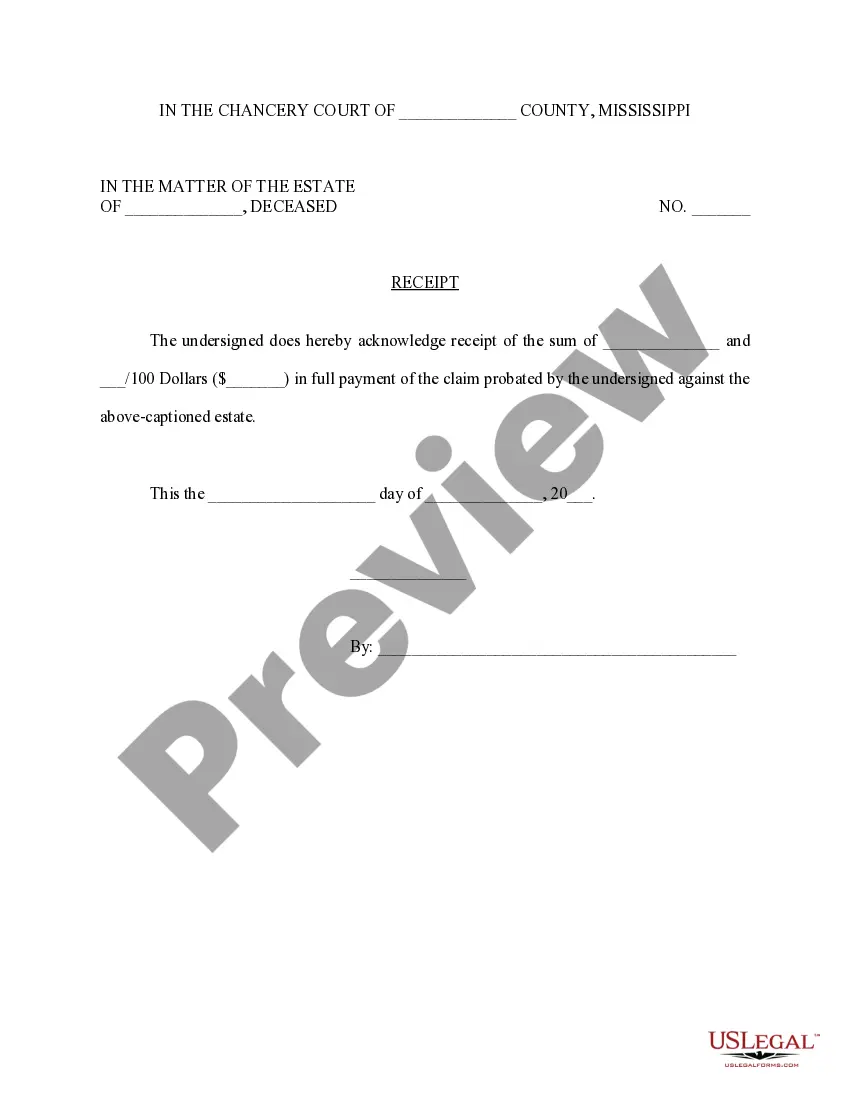

Mississippi Receipt of probated claim

Description Mississippi Claim Application

How to fill out Ms Claim Mississippi?

Obtain a printable Mississippi Receipt of probated claim in just several mouse clicks in the most complete library of legal e-files. Find, download and print professionally drafted and certified samples on the US Legal Forms website. US Legal Forms continues to be the #1 provider of affordable legal and tax templates for US citizens and residents on-line starting from 1997.

Users who have a subscription, must log in directly into their US Legal Forms account, download the Mississippi Receipt of probated claim and find it saved in the My Forms tab. Customers who don’t have a subscription are required to follow the tips below:

- Make sure your template meets your state’s requirements.

- If provided, look through form’s description to learn more.

- If accessible, review the form to see more content.

- Once you’re confident the form fits your needs, just click Buy Now.

- Create a personal account.

- Select a plan.

- Pay through PayPal or credit card.

- Download the template in Word or PDF format.

As soon as you’ve downloaded your Mississippi Receipt of probated claim, you are able to fill it out in any web-based editor or print it out and complete it manually. Use US Legal Forms to get access to 85,000 professionally-drafted, state-specific documents.

Mississippi Claim File Form popularity

Receipt Probated Print Other Form Names

Receipt Probated Mississippi FAQ

Explanation of the Mississippi Muniment of Title Procedure A muniment of title is an alternative to probate that allows a judge to recognize a will as valid for the sole purpose of transferring title to real estate. Creditors are not notified no executor or executrix is appointed.

All taxes and liabilities paid from the estate, including medical expenses, attorney fees, burial or cremation expenses, estate sale costs, appraisal expenses, and more. The executor should keep all receipts for any services or transactions needed to liquidate the assets of the deceased.

Before distributing assets to beneficiaries, the executor must pay valid debts and expenses, subject to any exclusions provided under state probate laws.The executor must maintain receipts and related documents and provide a detailed accounting to estate beneficiaries.

An inventory and appraisal is a required filing in California probate. The inventory and appraisal is a single document that (1) inventories the property in the decedent's estate and (2) contains an appraisal of the property in the inventory. California Probate Code § 8800(a).

Your inventory should include the number of shares of each type of stock, the name of the corporation, and the name of the exchange on which the stock is traded. Meanwhile, you should note the total gross amount of a bond, the name of the entity that issued it, the interest rate on the bond, and its maturity date.

When calculating the value of an estate, the gross value is the sum of all asset values, and the net value is the gross value minus any debts: in other words, the actual worth of the estate.

Determine Your State's Laws Regarding Inventory Forms. Review the Instructions Provided. Identify Real Property. Identify Personal Property. Identify Bank Accounts. Identify Retirement Accounts. Identify Non-Probate Assets. File the Form With the Court.

The first step in probating an estate is to locate all of the decedent's estate planning documents and other important papers, even before being appointed to serve as the personal representative or executor.

A letter of probate is a legal document that gives the executor the right to control the assets of a deceased persons estate.If a deceased person did not leave a will, a qualified candidate would also have to apply for a letter of probate to control the assets of the estate.