Title: An Overview of the Missouri Assignment of Overriding Royalty Interest For A Term of Years Introduction: In Missouri, the Assignment of Overriding Royalty Interest (ORRIS) allows for the transfer of the right to receive a certain percentage of revenues from oil and gas production. This contractual arrangement can be established for a specific term of years, providing a clear timeline within which the assignee will enjoy the benefits. This article discusses the types and significance of the Missouri Assignment of Overriding Royalty Interest for a term of years. 1. Missouri Assignment of Overriding Royalty Interest for a Term of Years: This type of assignment provides a legally binding agreement between the assignor (royalty interest owner) and the assignee, granting the assignee the right to receive a certain percentage of the proceeds generated from the production of oil and gas. The assignment is valid for an agreed-upon term, typically ranging from a few years to several decades. 2. Different Types of Missouri Assignment of Overriding Royalty Interest: a) Fixed-Term Assignments: This type of assignment specifies a predetermined term or duration during which the assignee will receive the overriding royalty interest. Once the term expires, the assignor regains the full ownership rights. These assignments are commonly used to finance projects or meet short-term financial needs. b) Renewable Assignments: These assignments allow for the extension or renewal of the overriding royalty interest for subsequent terms of years. The assignee may enjoy the benefits for an extended period, subject to the assignor's approval. Renewable assignments are considered more flexible, offering potential long-term benefits for both parties. c) Partial Assignments: In some cases, a royalty interest owner may opt to allocate only a portion of their overriding royalty interest to an assignee. This type of assignment allows the assignor to retain a certain percentage of the revenues while receiving financial compensation or other benefits from the assignee. 3. Key Guidelines for Missouri Assignment of Overriding Royalty Interest for a Term of Years: a) Clear Contractual Language: The assignment agreement should include precise terms, ownership details, percentage allocation, rights, and responsibilities of both the assignor and assignee. b) Consideration and Compensation: The assignee may provide consideration, such as financial compensation, services, or other benefits, in exchange for the assignor's overriding royalty interest, which is agreed upon and specified in the assignment agreement. c) Effective Date and Term: The agreement should clearly state the effective date and the duration for which the overriding royalty interest is assigned. Both parties should be aware of the specific term and any conditions under which the assignment can be terminated. d) Legal Compliance: The assignment should adhere to Missouri's laws, regulations, and taxation requirements. Seeking legal advice and ensuring compliance is essential before entering into an assignment agreement. Conclusion: The Missouri Assignment of Overriding Royalty Interest for a Term of Years is a contractual arrangement that allows royalty interest owners to assign a percentage of the revenues generated from oil and gas production to an assignee. Whether it is a fixed-term, renewable, or partial assignment, both parties should carefully consider the terms, rights, responsibilities, and legal compliance before entering into an agreement.

