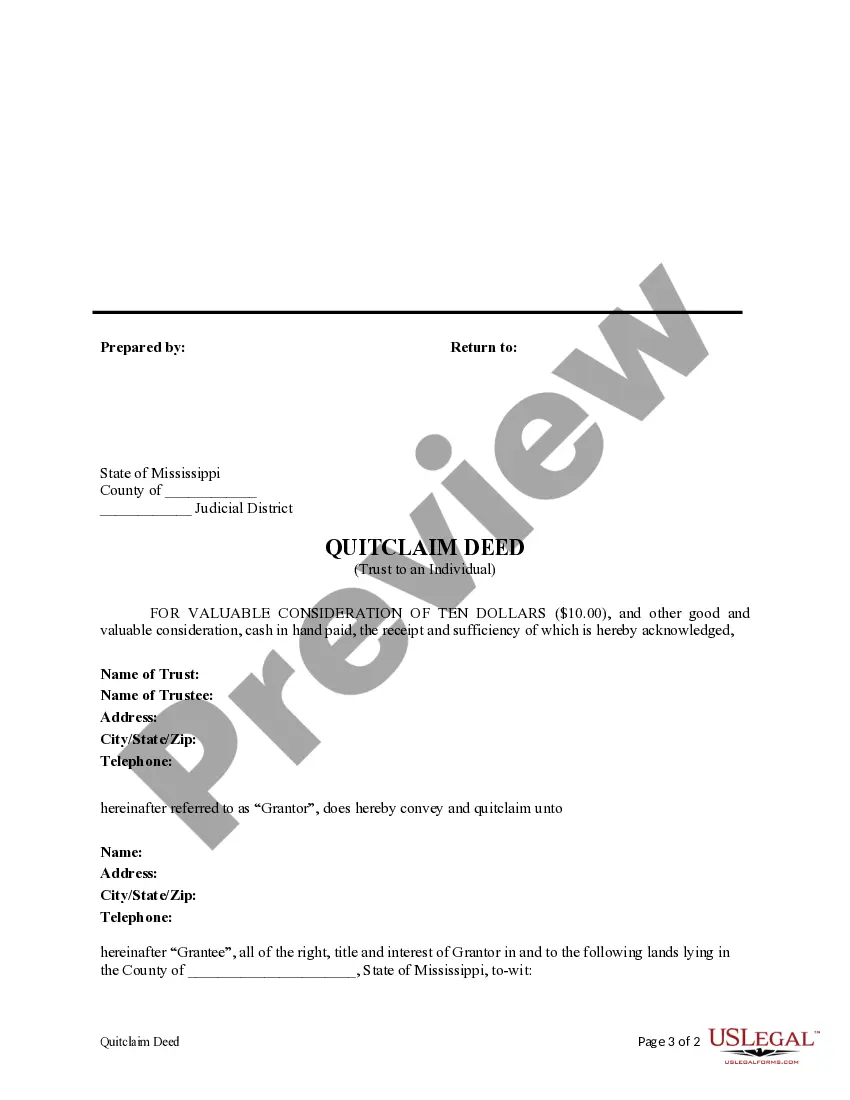

This form is a Quitclaim Deed where the Grantor is a Trust and the Grantee is an Individual. Grantor conveys and quitclaims any interest Grantor might have in the described property to Grantee. This deed complies with all state statutory laws.

Mississippi Quitclaim Deed from a Trust to an Individual

Description Quick Claim Deeds Mississippi

How to fill out Mississippi Quitclaim Deed From A Trust To An Individual?

Get a printable Mississippi Quitclaim Deed from a Trust to an Individual in only several mouse clicks from the most extensive library of legal e-files. Find, download and print professionally drafted and certified samples on the US Legal Forms website. US Legal Forms continues to be the Top supplier of affordable legal and tax forms for US citizens and residents online starting from 1997.

Customers who already have a subscription, need to log in straight into their US Legal Forms account, down load the Mississippi Quitclaim Deed from a Trust to an Individual and find it stored in the My Forms tab. Customers who don’t have a subscription must follow the tips below:

- Ensure your template meets your state’s requirements.

- If available, read the form’s description to learn more.

- If readily available, review the form to see more content.

- When you’re confident the template is right for you, simply click Buy Now.

- Create a personal account.

- Pick a plan.

- Pay via PayPal or credit card.

- Download the template in Word or PDF format.

As soon as you have downloaded your Mississippi Quitclaim Deed from a Trust to an Individual, you are able to fill it out in any online editor or print it out and complete it manually. Use US Legal Forms to to access 85,000 professionally-drafted, state-specific documents.

Form popularity

FAQ

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

A quitclaim deed can be used to transfer property from a trust, but a Special Warranty Deed seems to be a more common way to do this.

