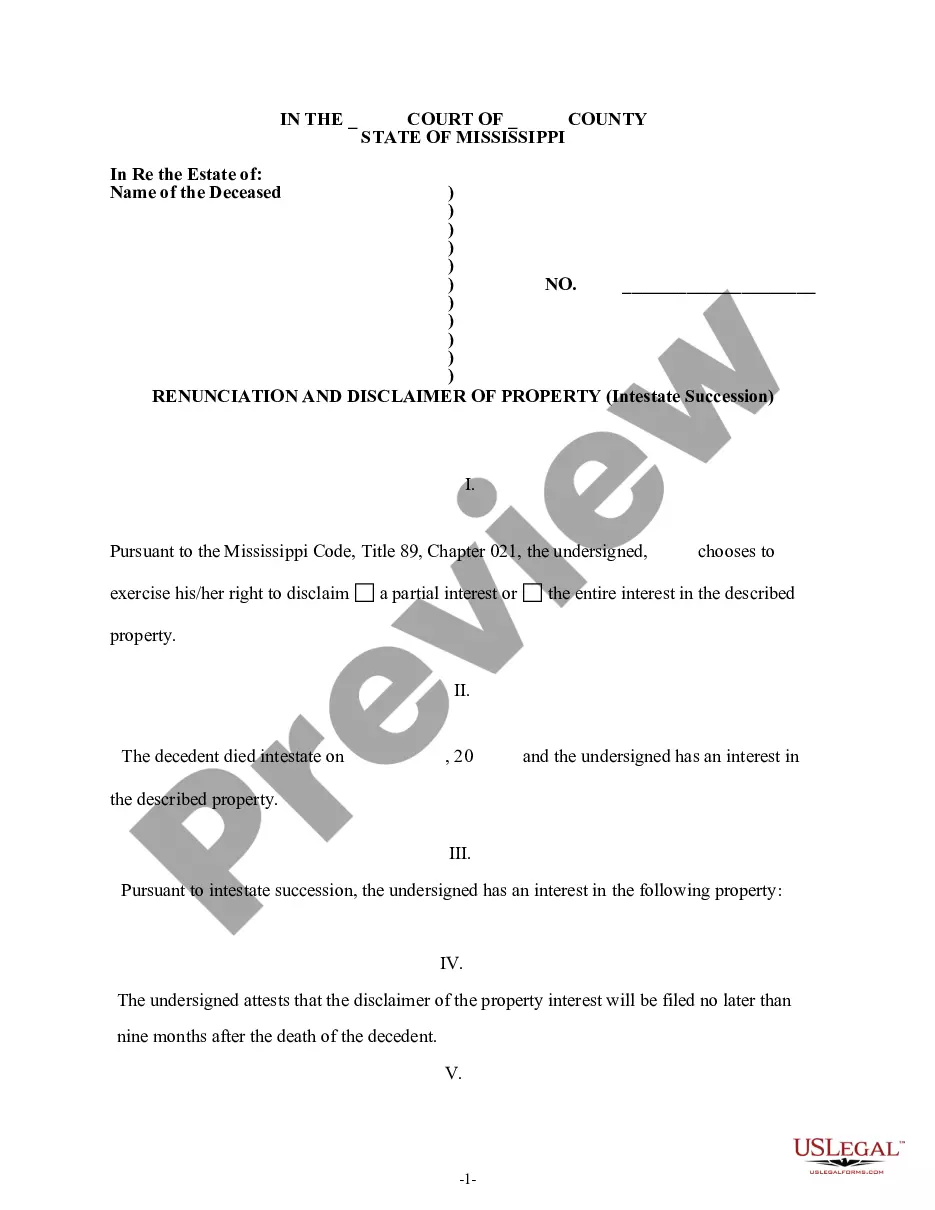

Mississippi Renunciation and Disclaimer of Property received by Intestate Succession

MISSISSIPPI CODE

Title 89 REAL AND PERSONAL PROPERTY

Chapter 021 UNIFORM DISCLAIMER OF PROPERTY INTERESTS ACT

Short title.

This chapter may be cited as the "Uniform Disclaimer

of Property Interests Act."

Title 89, Chap. 021, SEC. 89-21-1.

Right to disclaim interest in property.

A person, or the representative of a person,

to whom an interest in or with respect to property or an interest therein

devolves by whatever means may disclaim it in whole or in part by delivering

or filing a written disclaimer under this chapter. The right to disclaim

exists notwithstanding (a) any limitation on the interest of the disclaimant

in the nature of a spendthrift provision or similar restriction or (b)

any restriction or limitation on the right to disclaim contained in the

governing instrument. For purposes of this section, the "representative

of a person" includes an executor of a decedent's estate, an administrator

of a decedent's estate, a conservator of a disabled person, a guardian

of a minor or incapacitated person, and an agent acting on behalf of the

person within the authority of a power of attorney. For purposes of this

section, the term "governing instrument" means a deed, will, trust, insurance

or annuity policy, account with POD designation, security registered in

beneficiary form (TOD), pension, profit-sharing, retirement, or similar

benefit plan or instrument creating or exercising a power of appointment

or a power of attorney, or a dispositive, appointive or nominative instrument

of any similar type.

