Missouri Request for Information on Payout Status is a formal process through which individuals or organizations can obtain detailed information regarding the status of their payout requests in the state of Missouri. This is particularly relevant for individuals who are expecting a financial payout from a specific state agency or program. The Missouri Request for Information on Payout Status is designed to provide transparency and clarity to applicants or recipients regarding the progress of their payout requests. It allows them to inquire about the current status, estimated timeframes, and any potential issues or challenges that may arise during the process. Some key keywords and terms related to the Missouri Request for Information on Payout Status include: 1. Missouri: Refers to the state where the payout request or application has been filed. 2. Request for Information: The formal process by which individuals can inquire about the status of their payout. 3. Payout Status: The current stage of the payment process, such as pending, approved, denied, or processed. 4. State Agency: The government department or agency responsible for disbursing the payouts. 5. Financial Payout: The amount of money individuals or organizations expect to receive from the state agency. 6. Transparency: The aim of the process to provide clear and comprehensible information to the applicants or recipients. 7. Clarity: The goal of ensuring that individuals understand the details and developments related to their payout requests. 8. Estimated Timeframes: The approximate period within which the payout is expected to be processed. 9. Issues or Challenges: Any problems, delays, or obstacles that may affect the payout request. Different types of Missouri Request for Information on Payout Status may exist based on the specific state agency or program involved. For example: 1. Missouri Request for Information on Payout Status for Unemployment Benefits: This type of request would be specific to individuals seeking updates on their unemployment benefits payout status. 2. Missouri Request for Information on Payout Status for Medicaid: This request would be relevant for individuals who have submitted reimbursement requests or claims through the Missouri Medicaid program. 3. Missouri Request for Information on Payout Status for Tax Refunds: This type of request would pertain to individuals inquiring about the status of their state tax refund. In conclusion, the Missouri Request for Information on Payout Status is an essential process that allows individuals or organizations to gain clarity and transparency regarding the progress and status of their payout requests from specific state agencies or programs.

