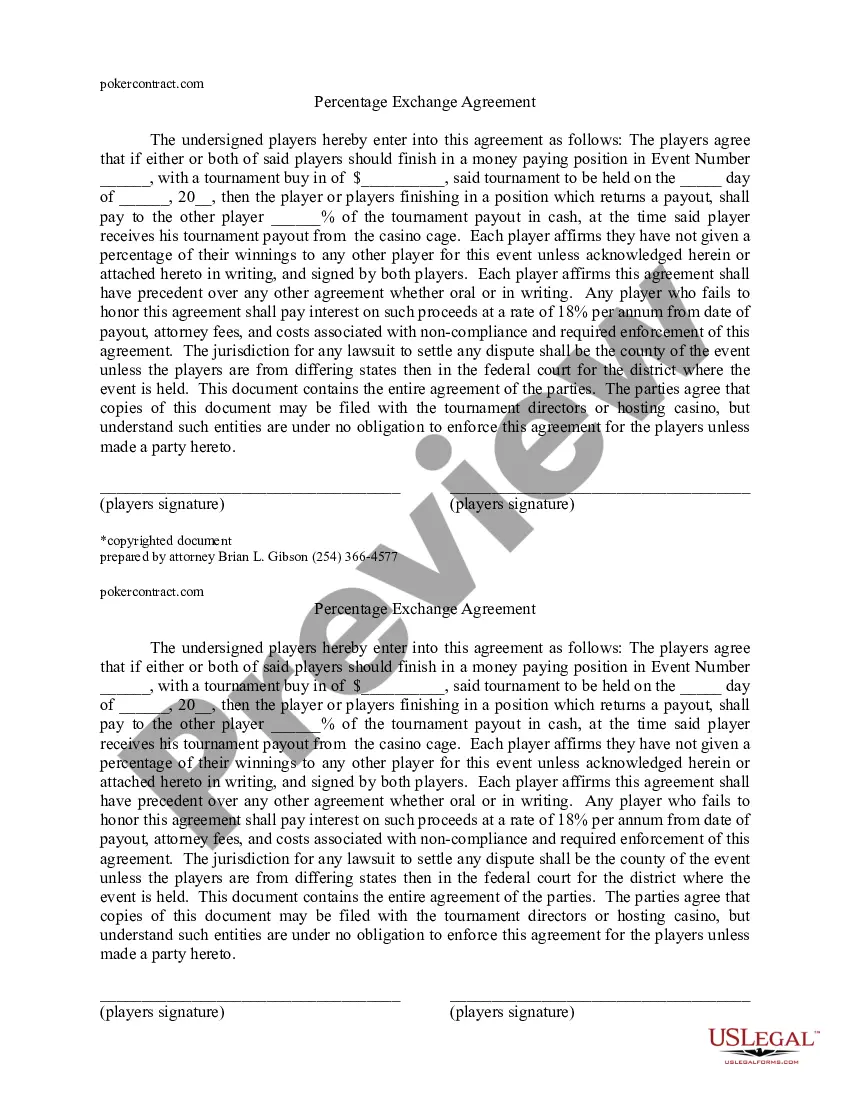

Missouri Percentage Exchange Agreement

Description

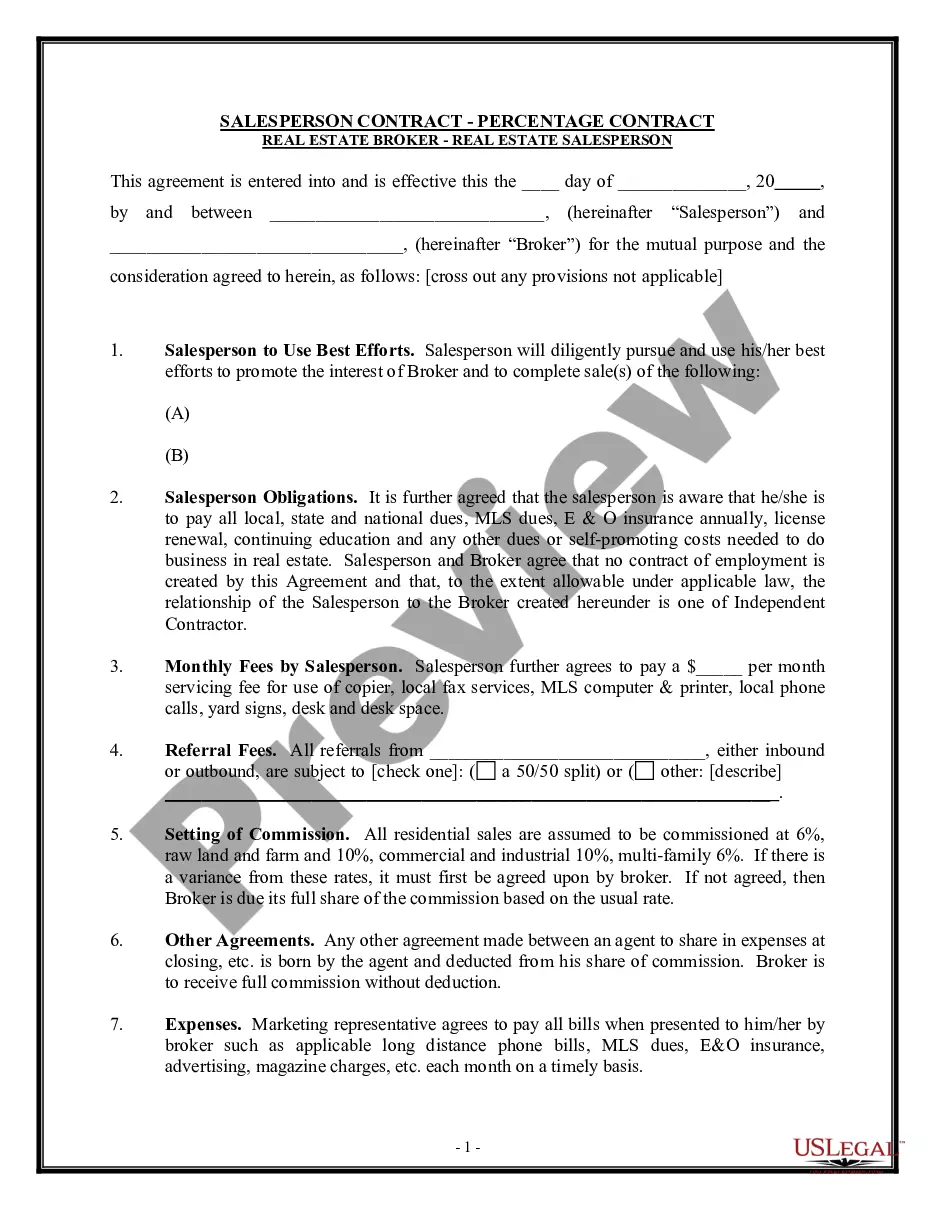

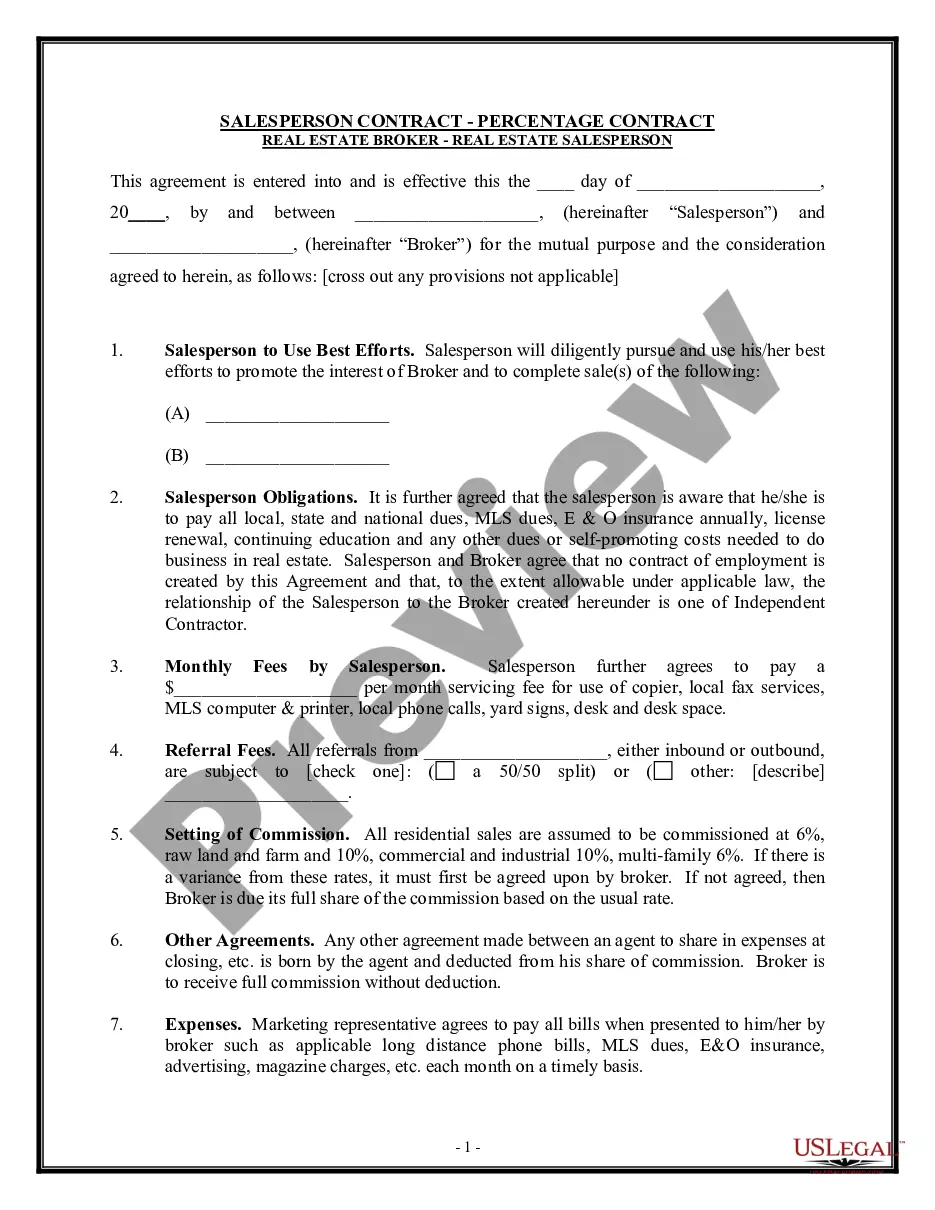

How to fill out Percentage Exchange Agreement?

Are you currently in the location where you require documents for either business or personal reasons almost every day.

There are numerous legal document templates accessible online, but finding ones you can trust is not easy.

US Legal Forms offers thousands of form templates, such as the Missouri Percentage Exchange Agreement, that are designed to comply with federal and state regulations.

Once you find the appropriate form, click Acquire now.

Select the pricing plan you prefer, fill in the required information to create your account, and complete your purchase using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Missouri Percentage Exchange Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/state.

- Use the Review button to examine the form.

- Read the description to confirm that you have selected the correct form.

- If the form is not what you're searching for, utilize the Lookup field to find the form that suits your needs and specifications.

Form popularity

FAQ

Yes, Missouri does have a Property Tax Exemption (PTE) program designed to assist eligible individuals with property tax relief. This program can benefit seniors, disabled individuals, and low-income households. While the Missouri Percentage Exchange Agreement focuses on property exchanges, understanding PTE options can enhance your overall financial strategy. Be sure to explore all available tax relief programs to maximize your benefits.

