Mississippi Change or Modification of Promissory Note Deed of Trust and Security Agreement

Description Modification Deed Security

How to fill out Mississippi Change Or Modification Of Promissory Note Deed Of Trust And Security Agreement?

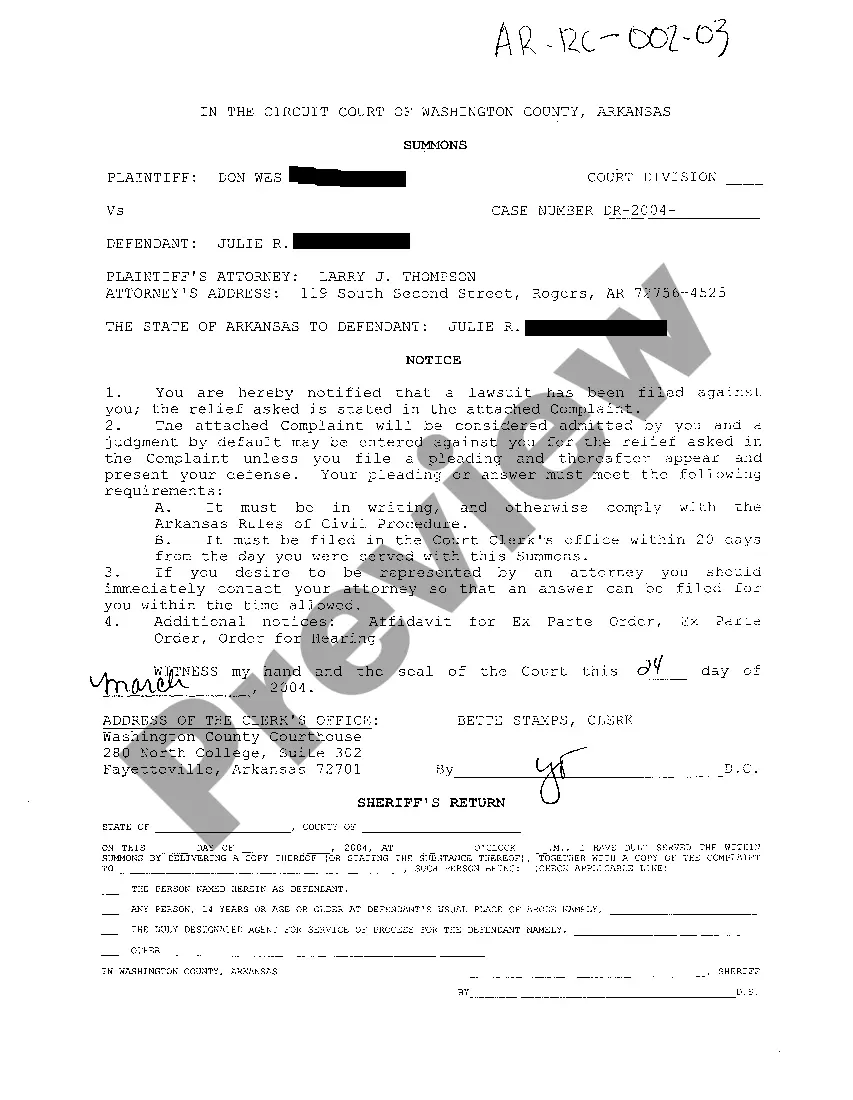

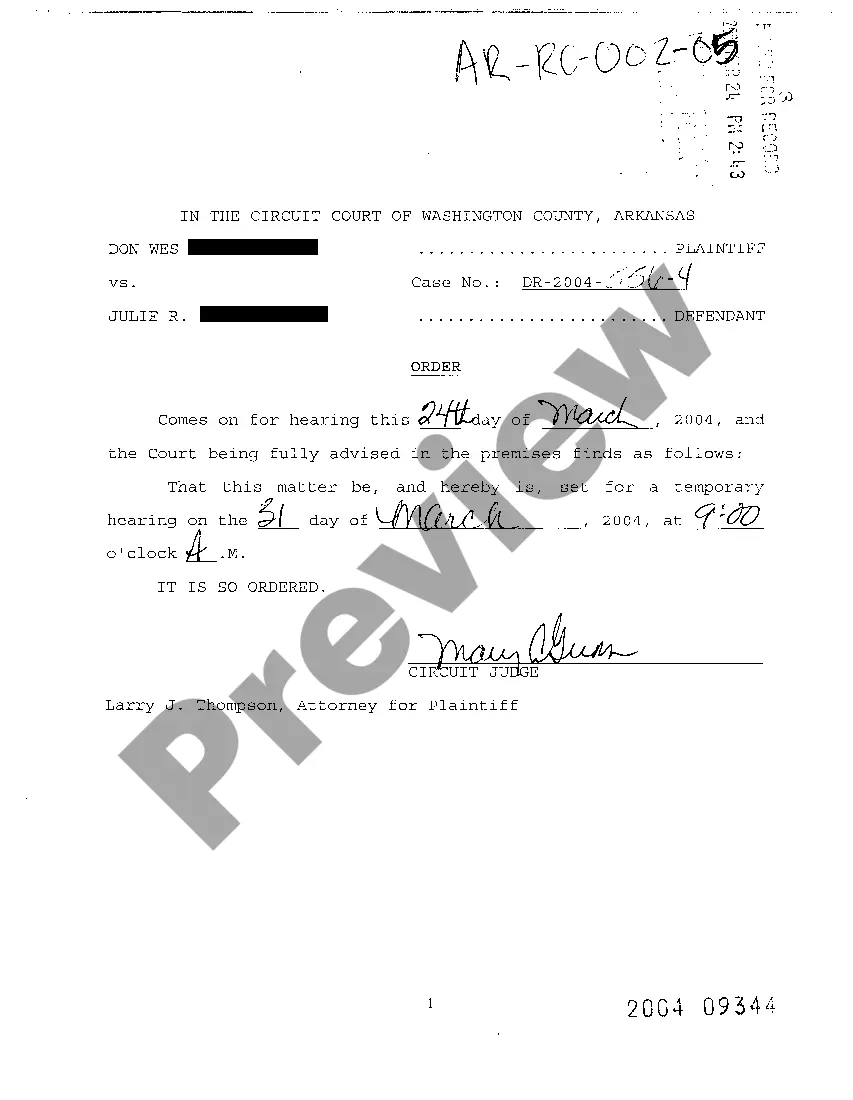

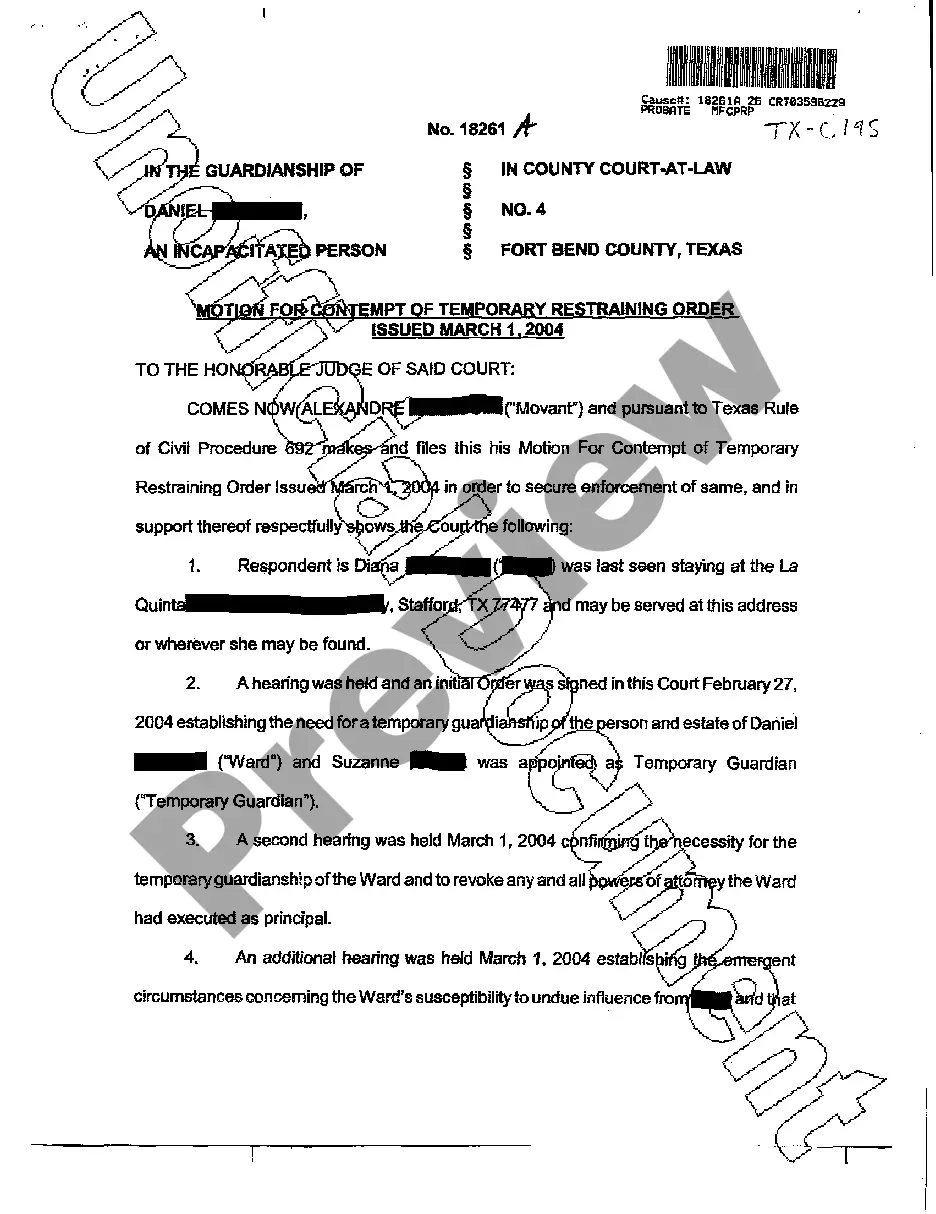

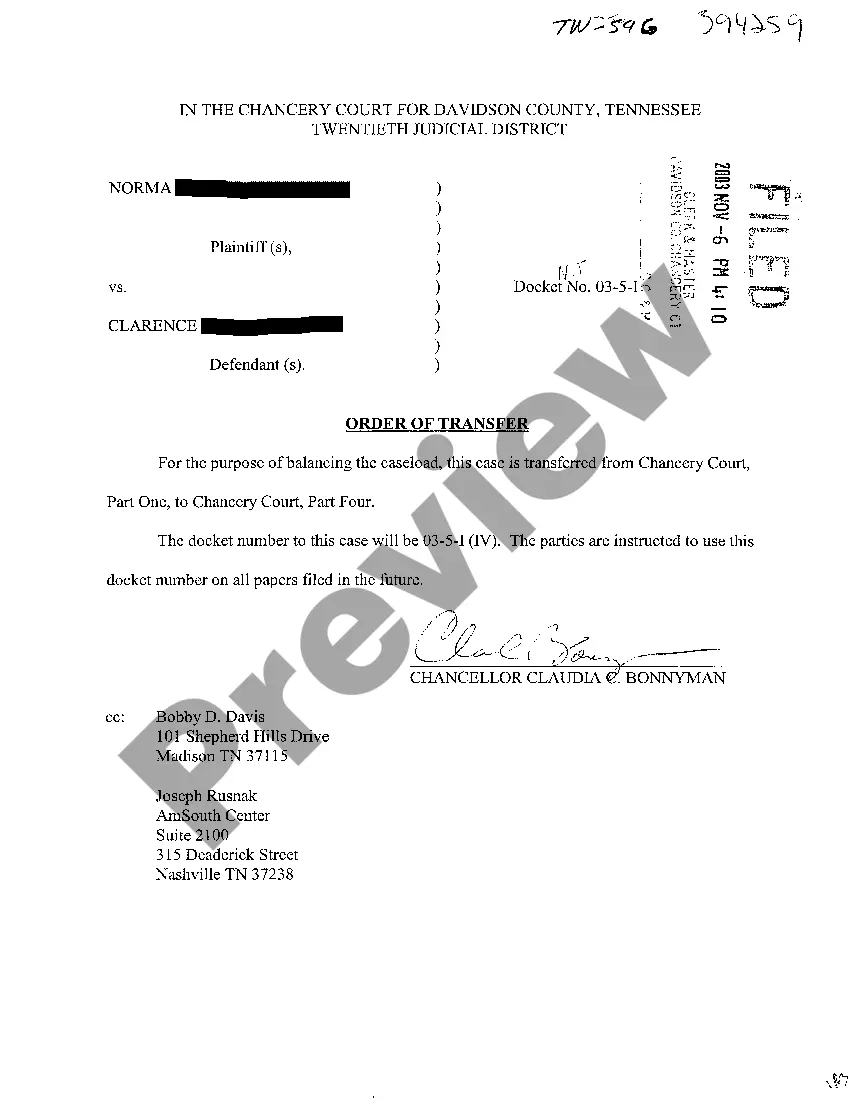

Get a printable Mississippi Change or Modification of Promissory Note Deed of Trust and Security Agreement within several clicks in the most