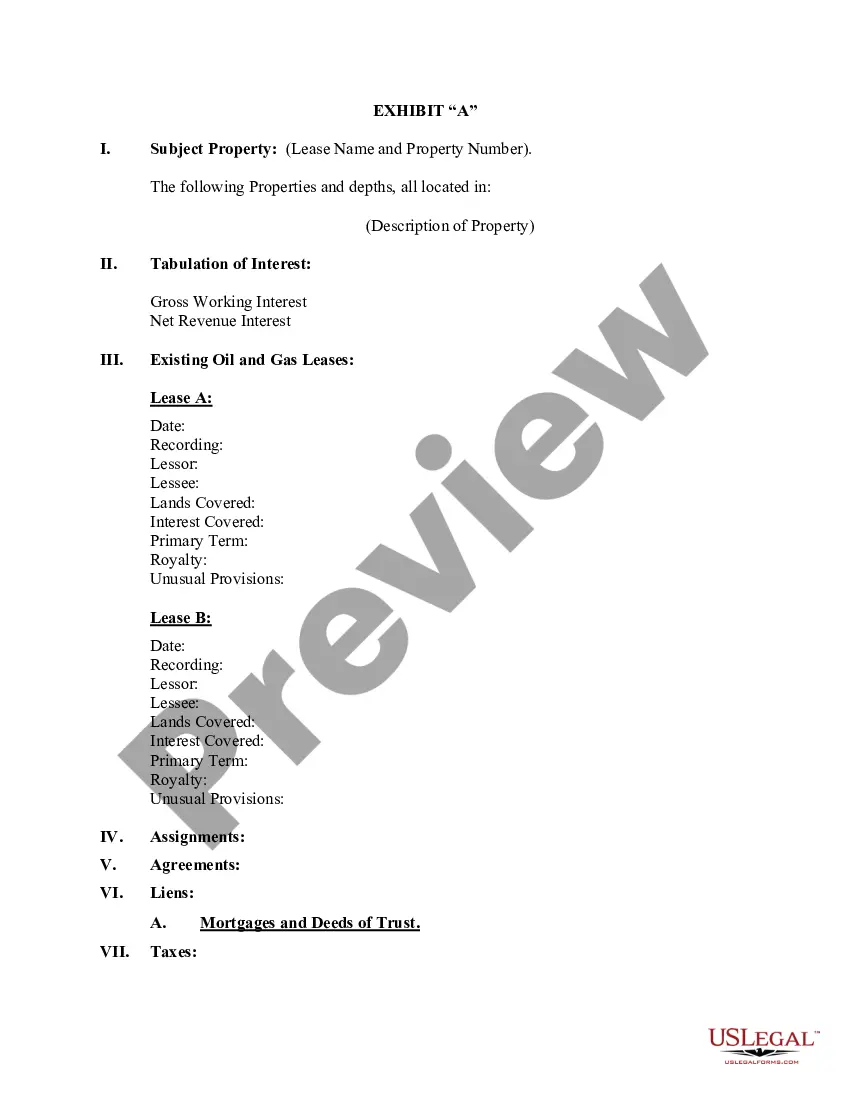

Missouri Acquisition Title Opinion is a comprehensive evaluation of the legal status and ownership of a property during an acquisition process in the state of Missouri. This thorough examination encompasses various legal documents, records, and evidence to determine the validity of a property's title, identify any potential issues, and provide an opinion on its transferability and insurability. The Missouri Acquisition Title Opinion involves conducting a meticulous review of public records, such as deeds, mortgages, liens, court records, tax records, and other relevant documents pertaining to the property in question. This in-depth analysis aims to identify any existing encumbrances, such as liens, easements, or rights-of-way that might affect the property's marketability or hinder the acquisition process. By examining historical records and legal documents, the acquisition title opinion seeks to verify the chain of ownership, ensuring that the property has been lawfully transferred from one owner to another. It also aims to determine if there are any undisclosed or missing interests in the property that may have an impact on its marketability or value. Typically, there are different types of Missouri Acquisition Title Opinions, including: 1. Full Ownership Opinion: This type of opinion is provided when a buyer intends to acquire the property with a clear and marketable title. It involves a comprehensive examination of all relevant records to ensure there are no defects or encumbrances that could impede the transfer of ownership. 2. Limited Ownership Opinion: In cases where a buyer needs assurance only for a specific portion or interest in a property, a limited ownership opinion may be conducted. This opinion focuses on the examination of records related to the identified portion, rather than the entire property. 3. Insurable Title Opinion: This opinion is prepared to support the issuance of title insurance for the property. It involves an assessment of the property's title, identifying any risks and recommending necessary steps to ensure insurability. 4. Non-Insured Title Opinion: When title insurance is not required, a non-insured title opinion may be conducted. This opinion provides an evaluation of the property's title and identifies any potential issues but does not provide any insurance coverage. In summary, Missouri Acquisition Title Opinion is a crucial step in the acquisition process as it provides buyers with a comprehensive understanding of the property's legal status, potential risks, and marketability. Various types of opinions may be conducted depending on the buyer's specific needs, ensuring a smooth and secure transfer of ownership.

Missouri Acquisition Title Opinion

Description

How to fill out Missouri Acquisition Title Opinion?

You can spend hrs on-line attempting to find the authorized document format that fits the state and federal demands you will need. US Legal Forms provides thousands of authorized forms that happen to be evaluated by specialists. It is possible to download or produce the Missouri Acquisition Title Opinion from my assistance.

If you already have a US Legal Forms bank account, you can log in and click on the Download button. Afterward, you can full, change, produce, or indicator the Missouri Acquisition Title Opinion. Every authorized document format you buy is the one you have forever. To have yet another backup of the purchased kind, go to the My Forms tab and click on the corresponding button.

If you work with the US Legal Forms website for the first time, stick to the straightforward guidelines below:

- Initially, be sure that you have chosen the correct document format to the state/town of your liking. Look at the kind explanation to make sure you have chosen the right kind. If offered, take advantage of the Review button to appear with the document format too.

- If you would like find yet another version of the kind, take advantage of the Look for field to obtain the format that suits you and demands.

- Upon having located the format you desire, click on Get now to move forward.

- Choose the prices plan you desire, type your accreditations, and sign up for a merchant account on US Legal Forms.

- Complete the purchase. You should use your Visa or Mastercard or PayPal bank account to purchase the authorized kind.

- Choose the formatting of the document and download it in your device.

- Make modifications in your document if necessary. You can full, change and indicator and produce Missouri Acquisition Title Opinion.

Download and produce thousands of document web templates making use of the US Legal Forms Internet site, that provides the greatest selection of authorized forms. Use specialist and condition-certain web templates to deal with your company or specific demands.