To mail your Missouri Property Tax Credit Claim (Form MO-PTE), send it to the appropriate address listed on the form. Typically, this will be the Missouri Department of Revenue or your local tax office. Using the Missouri Percentage Exchange Agreement can provide clarity on your property transactions, which may help streamline your paperwork. Ensure you check the latest mailing address on the official website to avoid delays.

To qualify for a Missouri property tax credit, you must meet certain criteria related to your age, income, and property ownership status. Generally, homeowners and renters who meet the income limits set by the state can apply. The Missouri Percentage Exchange Agreement does not directly affect your eligibility, but understanding the tax implications can enhance your financial planning. Check with the Missouri Department of Revenue for specific guidelines and application procedures.

To perform a 1031 exchange in Missouri, start by identifying the property you wish to sell and the replacement property you want to buy. Engage a qualified intermediary to handle the transaction and ensure compliance with IRS guidelines. The Missouri Percentage Exchange Agreement will help you document the exchange process, making it smoother and more efficient. Remember to complete the exchange within the specified time frames to benefit from tax deferral.

If you or your spouse earned Missouri source income of $600 or more (other than military pay), you must file a Missouri income tax return by completing Form MO-1040 and Form MO-NRI. Be sure to include a copy of your federal return.

Missouri requires employers to withhold state and local income taxes from employee paychecks in addition to employer paid unemployment taxes. Find Missouri's tax rates here. Employees fill out Form MO W-4, Missouri Employee's Withholding Allowance Certificate, to be used when calculating withholdings.

The following states require state tax withholding whenever federal taxes are withheld. We will apply the state's default with- holding rate to the taxable portion of your distribution if you reside in: Iowa, Kansas, Maine, Massachusetts, Nebraska, Oklahoma, or Virginia. You may not elect out of state withholding.

Form MO-NRI: Form MO-NRI is used when a nonresident elects to pay taxes on the percentage of income (Missouri income percentage) earned in Missouri, or when a part-year resident chooses to pay taxes on the percentage of income earned while a Missouri resident.

If you live in Missouri but work in Kansas, you still need to fill out a Missouri tax return, but you may be able to get a credit for the income tax you pay to Kansas.

Yes, an employer is required to withhold Missouri tax from all wages paid to an employee in exchange for services the employee performs for the employer in Missouri.