complete library of legal e-documents. Find, download and print out professionally drafted and certified samples on the US Legal Forms website. US Legal Forms has been the #1 provider of affordable legal and tax forms for US citizens and residents on-line starting from 1997.

Users who have already a subscription, must log in straight into their US Legal Forms account, download the Mississippi Change or Modification of Promissory Note Deed of Trust and Security Agreement see it stored in the My Forms tab. Users who don’t have a subscription are required to follow the steps below:

- Ensure your template meets your state’s requirements.

- If provided, look through form’s description to learn more.

- If available, preview the form to see more content.

- Once you’re sure the template meets your requirements, simply click Buy Now.

- Create a personal account.

- Choose a plan.

- Pay out via PayPal or bank card.

- Download the form in Word or PDF format.

When you’ve downloaded your Mississippi Change or Modification of Promissory Note Deed of Trust and Security Agreement, you may fill it out in any web-based editor or print it out and complete it by hand. Use US Legal Forms to to access 85,000 professionally-drafted, state-specific files.

Promissory Trust Form popularity

Deed Trust Agreement Other Form Names

Mississippi Modification FAQ

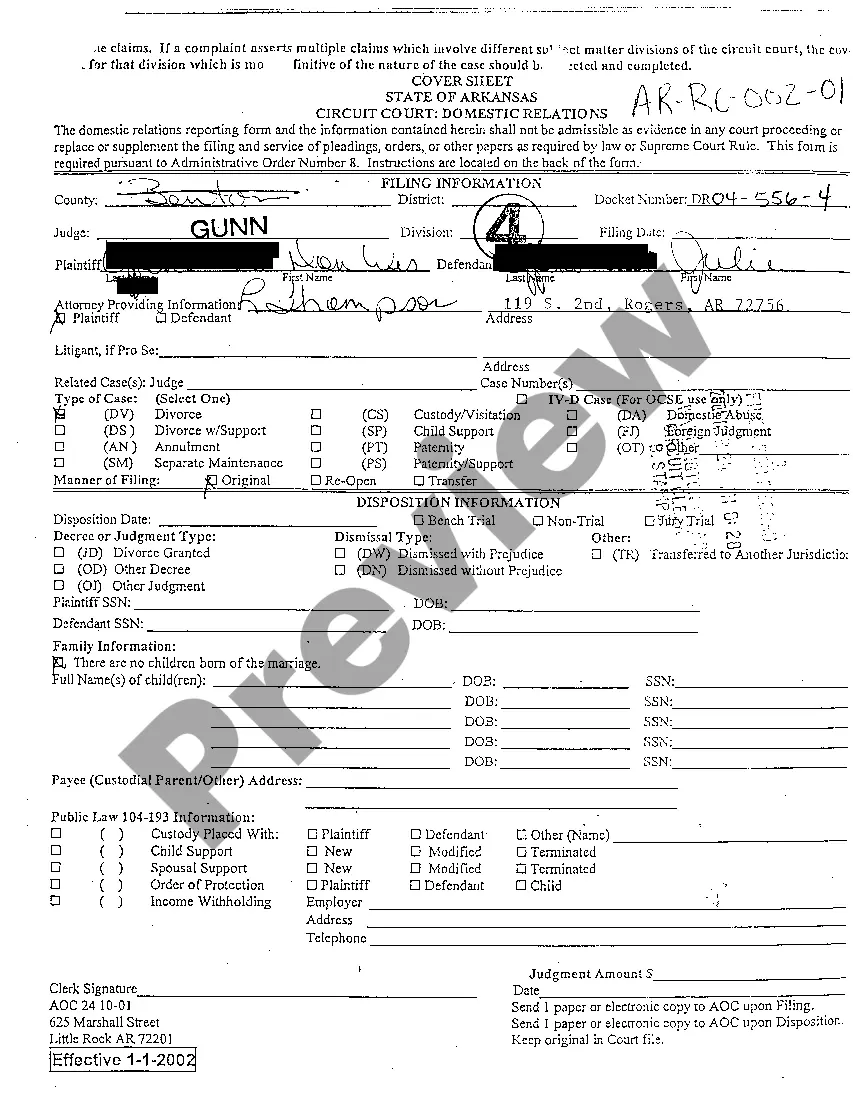

Party information: names and addresses of the trustor(s), trustee(s), beneficiary(ies), and guarantor(s) (if applicable) Property details: full address of the property and its legal description (which can be obtained from the County Recorder's Office)

