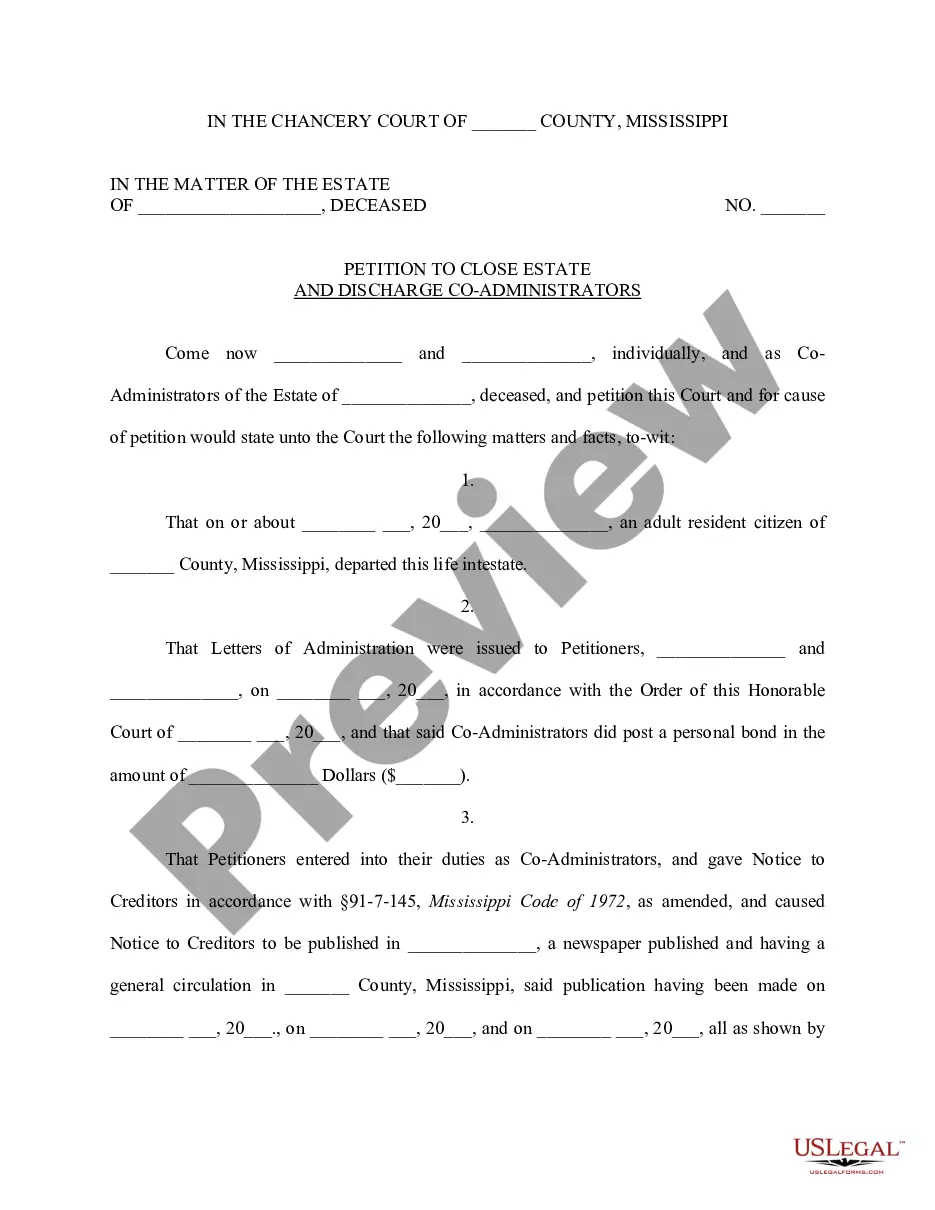

Mississippi Petition to Close Estate and Discharge Co-Administrators

Description