Title 89, Chap. 021, SEC. 89-21-3.

Time of disclaimer.

(1) The following rules govern the time when a disclaimer

must be filed or delivered:

(a) If the property or interest has devolved to the disclaimant

under a testamentary instrument or by the laws of intestacy, the disclaimer

must be filed, if of a present interest, not later than nine (9) months

after the death of the deceased owner or deceased donee of a power of appointment

and, if of a future interest, not later than nine (9) months after the

event determining that the taker of the property or interest is finally

ascertained and his interest is indefeasibly vested. The disclaimer must

be filed in the chancery court of the county in which proceedings for the

administration of the estate of the deceased owner or deceased donee of

the power have been commenced. A copy of the disclaimer must be delivered

in person or mailed by registered or certified mail, return receipt requested,

to the executor of the decedent's estate, the administrator of the decedent's

estate, or any other fiduciary of the decedent or donee of the power.

(b) If a property or interest has devolved to the disclaimant under

a nontestamentary instrument or contract, the disclaimer must be delivered

or filed and also, if real property or an interest therein is disclaimed,

a copy of the disclaimer must be recorded in the office of the chancery

clerk of the county in which the property, or interest disclaimed, is located

if a present interest, not later than nine (9) months after the effective

date of the nontestamentary instrument or contract and, if of a future

interest, not later than nine (9) months after the event determining that

the taker of the property or interest is finally ascertained and his interest

is indefeasibly vested. If the person entitled to disclaim does not know

of the existence of the interest, the disclaimer must be delivered or filed

and also, if real property or an interest therein is disclaimed, a copy

of the disclaimer must be recorded in the office of the chancery clerk

of the county in which the property or interest disclaimed is located,

if a present interest, not later than nine (9) months after the person

learns of the existence of the interest. The effective date of a revocable

instrument or contract is the date on which the maker no longer has power

to revoke it or to transfer to himself or another the entire legal and

equitable ownership of the interest. The disclaimer or a copy thereof must

be delivered in person or mailed by registered or certified mail, return

receipt requested, to the person who has legal title to or possession of

the interest disclaimed.

(2) A surviving joint tenant (or tenant by the entireties) may disclaim

as a separate interest any property or interest therein devolving to him

by right of survivorship. A surviving joint tenant (or tenant by the entireties)

may disclaim the entire interest in any property or interest therein that

is the subject of a joint tenancy (or tenancy by the entireties) devolving

to him, if the joint tenancy (or tenant by the entireties) was created

by act of a deceased joint tenant (or tenant by the entireties), and the

survivor did not join in creating the joint tenancy (or tenancy by the

entireties), and has not accepted a benefit under it.

(3) If real property or an interest therein is disclaimed under

subsection (1), a copy of the disclaimer may be recorded in the office

of the chancery clerk of the county in which the property or interest disclaimed

is located.

Title 89, Chap. 021, SEC. 89-21-5.

Form of disclaimer.

The disclaimer must (a) describe the property

or interest disclaimed, (b) declare the disclaimer and extent thereof,

and (c) be signed by the disclaimant.

Title 89, Chap. 021, SEC. 89-21-7.