Writing the Promissory Note Terms You don't have to write a promissory note from scratch. You can use a template or create a promissory note online.

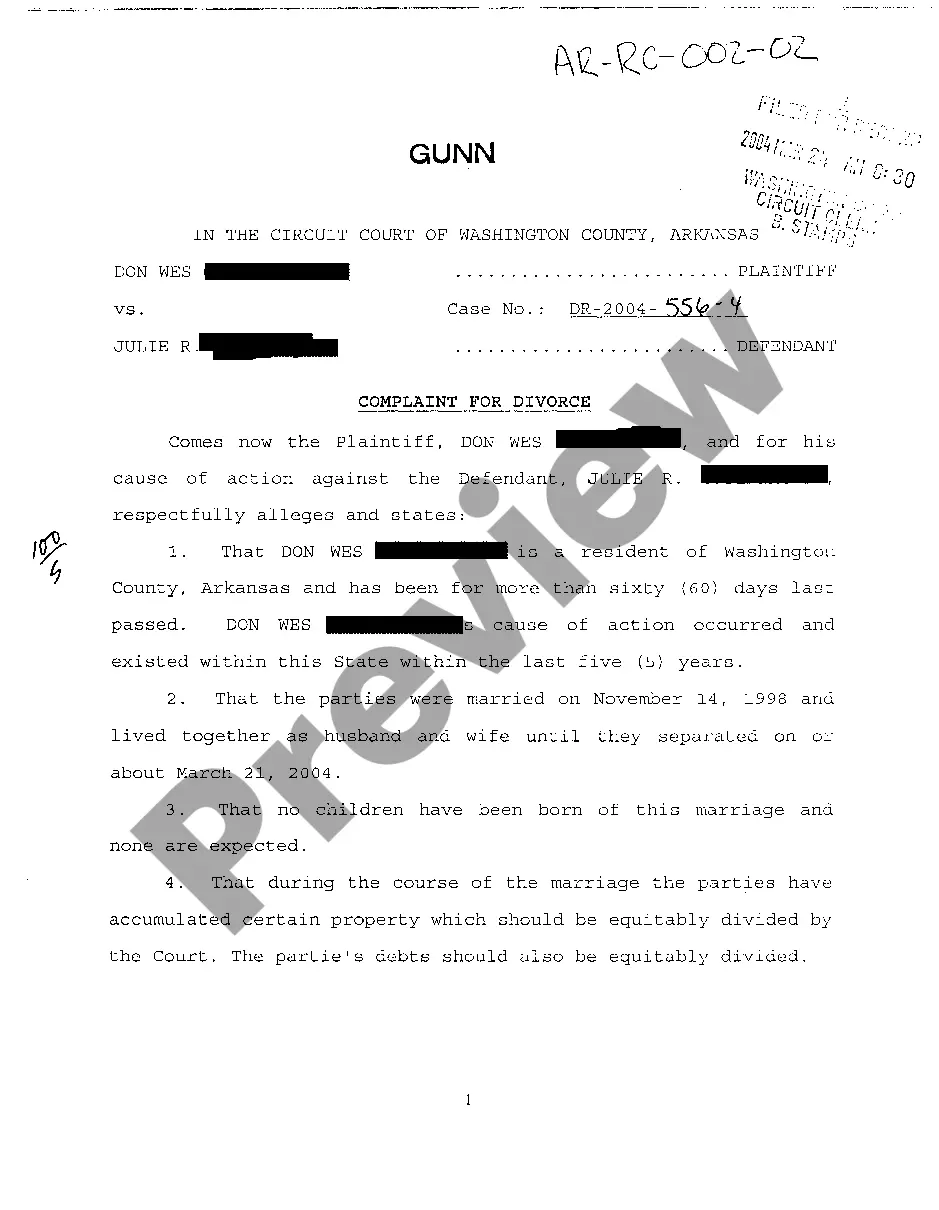

In order for a promissory note to be valid, both the lender and the borrower must sign the documentation. If you are a co-signer for the loan, you are required to sign the promissory note. Being a co-signer requires you to repay the loan amount in the instance that the borrower defaults on payment.

