Missouri Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool)

Description

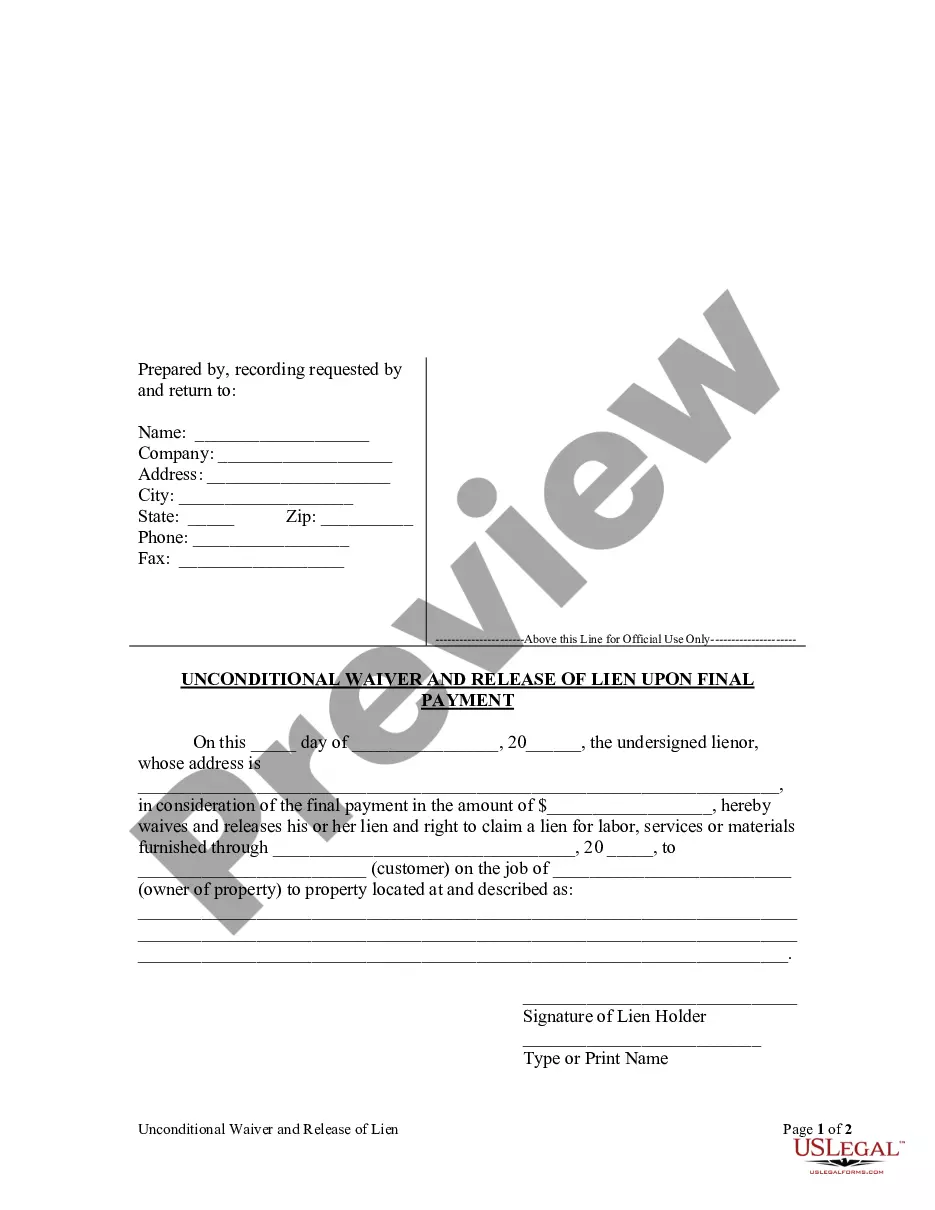

How to fill out Assignment Of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right To Pool)?

Are you presently within a place in which you require documents for sometimes enterprise or person purposes just about every time? There are tons of legitimate record themes available on the net, but locating kinds you can depend on isn`t straightforward. US Legal Forms delivers a large number of kind themes, much like the Missouri Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool), that happen to be written to fulfill federal and state needs.

When you are already informed about US Legal Forms site and also have a merchant account, basically log in. After that, you are able to obtain the Missouri Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool) design.

Should you not have an account and need to begin to use US Legal Forms, follow these steps:

- Find the kind you require and make sure it is for that correct metropolis/region.

- Use the Review option to review the form.

- See the description to actually have chosen the right kind.

- If the kind isn`t what you`re searching for, use the Lookup area to get the kind that meets your needs and needs.

- When you discover the correct kind, simply click Purchase now.

- Opt for the costs plan you want, fill in the desired information and facts to generate your account, and pay for an order making use of your PayPal or Visa or Mastercard.

- Select a convenient paper format and obtain your backup.

Find each of the record themes you have purchased in the My Forms food list. You can obtain a further backup of Missouri Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool) at any time, if possible. Just click on the necessary kind to obtain or printing the record design.

Use US Legal Forms, by far the most extensive assortment of legitimate types, to conserve some time and stay away from mistakes. The support delivers expertly produced legitimate record themes which can be used for a selection of purposes. Make a merchant account on US Legal Forms and commence making your daily life easier.

Form popularity

FAQ

Overriding royalty interest: Unlike mineral and royalty interests, an overriding royalty interest runs with a lease and not with the land. Therefore, they only remain in effect for as long as a lease is in effect and they expire when a lease expires.

Essentially, NPRI is the royalty severed from minerals just as minerals are severed from the surface interest. Unlike mineral owners, non-participating royalties do not have executive rights in lease negotiations, leasing incentives, or rental payments. They just receive the actual production proceeds.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

The formula to calculate NPRI without proportionate share reduction is LRR ? RI = NPRI. As an example, reducing your revenue interest from 25% LRR results in 1/16 NPRI, leaving 75% NRI for working interest owners.

Royalty interest in the oil and gas industry refers to ownership of a portion of a resource or the revenue it produces. A company or person that owns a royalty interest does not bear any operational costs needed to produce the resource, yet they still own a portion of the resource or revenue it produces.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

Calculating Overriding Royalty Interest An ORRI is a straight percentage. For example, a 2% override would appear on the royalty statement as 0.02 interest in the proceeds from the sale of the leased hydrocarbons.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.