Missouri Direction For Payment of Royalty to Trustee by Royalty Owners

Description

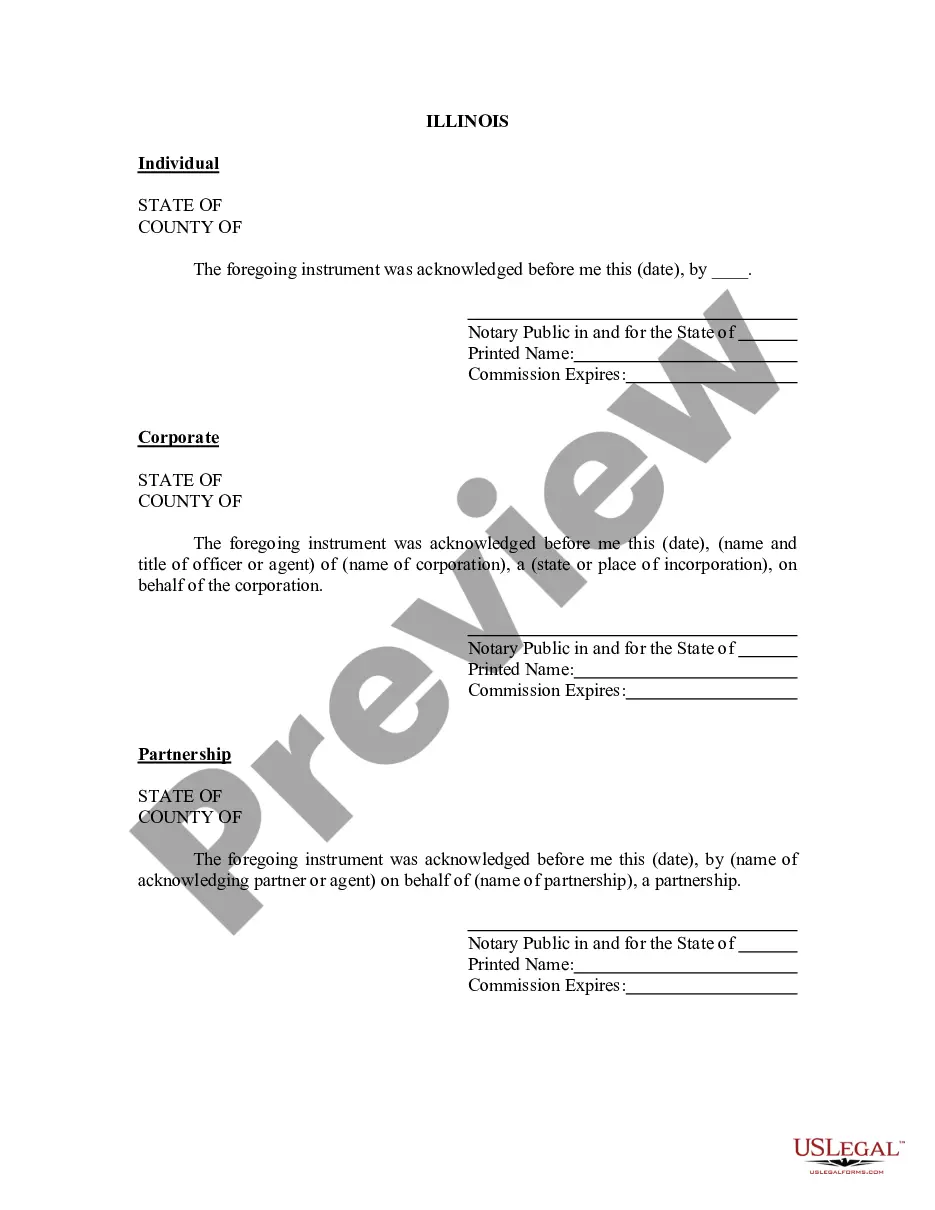

How to fill out Direction For Payment Of Royalty To Trustee By Royalty Owners?

If you wish to complete, download, or print out authorized record templates, use US Legal Forms, the greatest collection of authorized kinds, which can be found on-line. Take advantage of the site`s basic and handy search to get the papers you need. A variety of templates for enterprise and person purposes are categorized by categories and suggests, or keywords and phrases. Use US Legal Forms to get the Missouri Direction For Payment of Royalty to Trustee by Royalty Owners in just a handful of mouse clicks.

If you are presently a US Legal Forms buyer, log in in your account and click the Obtain switch to have the Missouri Direction For Payment of Royalty to Trustee by Royalty Owners. Also you can accessibility kinds you previously downloaded from the My Forms tab of your respective account.

If you work with US Legal Forms the very first time, refer to the instructions below:

- Step 1. Be sure you have chosen the form for the right metropolis/land.

- Step 2. Utilize the Preview option to examine the form`s information. Don`t neglect to read through the description.

- Step 3. If you are unsatisfied using the form, take advantage of the Lookup area on top of the display screen to locate other types from the authorized form template.

- Step 4. Once you have located the form you need, click the Get now switch. Pick the prices prepare you like and add your qualifications to register to have an account.

- Step 5. Approach the financial transaction. You can utilize your Мisa or Ьastercard or PayPal account to complete the financial transaction.

- Step 6. Choose the structure from the authorized form and download it on your product.

- Step 7. Full, revise and print out or indicator the Missouri Direction For Payment of Royalty to Trustee by Royalty Owners.

Every authorized record template you purchase is your own eternally. You have acces to every form you downloaded inside your acccount. Go through the My Forms section and choose a form to print out or download once more.

Remain competitive and download, and print out the Missouri Direction For Payment of Royalty to Trustee by Royalty Owners with US Legal Forms. There are many specialist and express-certain kinds you can utilize to your enterprise or person requirements.

Form popularity

FAQ

Make check payable to Missouri Department of Revenue. Mail Form MO-1040V and payment to the Missouri Department of Revenue, P.O. Box 371, Jefferson City, MO 65105-0371.

Form MO-A is a supplemental form that should be used by all Missouri nonresidents who need to claim tax adjustments.

The Missouri standard deduction is tied to the federal deduction; this means that for the 2022 tax year, it's $12,950 for individual filers, $25,900 for joint filers, $19,400 for heads of household and $25,900 qualified widow(er)s.

Missouri Form 1040 ? Personal Income Tax Return for Residents.

A composite return is allowed by the Missouri Department of Revenue for any partnership, S corporation, limited liability partnership, or limited liability company (treated as a partnership for tax purposes) with nonresident partners or S corporation shareholders not otherwise required to file a Missouri individual ...

In Missouri, both U.S. residents and nonresidents use the same forms. If you are single or married with one income, you can probably use the MO-1040A. There is a longer MO-1040 form that married couples with two incomes must use.

The IRS eliminated Form 1040-A for the 2018 tax year in favor of the redesigned Form 1040. Another variant of Form 1040 was Form 1040-EZ, which was even simpler than Form 1040-A and was also eliminated starting with the 2018 tax filing.

PART 1 - Missouri Modifications to Federal Adjusted Gross Income. Form MO-A, Part 1, computes Missouri modifications to federal adjusted gross income. Modifications on Lines 1, 2, 3, 4 and 5 include income that is exempt from federal tax, but taxable for state tax purposes.