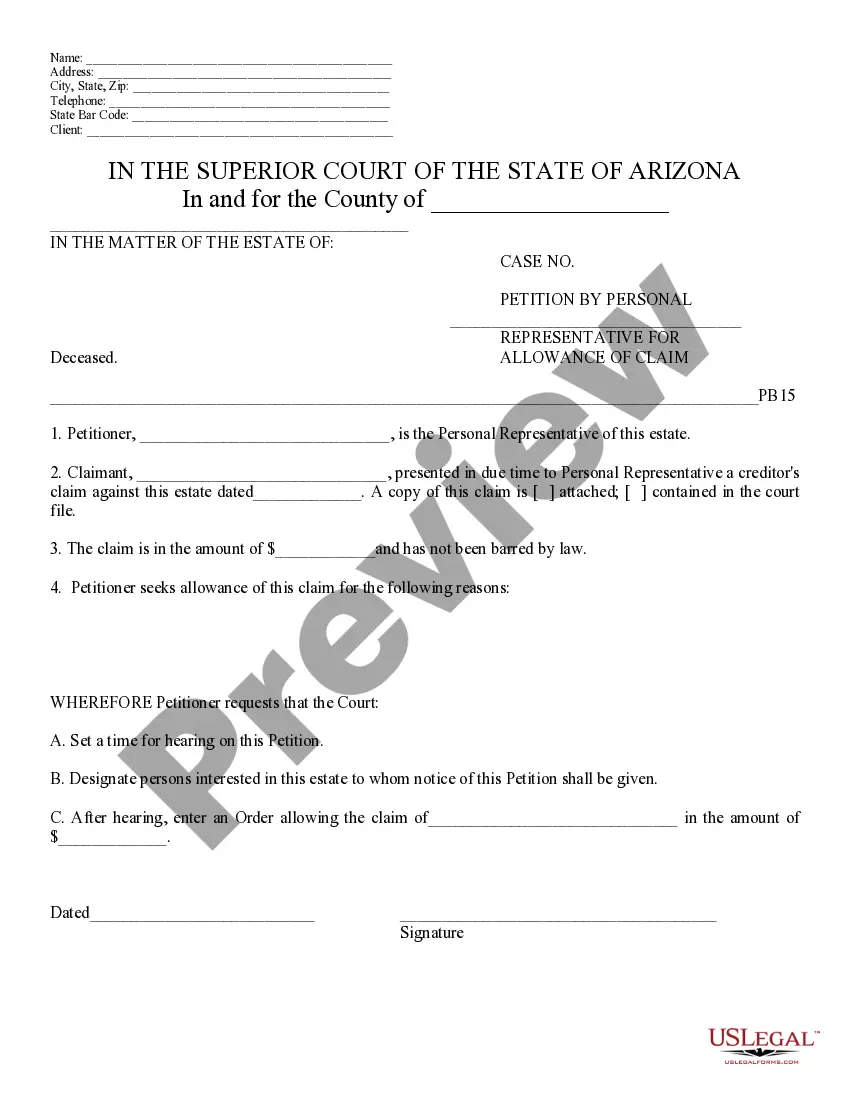

How to fill out Mississippi Petition To Close Estate And Discharge Co-Administrators?