Missouri Request For Information on Payout Status

Description

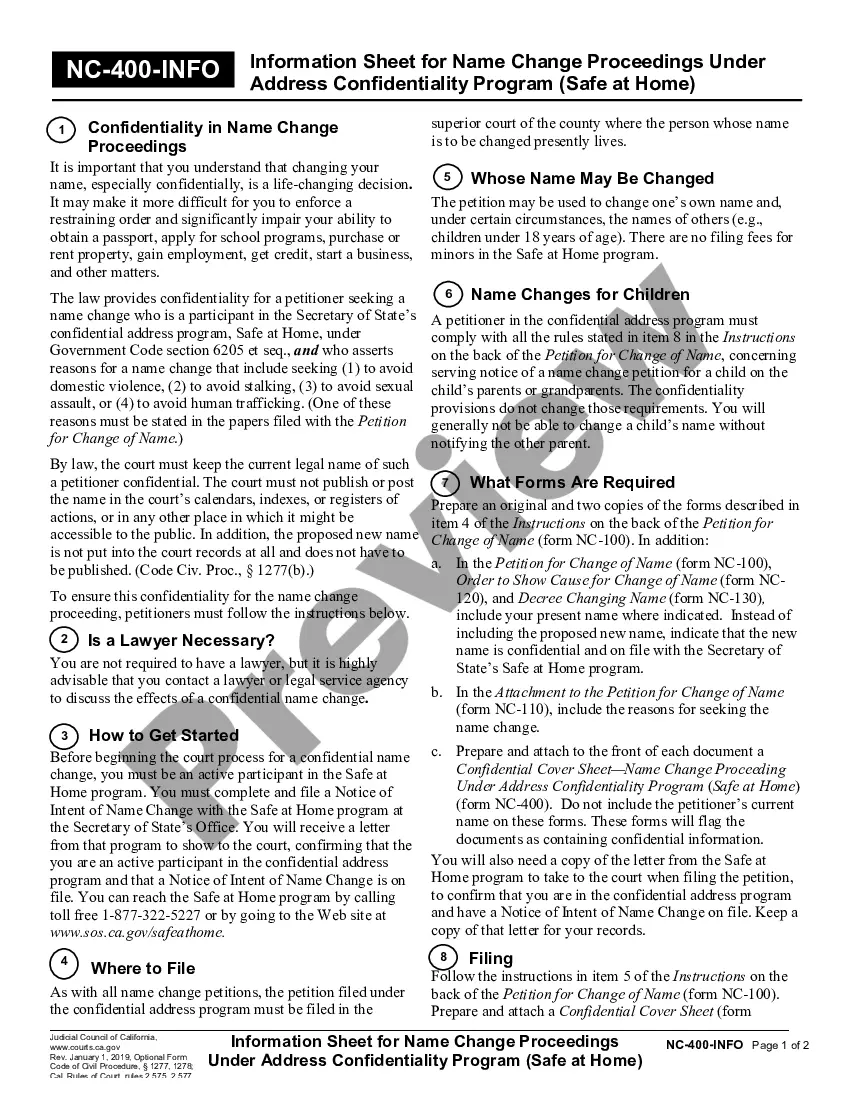

How to fill out Missouri Request For Information On Payout Status?

Are you within a placement where you need files for possibly company or personal functions almost every time? There are a variety of legal papers web templates available on the Internet, but getting ones you can rely on is not easy. US Legal Forms gives a large number of kind web templates, just like the Missouri Request For Information on Payout Status, which are published to meet federal and state needs.

When you are presently familiar with US Legal Forms web site and also have a merchant account, simply log in. Next, you may obtain the Missouri Request For Information on Payout Status template.

Unless you offer an accounts and would like to begin to use US Legal Forms, abide by these steps:

- Get the kind you require and ensure it is for the right metropolis/area.

- Use the Preview switch to examine the shape.

- Read the explanation to ensure that you have chosen the appropriate kind.

- In case the kind is not what you are trying to find, make use of the Look for field to discover the kind that meets your needs and needs.

- If you obtain the right kind, click Purchase now.

- Choose the rates prepare you need, complete the specified information to make your money, and pay money for the order making use of your PayPal or charge card.

- Select a practical data file formatting and obtain your copy.

Locate each of the papers web templates you have bought in the My Forms menus. You can aquire a further copy of Missouri Request For Information on Payout Status any time, if required. Just select the needed kind to obtain or print out the papers template.

Use US Legal Forms, by far the most comprehensive variety of legal forms, in order to save time and prevent mistakes. The assistance gives professionally produced legal papers web templates that you can use for a range of functions. Generate a merchant account on US Legal Forms and commence creating your way of life a little easier.

Form popularity

FAQ

A number of things could create a delay in your Missouri refund, including the following: Math errors in your return or other adjustments. You used more than one form type to complete your return. Your return was missing information or incomplete.

We issue most refunds in less than 21 calendar days. However, if you filed a paper return and expect a refund, it could take four weeks or more to process your return. Where's My Refund? has the most up to date information available about your refund.

An incomplete return, an inaccurate return, an amended return, tax fraud, claiming tax credits, owing certain debts for which the government can take part or all of your refund, and sending your refund to the wrong bank due to an incorrect routing number are all reasons that a tax refund can be delayed.

Step 1: Go to the e-Filing portal homepage. Step 2: Enter the user ID and password. Step 3: Go to e-File tab > Income Tax Returns > View Filed Returns. Step 4: Now you can check the refund status for the desired Assessment year. Status 1: When refund is issued: Status 2: When refund is partially adjusted:

The best way to check the status your refund is through Where's My Refund? on IRS.gov. All you need is internet access and this information: Your Social Security numbers. Your filing status.

When Will I Get My Tax Refund? Estimated Federal Tax Refund ScheduleFiling MethodE-File, Direct DepositPaper File, Check in MailTime from the day you file until you receive your refund1-3 weeks2 months

Understanding Your Notice You received this notice because: The Department received a return indicating a balance due. The Department did not receive a payment in full.

The Department can intercept a refund of state income tax and apply it towards any income tax debt from previous years. If the individual owns a business that has delinquent sales tax, use tax, employer's withholding tax or corporate income tax their income tax refund may be applied towards these debts.