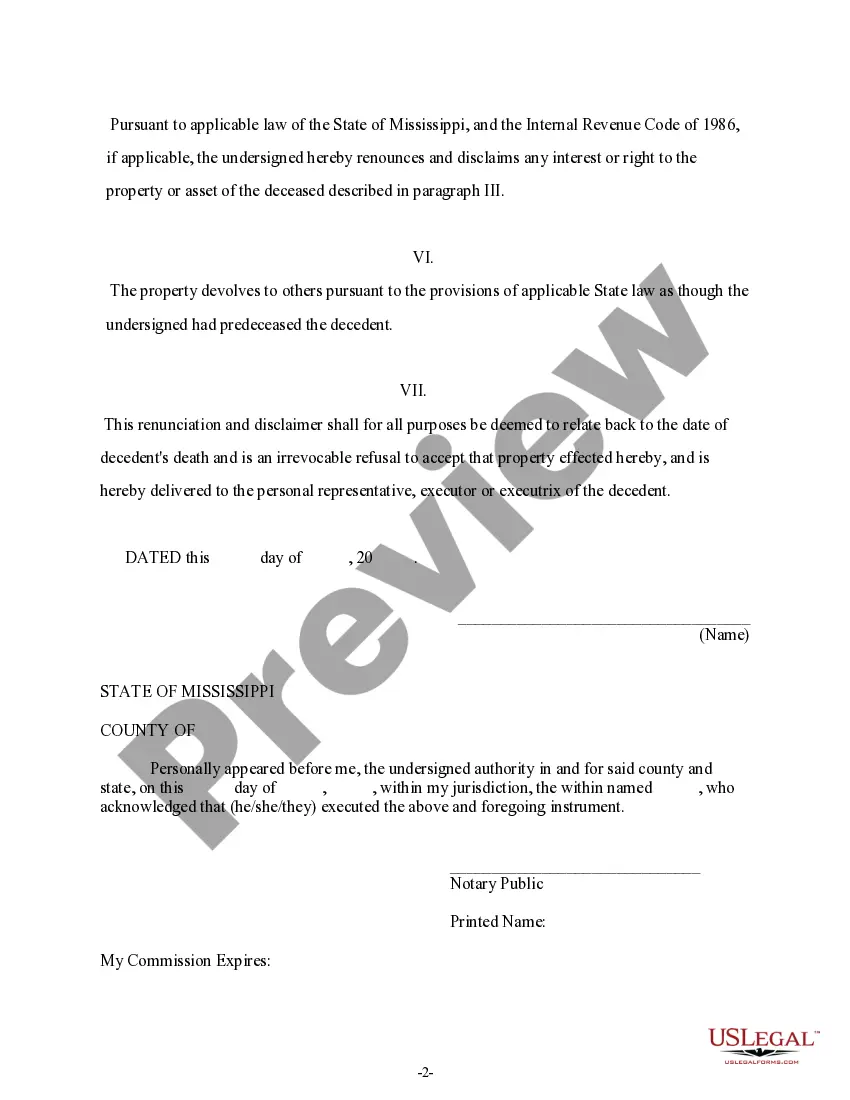

Effect of disclaimer.

(1) The effects of a disclaimer are:

(a) If property or an interest therein devolves to a disclaimant

under a testamentary instrument, under a power of appointment exercised

by a testamentary instrument, or under the laws of intestacy, and the decedent

has not provided for another disposition of that interest, should

it be disclaimed, or of disclaimed or failed interests in general, the

disclaimed interest devolves as if the disclaimant had predeceased the

decedent, but if by law or under the testamentary instrument the descendants

of the disclaimant would take the disclaimant's share by representation

were the disclaimant to predecease the decedent, then the disclaimed interest

passes by representation to the descendants of the disclaimant who survive

the decedent. A future interest that takes effect in possession or enjoyment

after the termination of the estate or interest disclaimed takes effect

as if the disclaimant had predeceased the decedent. A disclaimer relates

back for all purposes to the date of death of the decedent.

(b) If property or an interest therein devolves to a disclaimant

under a nontestamentary instrument or contract and the instrument or contract

does not provide for another disposition of that interest, should it be

disclaimed, or of disclaimed or failed interests in general, the disclaimed

interest devolves as if the disclaimant had predeceased the effective date

of the instrument or contract, but if by law or under the nontestamentary

instrument or contract the descendants of the disclaimant would take the

disclaimant's share by representation were the disclaimant to predecease

the effective date of the instrument, then the disclaimed interest passes

by representation to the descendants of the disclaimant who survive the

effective date of the instrument. A disclaimer relates back for all purposes

to that date. A future interest that takes effect in possession or enjoyment

at or after the termination of the disclaimed interest takes effect as

if the disclaimant had died before the effective date of the instrument

or contract that transferred the disclaimed interest.

(2) The disclaimer or the written waiver of the right to disclaim is

binding upon the disclaimant or person waiving and all persons claiming

through or under either of them.

Title 89, Chap. 021, SEC. 89-21-9.

Waiver and bar.

The right to disclaim property or an interest

therein is barred by (a) an assignment, conveyance, encumbrance, pledge,

or transfer of the property or interest, or a contract therefor, (b) a

written waiver of the right to disclaim, (c) an acceptance of the property

or interest or a benefit under it, or (d) a sale of the property or interest

under judicial sale made before the disclaimer is made.

Title 89, Chap. 021, SEC. 89-21-11.

Remedy not exclusive.

This chapter does not abridge the right of person to waive, release,

disclaim, or renounce property or an interest therein under any other statute.

Title 89, Chap. 021, SEC. 89-21-13.

Application.

An interest in property that exists on July

1, 1994, as to which, if a present interest, the time for filing a disclaimer

under this chapter has not expired or, if a future interest, the interest

has not become indefeasibly vested or the taker finally ascertained, may

be disclaimed within nine (9) months after July 1, 1994.

Title 89, Chap. 021, SEC. 89-21-15.

Uniformity of application and construction.

This chapter shall be applied and construed

to effectuate its general purpose to make uniform the law with respect

to the subject of this chapter among states enacting it.

Title 89, Chap. 021, SEC. 89-21-17.