Missouri Cease and Desist for Debt Collectors

Description

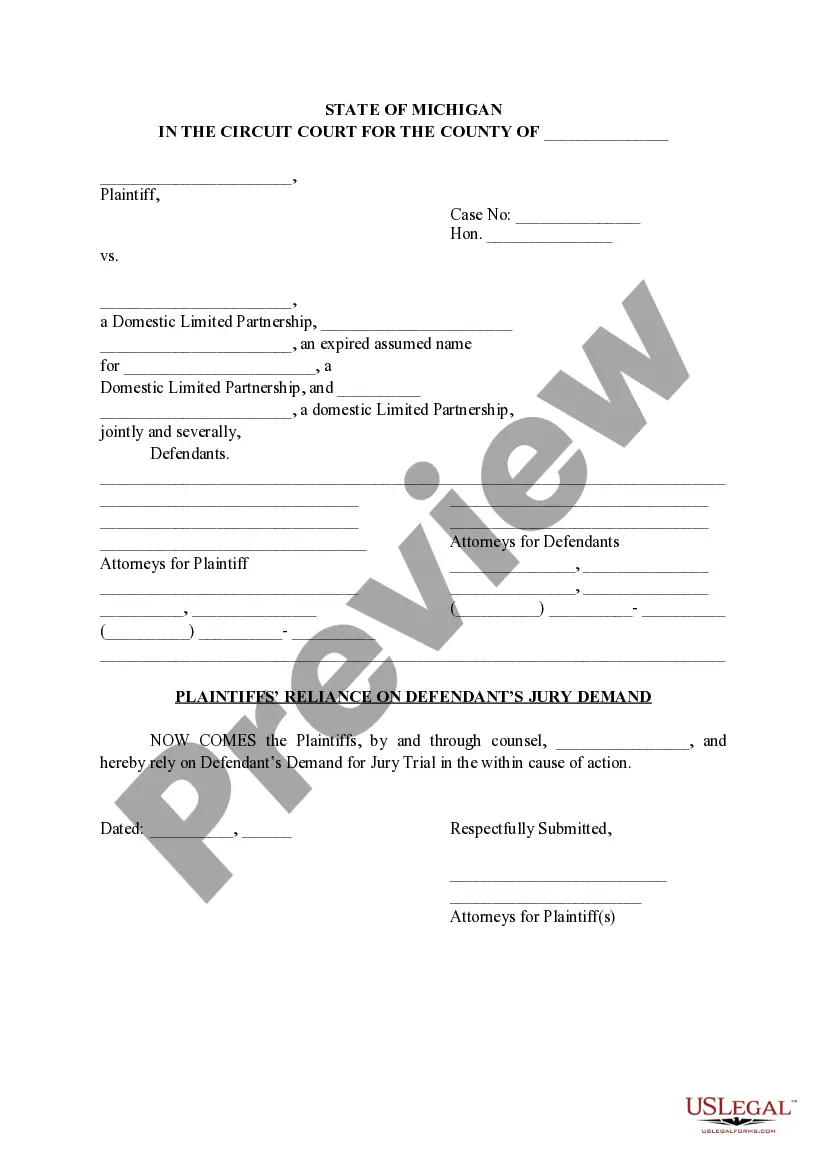

How to fill out Missouri Cease And Desist For Debt Collectors?

US Legal Forms - one of many most significant libraries of legal varieties in the USA - delivers a wide array of legal papers web templates it is possible to download or print out. Using the web site, you will get thousands of varieties for company and personal functions, categorized by types, claims, or key phrases.You will discover the latest variations of varieties such as the Missouri Cease and Desist for Debt Collectors within minutes.

If you already have a registration, log in and download Missouri Cease and Desist for Debt Collectors in the US Legal Forms collection. The Acquire key will show up on every form you see. You get access to all in the past saved varieties within the My Forms tab of the accounts.

In order to use US Legal Forms the very first time, allow me to share straightforward recommendations to help you get started:

- Make sure you have chosen the best form to your area/region. Click the Preview key to analyze the form`s content. Read the form description to ensure that you have chosen the proper form.

- When the form does not satisfy your needs, make use of the Lookup field near the top of the display to obtain the one who does.

- If you are satisfied with the form, affirm your decision by clicking the Buy now key. Then, pick the rates strategy you want and provide your accreditations to sign up to have an accounts.

- Method the purchase. Make use of your bank card or PayPal accounts to perform the purchase.

- Pick the formatting and download the form in your device.

- Make adjustments. Fill up, modify and print out and signal the saved Missouri Cease and Desist for Debt Collectors.

Each and every format you included with your account lacks an expiry date and is yours for a long time. So, if you wish to download or print out another duplicate, just visit the My Forms area and then click around the form you will need.

Obtain access to the Missouri Cease and Desist for Debt Collectors with US Legal Forms, by far the most comprehensive collection of legal papers web templates. Use thousands of professional and condition-certain web templates that meet your company or personal requires and needs.

Form popularity

FAQ

This letter should be addressed and directed at one creditor only. You'll have to write one for each of the creditors that you want to stop calling you. Sending a cease and desist letter isn't a solution to your problem; it's merely a solution to receiving annoying phone calls.

3 Things You Should NEVER Say To A Debt CollectorAdditional Phone Numbers (other than what they already have)Email Addresses.Mailing Address (unless you intend on coming to a payment agreement)Employer or Past Employers.Family Information (ex.Bank Account Information.Credit Card Number.Social Security Number.

In Missouri, there is a five-year statute of limitations for personal injury claims; but fraud and debt collection claims have a ten-year limit. For criminal charges, there is no limit for murder charges but a one-year statute of limitations for misdemeanors. Choose a link below to learn more.

If you don't pay a debt, a creditor or its debt collector generally can sue you to collect. If they go to court and win, the court will enter a judgment against you.

The Fair Debt Collection Practices Act (FDCPA) is a federal law that provides a mechanism for you to stop debt collectors from contacting you. You can do this by sending a Cease and Desist Letter. Federal law allows you to communicate with debt collectors to tell them that you want them to stop contacting you.

If you believe a debt collector is harassing you, you can submit a complaint with the CFPB online or by calling (855) 411-CFPB (2372). You can also contact your state's attorney general .

The statute of limitations is a law that limits how long debt collectors can legally sue consumers for unpaid debt. The statute of limitations on debt varies by state and type of debt, ranging from three years to as long as 20 years.

Dear debt collector: Pursuant to my rights under the state and federal fair debt collection laws, I hereby request that you immediately cease all calls to your phone number in relation to the account of wrong person's full name. This is the wrong number to contact that person.

Depending on the type of debt, Missouri statute of limitations on debt range between five to 10 years. After that period has passed, the debt becomes time-barred, which means collectors no longer have the right to sue you.

Include your contact information and send this letter via certified mail with a return receipt requested so that you know if and when the creditor receives your letter. Once the debt collector receives a cease and desist letter, it must stop all further contact unless the law permits otherwise.