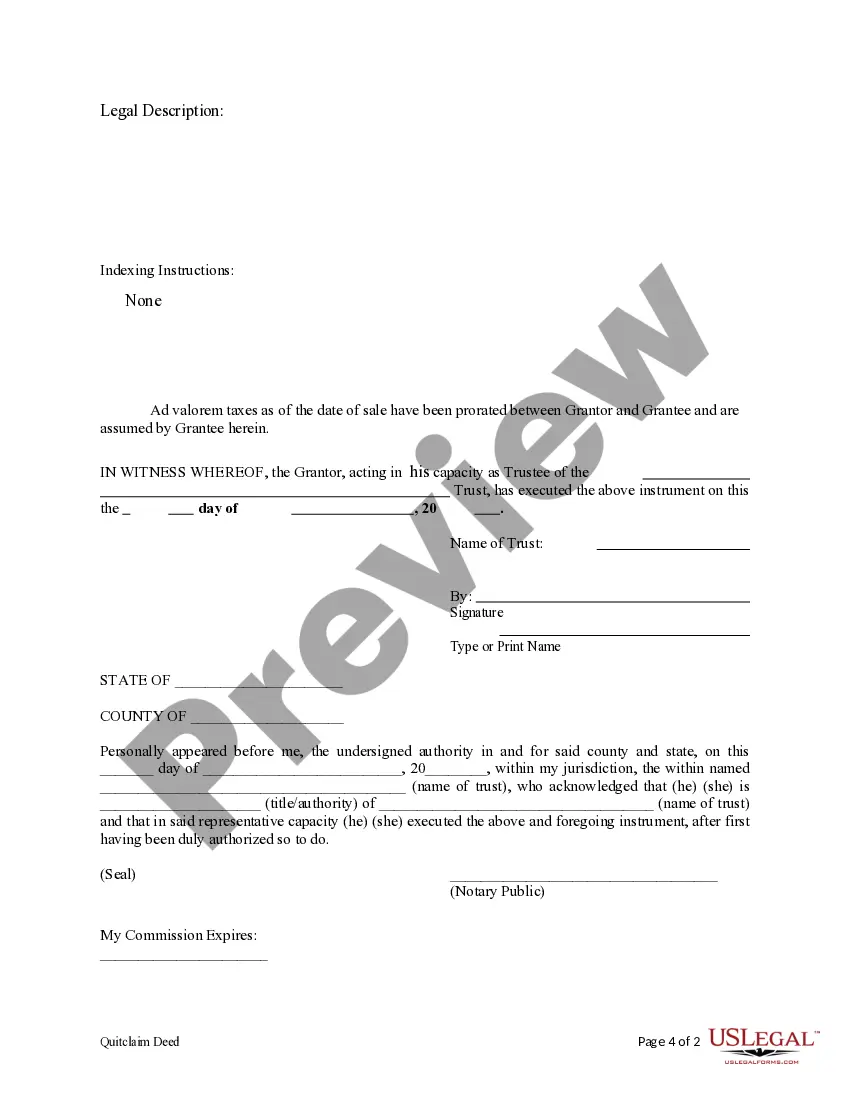

Before a quitclaim deed can be recorded with a county recorder in Mississippi, the grantor must sign and acknowledge it. The names, addresses, and telephone numbers of the grantors and grantees to the quit claim deed, along with a legal description of the real property should be provided on the first page (89-5-24).

Yes, a quit claim deed supercedes the trust. The only thing that can be done is to file a suit in court challenging the deed as the product of fraud and undue influence. A court action like that will cost thousands of dollars, but might be worth it if the house was owned free and clear.

Yes, you can use a Quitclaim Deed to transfer a gift of property to someone. You must still include consideration when filing your Quitclaim Deed with the County Recorder's Office to show that title has been transferred, so you would use $10.00 as the consideration for the property.

When you're ready to transfer trust real estate to the beneficiary who is named in the trust document to receive it, you'll need to prepare, sign, and record a deed. That's the document that transfers title to the property from you, the trustee, to the new owner.

A deed of trust acts as an agreement between youthe homebuyerand your lender. It states not just that you'll repay the loan, but that a third party called the trustee will hold legal title to the property until you do. A deed of trust is the security for your loan, and it's recorded in the public records.

As you stated in your question, it is recorded among the land records, and your lender keeps the original. When you pay off the loan, the lender will return the deed of trust with the promissory note. This document is rather lengthy and quite legalistic.

In real estate in the United States, a deed of trust or trust deed is a legal instrument which is used to create a security interest in real property wherein legal title in real property is transferred to a trustee, which holds it as security for a loan (debt) between a borrower and lender.