Write the date of the writing of the promissory note at the top of the page. Write the amount of the note. Describe the note terms. Write the interest rate. State if the note is secured or unsecured. Include the names of both the lender and the borrower on the note, indicating which person is which.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

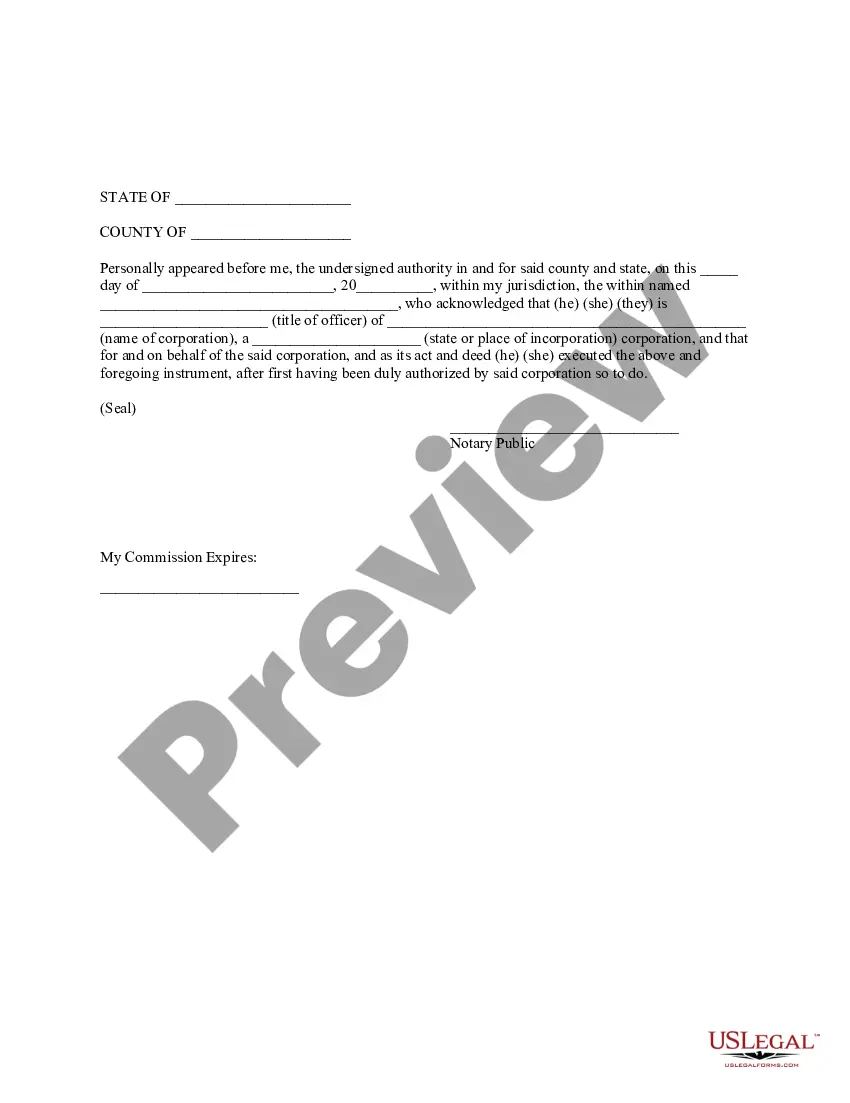

Contact the other parties involved in the deed of trust. Obtain the correct deed of trust modification form from the county courthouse. Make the required changes. Sign the modification and have it notarized.

In general, under the Securities Acts, promissory notes are defined as securities, but notes with a maturity of 9 months or less are not securities.The US Supreme Court in Reves recognizes that most notes are, in fact, not securities.

Navigate to the website: www.studentloans.gov. Click "Log In." Enter your FSA ID and Password. Click "Complete Master Promissory Note." Select the appropriate loan type. Enter Your Personal Information.

Promissory notes are defined as securities under the Securities Act. However, notes that have a maturity of nine months or less are not considered securities.