This lease rider form may be used when you are involved in a lease transaction, and have made the decision to utilize the form of Oil and Gas Lease presented to you by the Lessee, and you want to include additional provisions to that Lease form to address specific concerns you may have, or place limitations on the rights granted the Lessee in the “standard” lease form.

Missouri Minimum Royalty Payments

Description

How to fill out Minimum Royalty Payments?

Discovering the right legal file template can be a battle. Of course, there are tons of layouts available on the Internet, but how do you obtain the legal develop you want? Utilize the US Legal Forms web site. The assistance gives 1000s of layouts, like the Missouri Minimum Royalty Payments, which can be used for business and private requires. All the kinds are checked out by experts and meet federal and state specifications.

When you are already registered, log in to your accounts and click the Download option to find the Missouri Minimum Royalty Payments. Utilize your accounts to check through the legal kinds you may have acquired in the past. Go to the My Forms tab of your own accounts and have yet another duplicate of the file you want.

When you are a brand new end user of US Legal Forms, here are easy instructions that you can adhere to:

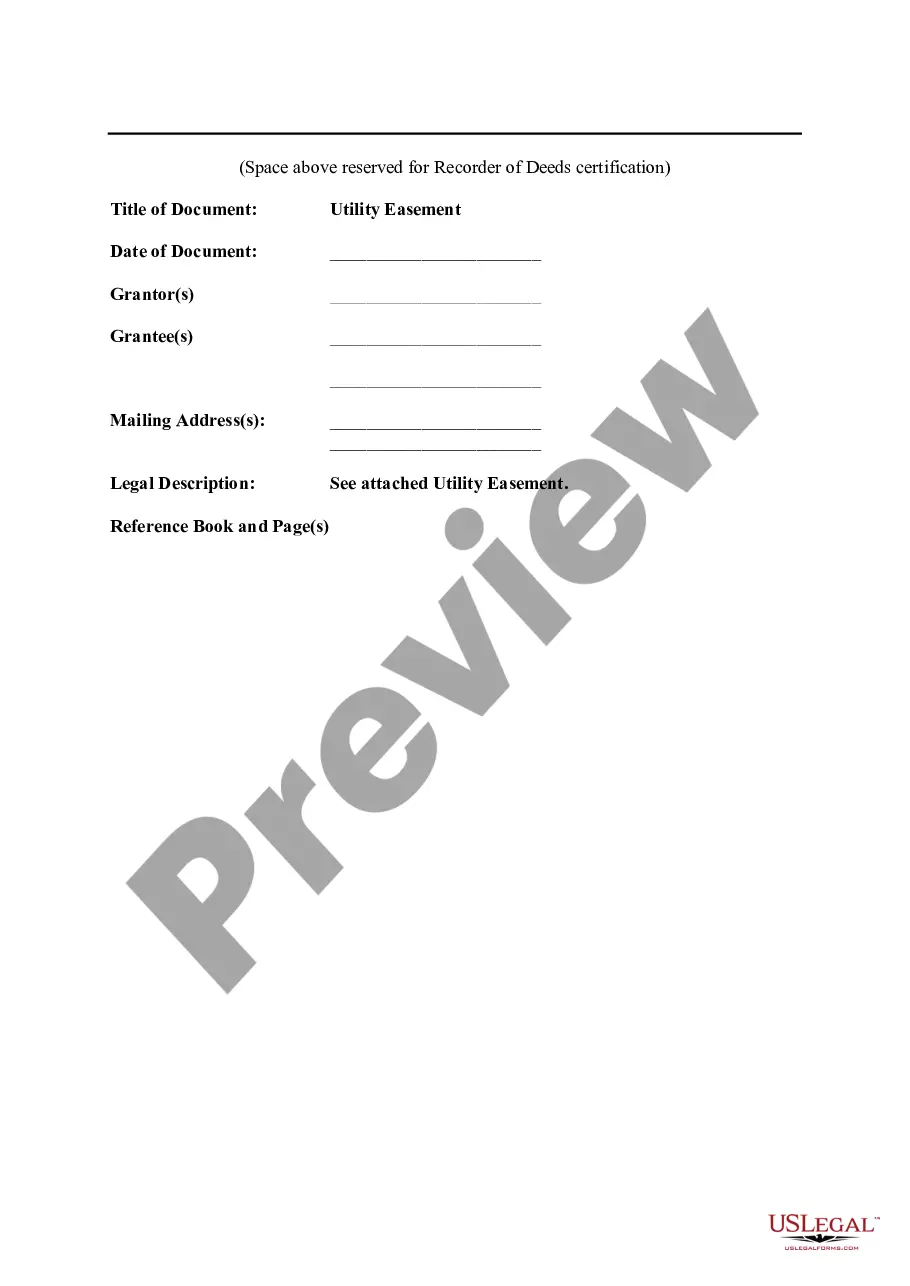

- First, make sure you have selected the appropriate develop for your personal city/area. You are able to look through the form using the Review option and look at the form explanation to guarantee this is basically the right one for you.

- When the develop fails to meet your preferences, make use of the Seach area to get the appropriate develop.

- Once you are certain the form would work, click on the Acquire now option to find the develop.

- Choose the pricing strategy you desire and type in the needed information. Design your accounts and pay for your order utilizing your PayPal accounts or Visa or Mastercard.

- Select the submit file format and obtain the legal file template to your device.

- Full, modify and printing and indicator the acquired Missouri Minimum Royalty Payments.

US Legal Forms is the greatest local library of legal kinds that you can see a variety of file layouts. Utilize the service to obtain appropriately-created files that adhere to state specifications.

Form popularity

FAQ

The NOL deduction cannot exceed the corporation's taxable income (after special deductions). An NOL deduction cannot be used to increase a loss in a loss year or to create a loss in a profit year.

The tax increments, referred to as ?payments in lieu of taxes,? are paid by the owner of the property in the same manner as regular property taxes. The payments in lieu of taxes are transferred by the collecting agency to the treasurer of the municipality and deposited in a special allocation fund.

Generally, an NOL arising in a tax year beginning in 2021 or later may not be carried back and instead must be carried forward indefinitely. However, farming losses arising in tax years beginning in 2021 or later may be carried back two years and carried forward indefinitely.

Statute of Limitations on Missouri Tax Liabilities The state has three years to assess additional tax. The clock starts on the later of the date you filed the return or its due date.

?Nonapportionable income? means all income other than apportionable income. Example: The taxpayer's business is to operate a multistate chain of grocery stores.

Missouri franchise tax is paid by all corporations doing business in the state. Companies required to pay the tax must file Form MO-1120 or Form MO-1120S when paying their tax bill. Missouri has been collecting franchise tax from businesses since 1970.

For federal and Missouri purposes, a corporation can use the federal NOL incurred in one tax year to reduce the taxable income in another tax year. The NOL deduction cannot exceed the corporation's taxable income (after special deductions).

How It Works. The rules state that the amount of the NOL is limited to 80% of the excess of taxable income without respect to any § 199A (QBI), § 250 (GILTI), or the NOL. For example: In this example, tax is paid on $20,000 of income even though there was an NOL carryover more than the current year's income.