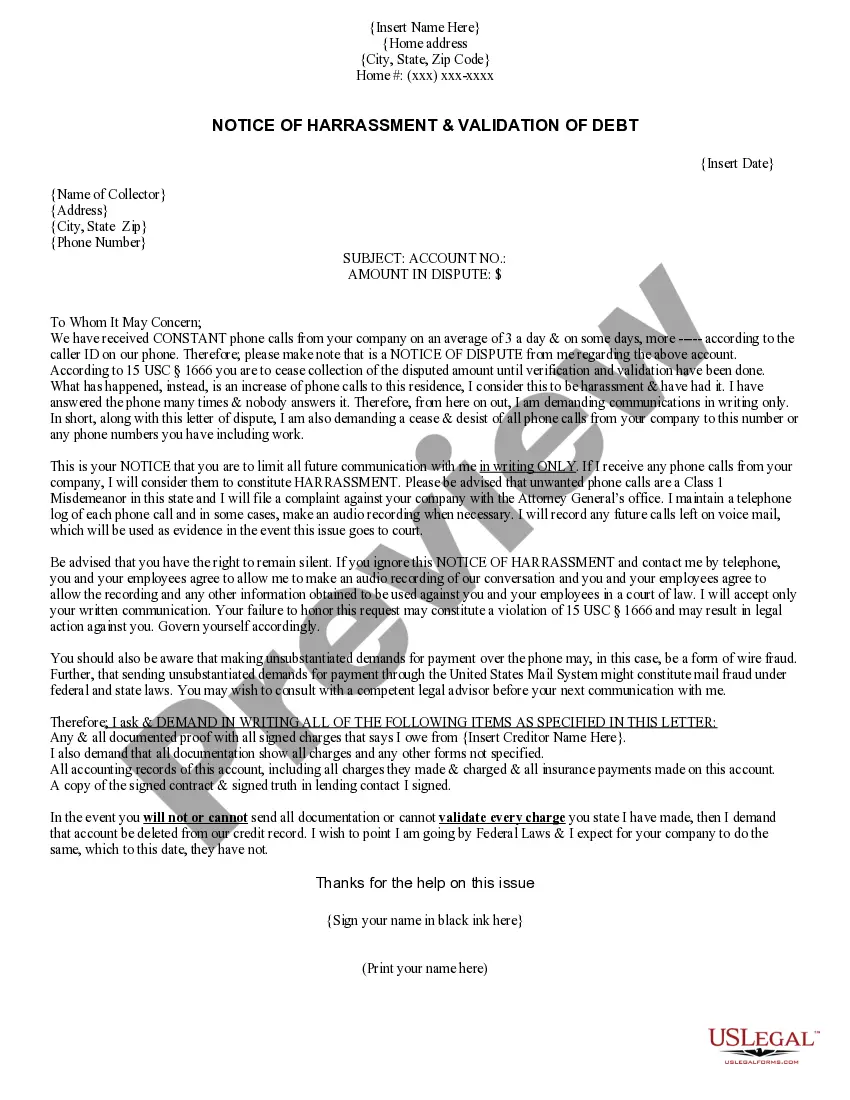

This NOTICE OF HARRASSMENT & VALIDATION OF DEBT is to be used when creditors call you repeatedly and mail you letters too. This form includes a cease and desist and a validation of debt, 2 letters in one.

Missouri Notice of Harassment and Validation of Debt

Description

How to fill out Missouri Notice Of Harassment And Validation Of Debt?

You are able to devote hours on the web searching for the authorized papers template that meets the federal and state demands you require. US Legal Forms offers a huge number of authorized kinds which are analyzed by specialists. It is possible to download or print out the Missouri Notice of Harassment and Validation of Debt from your assistance.

If you currently have a US Legal Forms bank account, you may log in and click the Down load option. Next, you may complete, modify, print out, or sign the Missouri Notice of Harassment and Validation of Debt. Each authorized papers template you acquire is yours permanently. To have an additional copy of any bought kind, proceed to the My Forms tab and click the related option.

Should you use the US Legal Forms website the first time, stick to the basic recommendations listed below:

- Initial, make certain you have selected the correct papers template to the area/metropolis of your choosing. Browse the kind explanation to make sure you have selected the proper kind. If available, take advantage of the Preview option to search throughout the papers template also.

- If you would like locate an additional version of your kind, take advantage of the Lookup area to discover the template that meets your requirements and demands.

- Once you have found the template you want, click on Buy now to carry on.

- Choose the rates prepare you want, type your references, and register for a merchant account on US Legal Forms.

- Total the deal. You may use your bank card or PayPal bank account to purchase the authorized kind.

- Choose the structure of your papers and download it to the system.

- Make changes to the papers if needed. You are able to complete, modify and sign and print out Missouri Notice of Harassment and Validation of Debt.

Down load and print out a huge number of papers layouts making use of the US Legal Forms web site, that offers the biggest selection of authorized kinds. Use professional and status-distinct layouts to handle your business or specific demands.

Form popularity

FAQ

The definition of debt collection harassment is to intimidate, abuse, coerce, bully or browbeat consumers into paying off debt. This happens most often over the phone, but harassment could come in the form of emails, texts, direct mail or talking to friends or neighbors about your debt.

The statute of limitations is a law that limits how long debt collectors can legally sue consumers for unpaid debt. The statute of limitations on debt varies by state and type of debt, ranging from three years to as long as 20 years.

According to the above FDCPA Section, Debt Validation is defined as the debt collector contacting the original creditor to affirm the debt amount being requested is correct. It is highly doubtful the debt collector ever contacts the original creditor for any debt validation purposes.

Depending on the type of debt, Missouri statute of limitations on debt range between five to 10 years. After that period has passed, the debt becomes time-barred, which means collectors no longer have the right to sue you.

In Missouri, there is a five-year statute of limitations for personal injury claims; but fraud and debt collection claims have a ten-year limit. For criminal charges, there is no limit for murder charges but a one-year statute of limitations for misdemeanors. Choose a link below to learn more.

In most cases, the statute of limitations for a debt will have passed after 10 years. This means a debt collector may still attempt to pursue it (and you technically do still owe it), but they can't typically take legal action against you.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

No harassment The Fair Debt Collection Practices Act (FDCPA) says debt collectors can't harass, oppress, or abuse you or anyone else they contact. Some examples of harassment are: Repetitious phone calls that are intended to annoy, abuse, or harass you or any person answering the phone. Obscene or profane language.

Reviving Judgments in Missouri Judgment Creditors Need to Pay Close Attention to the 10-year Statute. Under Missouri law, a judgment is considered active (collectible) for ten years. This includes a monetary judgment as well as any real property liens resulting from that judgment.

Debt collectors are legally required to send one within five days of first contact. You have within 30 days from receiving a debt validation letter to send a debt verification letter. Here's the important part: You have just 30 days to respond to a debt validation letter with your debt verification letter.

More info

S Options Roth Fundamental Analysis Technical Analysis View Debt Validation Letter Definition Debt Validation Letter Definition Sample Your Rights Debt Validation Letter Definition Sample Your Rights Debt Validation Letter Definition Debt Validation Letter Definition Debt Validation Letter Definition Debt Validation Letter Definition Debt Validation Letter Definition Debt Validation Letter Definition.