Missouri Exhibit D to Operating Agreement Insurance — Form 2 is a legal document that serves as an essential component of an operating agreement for businesses operating in Missouri. This exhibit specifically addresses insurance provisions and requirements within the agreement. Keywords: Missouri, Exhibit D, Operating Agreement Insurance, Form 2, legal document, business, insurance provisions, requirements. Different types of Missouri Exhibit D to Operating Agreement Insurance — Form 2 may include: 1. General Liability Insurance: This type of insurance covers the legal liabilities of a business in case of third-party bodily injury, property damage, or personal injury claims. It is essential for businesses to have adequate general liability insurance to protect themselves from potential lawsuits. 2. Professional Liability Insurance: Also known as Errors and Omissions (E&O) insurance, this coverage is specifically designed for businesses that provide professional services. It protects against negligence claims or damages resulting from professional errors, omissions, or failure to perform services as agreed. 3. Property Insurance: Property insurance safeguards businesses against financial losses due to damage or loss of property, including buildings, equipment, inventory, and other assets. It can cover perils like fire, theft, vandalism, or natural disasters. 4. Workers' Compensation Insurance: This type of insurance is a legal requirement in most states, including Missouri. It provides coverage for employees who suffer work-related injuries or illnesses, including medical expenses, lost wages, rehabilitation, and disability benefits. 5. Commercial Auto Insurance: If a business uses vehicles for commercial purposes in Missouri, commercial auto insurance is crucial. It covers liability, property damage, and medical expenses in case of accidents involving company-owned vehicles. 6. Umbrella Insurance: Umbrella insurance provides additional liability coverage beyond the limits of general liability or other primary policies. It acts as an extra layer of protection, especially when the primary coverage is exhausted. 7. Cyber Liability Insurance: In the digital age, businesses face increasing cyber threats. Cyber liability insurance helps protect against data breaches, cyberattacks, and associated costs like legal fees, notification expenses, and customer data recovery. 8. Employment Practices Liability Insurance (EPL): EPL covers businesses against claims brought by employees for wrongful termination, discrimination, sexual harassment, or other employment-related issues. It is crucial for businesses operating in Missouri to thoroughly review and understand the specific insurance requirements outlined in Missouri Exhibit D to Operating Agreement Insurance — Form 2. Seeking legal counsel is always advised to ensure compliance with state laws and regulations.