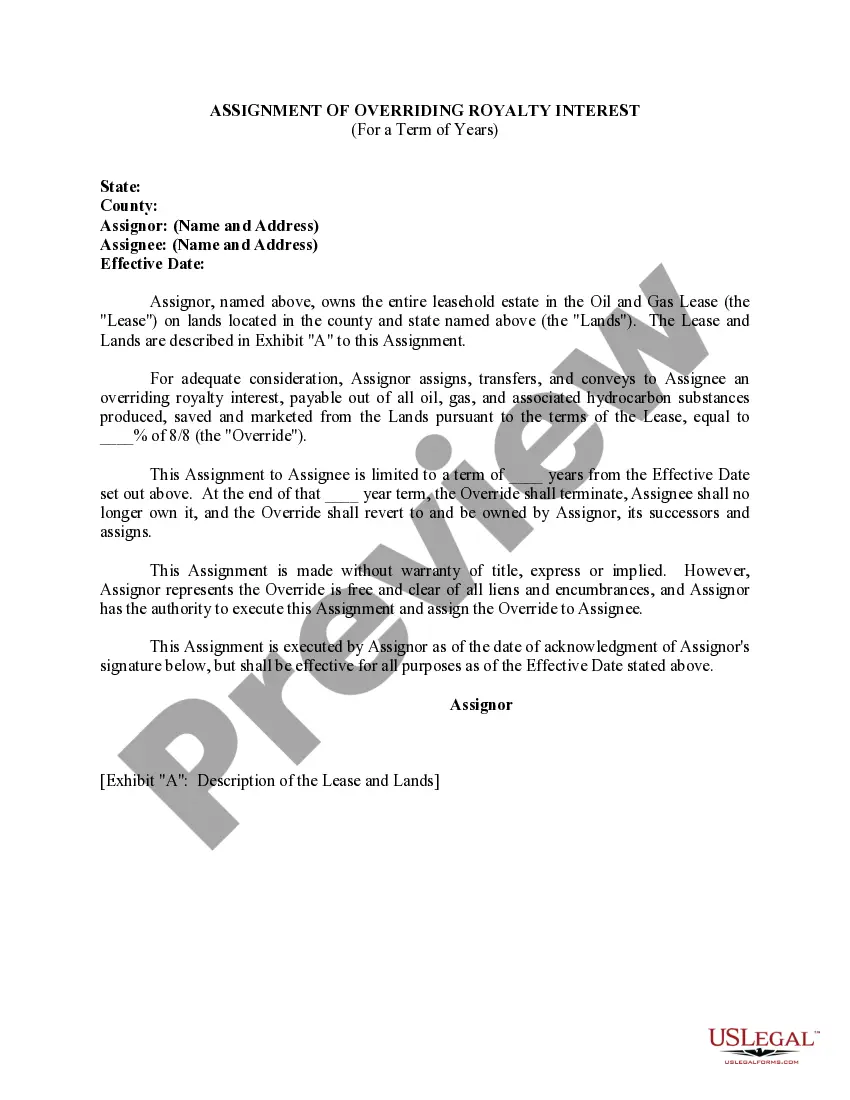

Missouri Assignment of Overriding Royalty Interest For A Term of Years

Description

How to fill out Missouri Assignment Of Overriding Royalty Interest For A Term Of Years?

US Legal Forms - one of several most significant libraries of legal varieties in the States - delivers an array of legal file web templates you are able to obtain or produce. Utilizing the internet site, you can get a huge number of varieties for business and specific functions, categorized by categories, suggests, or keywords and phrases.You will discover the newest models of varieties just like the Missouri Assignment of Overriding Royalty Interest For A Term of Years in seconds.

If you already possess a registration, log in and obtain Missouri Assignment of Overriding Royalty Interest For A Term of Years from your US Legal Forms library. The Down load option will appear on every single develop you view. You gain access to all in the past delivered electronically varieties inside the My Forms tab of your own profile.

If you want to use US Legal Forms the very first time, listed below are easy guidelines to get you started out:

- Be sure to have chosen the right develop to your town/region. Click the Preview option to analyze the form`s content material. Read the develop outline to ensure that you have selected the correct develop.

- If the develop doesn`t satisfy your needs, make use of the Search discipline near the top of the display screen to find the the one that does.

- Should you be pleased with the form, affirm your choice by simply clicking the Get now option. Then, pick the costs program you like and give your accreditations to sign up on an profile.

- Method the financial transaction. Use your Visa or Mastercard or PayPal profile to finish the financial transaction.

- Find the structure and obtain the form on your device.

- Make modifications. Load, revise and produce and indication the delivered electronically Missouri Assignment of Overriding Royalty Interest For A Term of Years.

Every single template you included in your account does not have an expiry date which is yours permanently. So, if you would like obtain or produce yet another version, just go to the My Forms portion and click in the develop you require.

Get access to the Missouri Assignment of Overriding Royalty Interest For A Term of Years with US Legal Forms, probably the most substantial library of legal file web templates. Use a huge number of specialist and express-particular web templates that satisfy your organization or specific requires and needs.