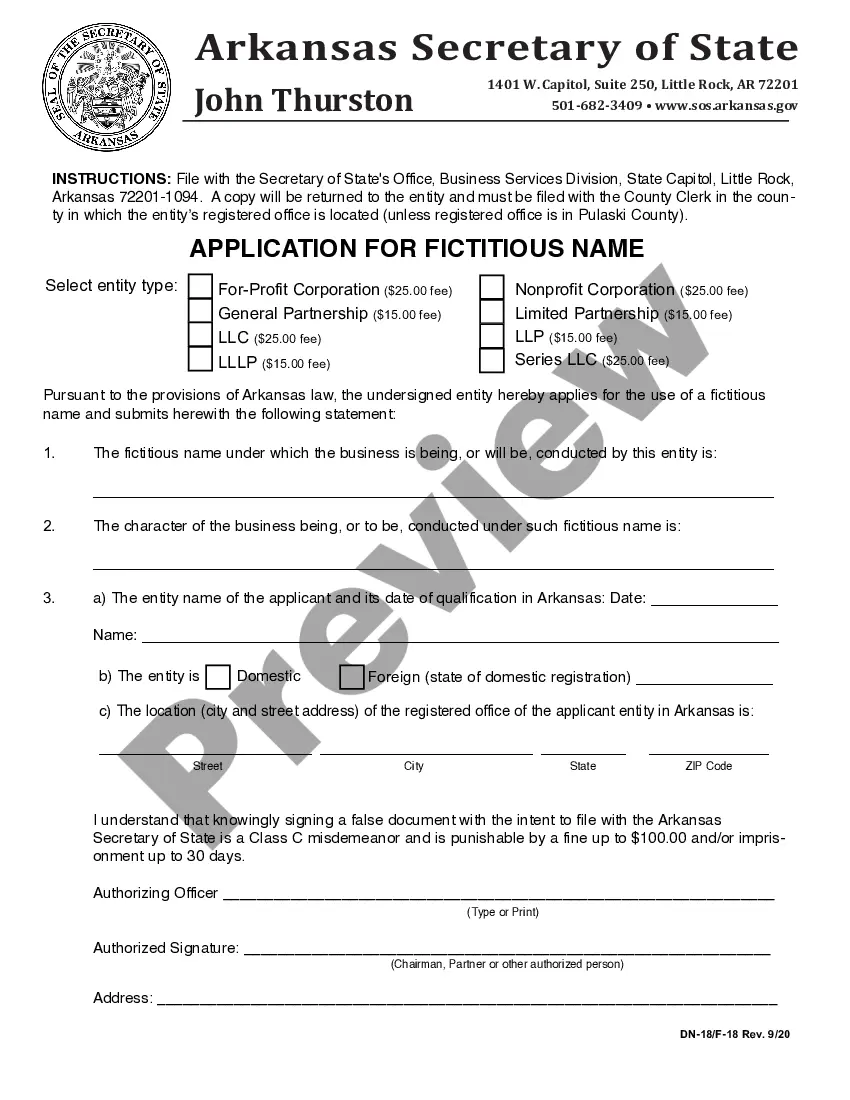

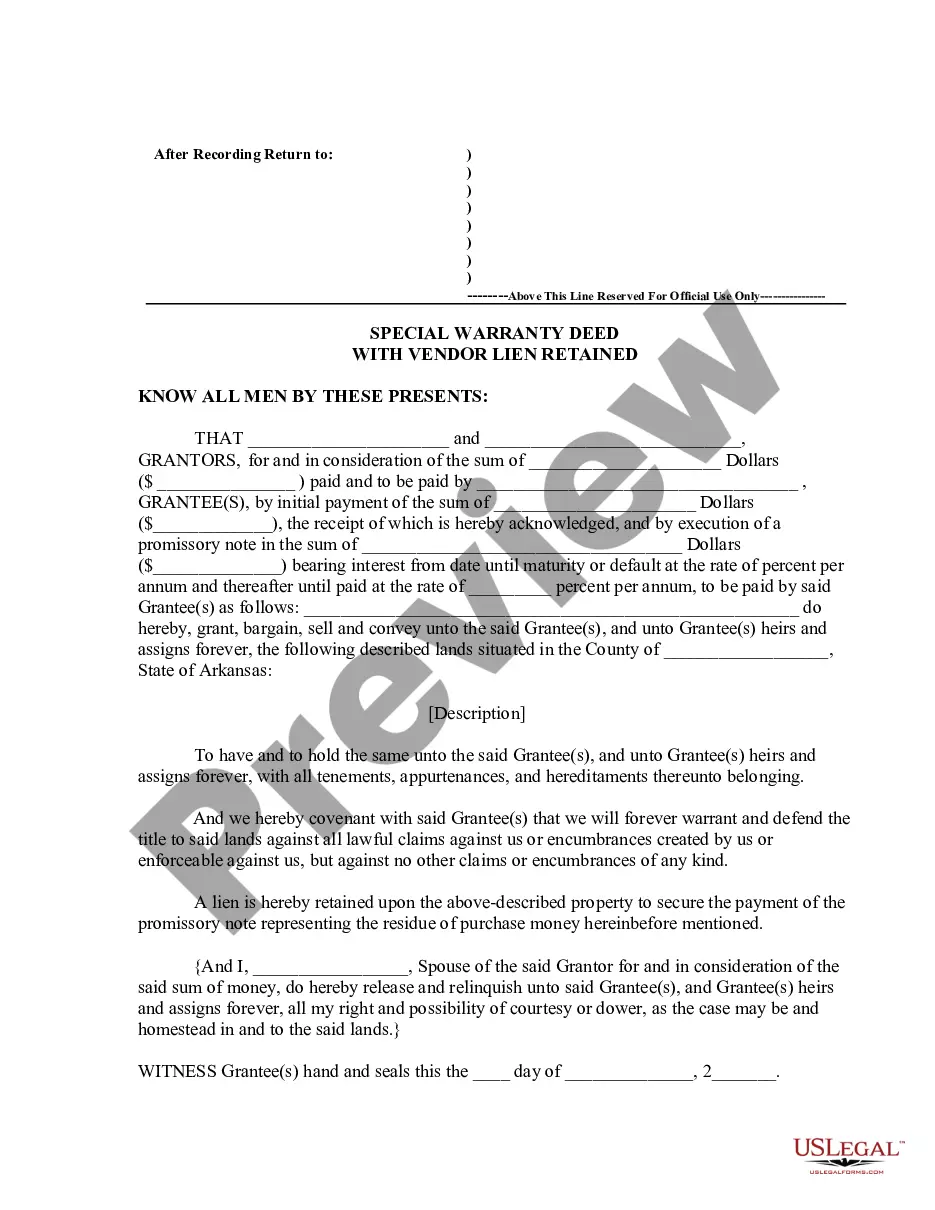

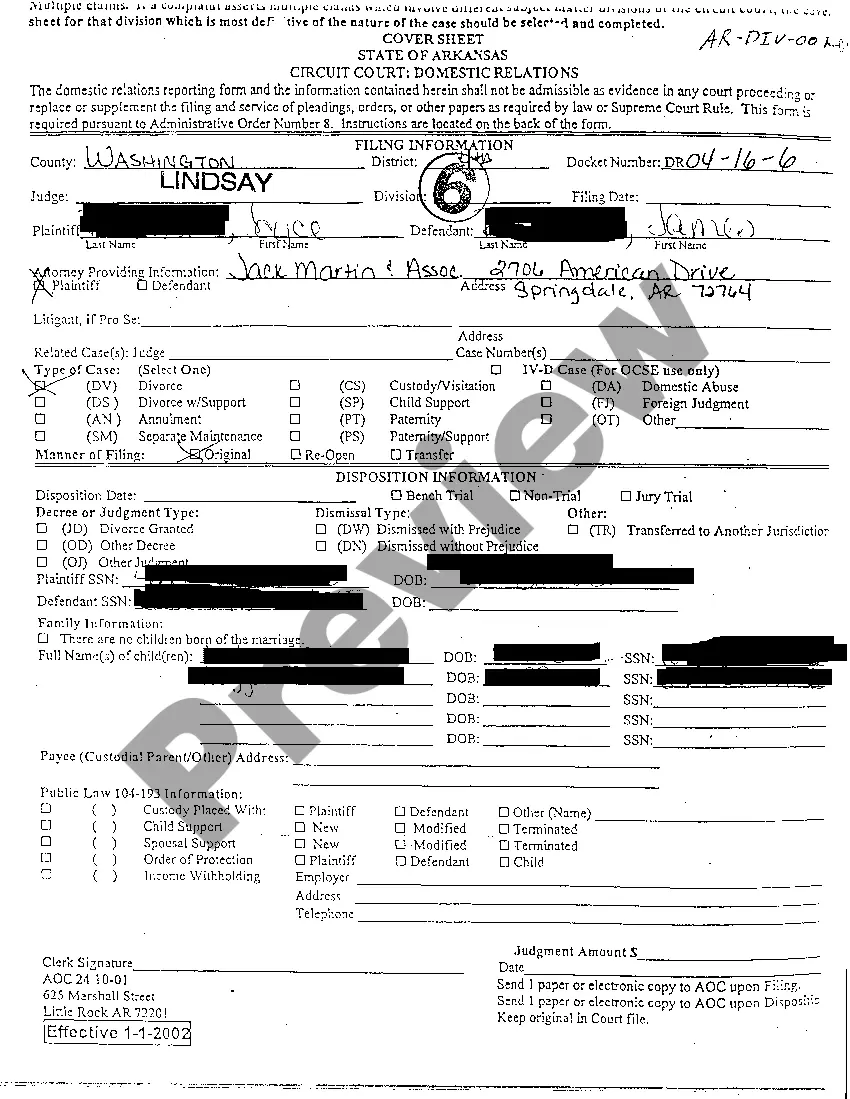

Obtain a printable Mississippi Petition to Close Estate and Discharge Co-Administrators in only several clicks from the most extensive library of legal e-documents. Find, download and print out professionally drafted and certified samples on the US Legal Forms website. US Legal Forms continues to be the Top provider of affordable legal and tax forms for US citizens and residents online starting from 1997.

Customers who have a subscription, need to log in directly into their US Legal Forms account, download the Mississippi Petition to Close Estate and Discharge Co-Administrators see it saved in the My Forms tab. Customers who don’t have a subscription must follow the tips below:

- Ensure your template meets your state’s requirements.

- If available, look through form’s description to find out more.

- If available, review the shape to find out more content.

- As soon as you are confident the template is right for you, simply click Buy Now.

- Create a personal account.

- Pick a plan.

- Pay via PayPal or bank card.