Missouri Exhibit D to Operating Agreement Insurance - Form 2

Description

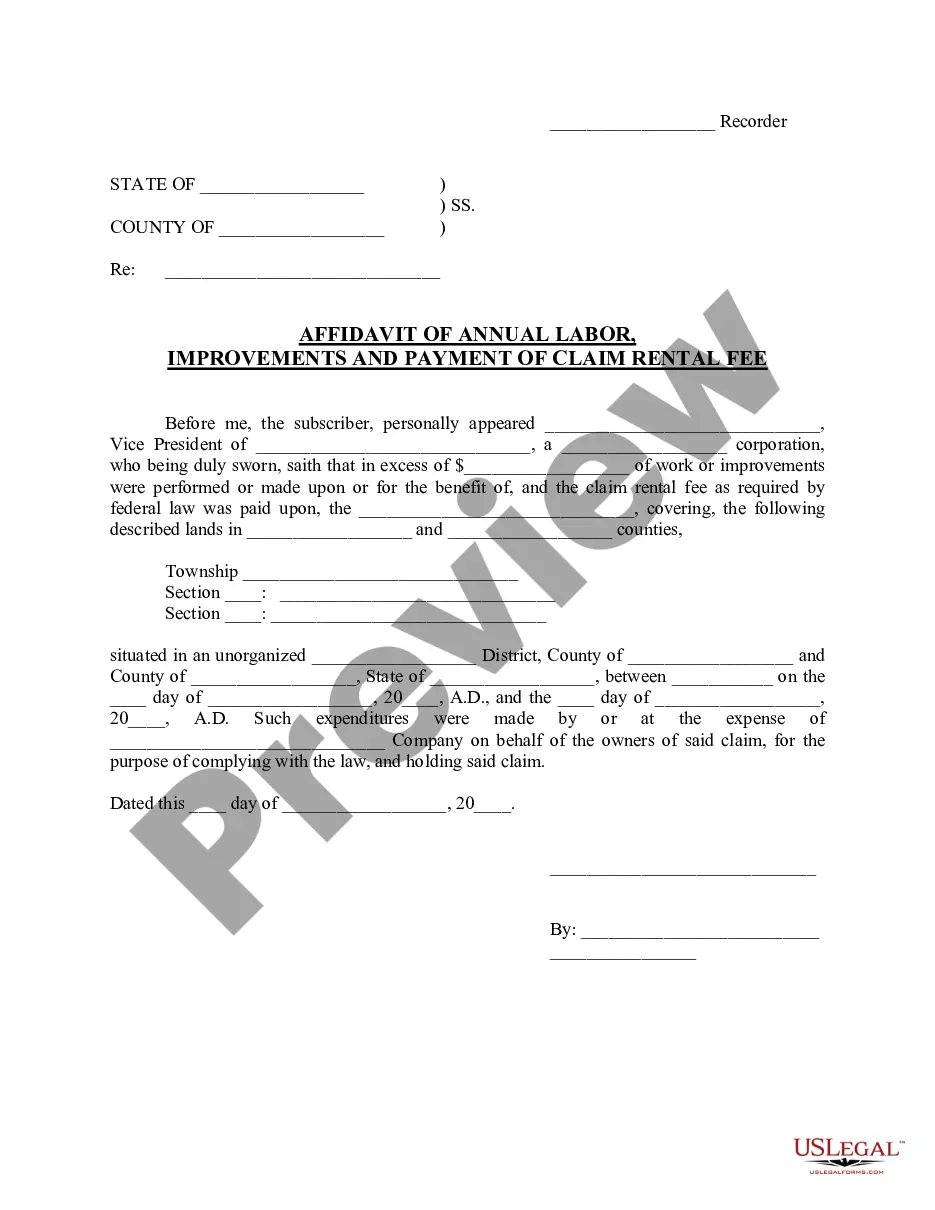

How to fill out Missouri Exhibit D To Operating Agreement Insurance - Form 2?

If you want to complete, obtain, or produce legitimate papers web templates, use US Legal Forms, the greatest selection of legitimate kinds, that can be found on the web. Make use of the site`s basic and practical research to get the papers you will need. Different web templates for company and personal functions are categorized by types and suggests, or keywords and phrases. Use US Legal Forms to get the Missouri Exhibit D to Operating Agreement Insurance - Form 2 in a handful of click throughs.

When you are already a US Legal Forms customer, log in for your profile and then click the Down load option to find the Missouri Exhibit D to Operating Agreement Insurance - Form 2. Also you can entry kinds you earlier acquired from the My Forms tab of your respective profile.

If you work with US Legal Forms the very first time, follow the instructions below:

- Step 1. Ensure you have selected the form for the right city/nation.

- Step 2. Use the Preview option to check out the form`s information. Don`t forget about to learn the information.

- Step 3. When you are not happy with all the form, make use of the Lookup discipline towards the top of the monitor to locate other variations from the legitimate form design.

- Step 4. Once you have identified the form you will need, click on the Acquire now option. Select the prices plan you prefer and include your accreditations to register for the profile.

- Step 5. Procedure the deal. You can utilize your bank card or PayPal profile to accomplish the deal.

- Step 6. Select the format from the legitimate form and obtain it on the gadget.

- Step 7. Comprehensive, modify and produce or indication the Missouri Exhibit D to Operating Agreement Insurance - Form 2.

Every legitimate papers design you purchase is your own property eternally. You might have acces to every single form you acquired in your acccount. Select the My Forms section and pick a form to produce or obtain yet again.

Be competitive and obtain, and produce the Missouri Exhibit D to Operating Agreement Insurance - Form 2 with US Legal Forms. There are many professional and express-specific kinds you can use to your company or personal needs.