- Download the template in Word or PDF format.

As soon as you’ve downloaded your Mississippi Petition to Close Estate and Discharge Co-Administrators, it is possible to fill it out in any web-based editor or print it out and complete it manually. Use US Legal Forms to to access 85,000 professionally-drafted, state-specific documents.

Form popularity

FAQ

In the best of circumstances, the Mississippi probate process usually takes 4 to 6 months. This would only be possible if the estate was fairly simple, all interested parties are agreeable, and documents are signed and returned to the probate attorney in a timely manner.

If an estate is not properly probated and closed in a timely manner, there may be a number of consequences that can jeopardize the estate: The statute of limitations for creditors' claims is extended. Assets may lose value or be lost altogether. The state may claim the assets.

The Executor's Final Act, Closing an Estate The personal representative, now without any estate funds to pay his lawyer, must respond. Even if the charges are baseless, the executor is stuck paying the legal bill. Instead, before making any distribution, the administrator should insist on receiving a release.

Generally, an executor has 12 months from the date of death to distribute the estate. This is known as 'the executor's year'. However, for various reasons the executor may have been delayed and has not distributed the estate within this time frame.

Notify all creditors. File tax returns and pay final taxes. File the final accounting with the probate court. Distribute remaining assets to beneficiaries. File a closing statement with the court.

Generally, an executor has 12 months from the date of death to distribute the estate. This is known as 'the executor's year'. However, for various reasons the executor may have been delayed and has not distributed the estate within this time frame.

1) Petition the court to be the estate representative. 2) Notify heirs and creditors. 3) Change legal ownership of assets. 4) Pay Funeral Expenses, Taxes, Debts and Transfer assets to heirs.

File the Will and Probate Petition. Secure Personal Property. Appraise and Insure Valuable Assets. Cancel Personal Accounts. Determine Cash Needs. Remove Estate Tax Lien. Determine Location of Assets and Secure "Date of Death Values" Submit Probate Inventory.