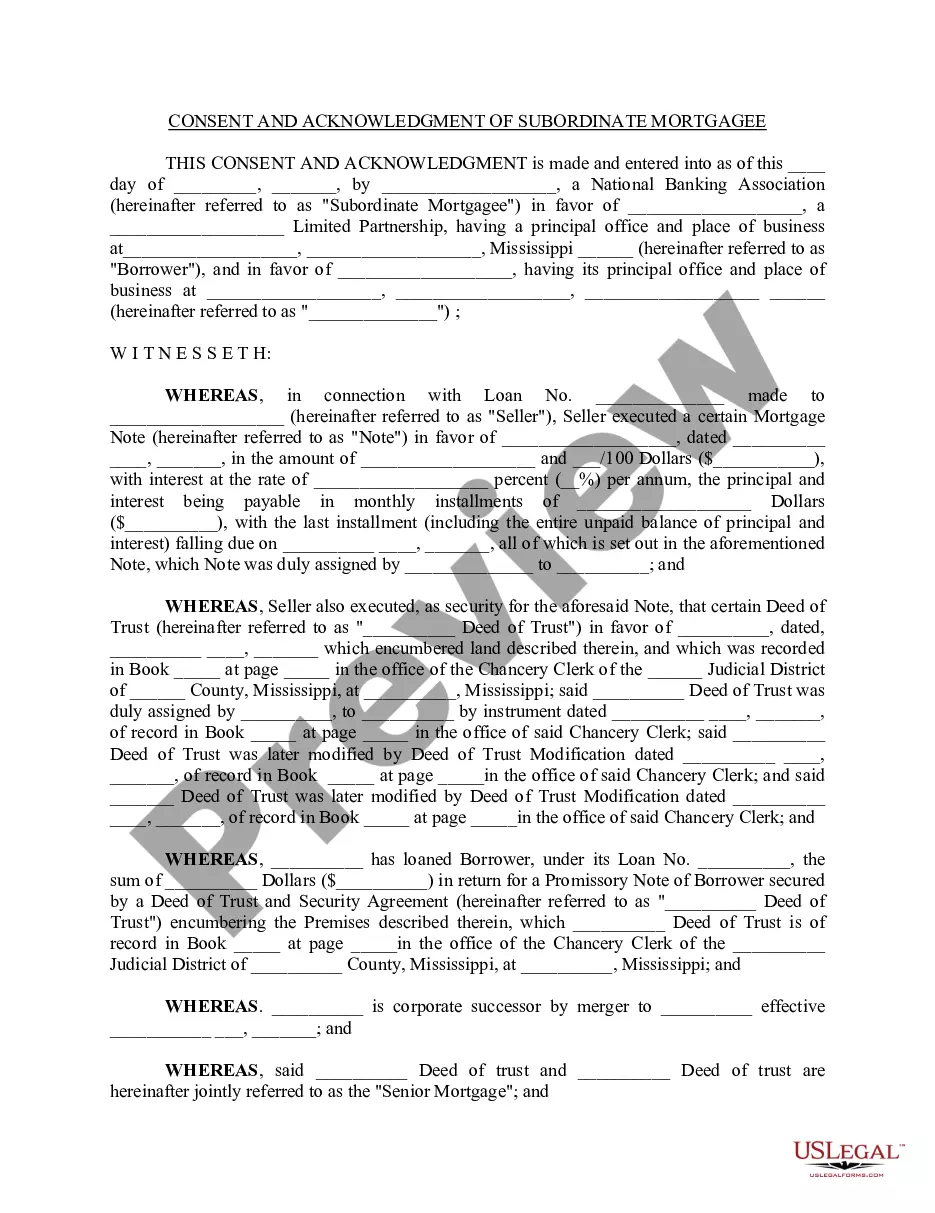

This form is a Consent and Acknowledgment of Subordinate Mortgage for use in mortgages within the state of Mississippi.

Mississippi Consent and acknowledgment of subordinate mortgage

Description

How to fill out Mississippi Consent And Acknowledgment Of Subordinate Mortgage?

Obtain a printable Mississippi Consent and acknowledgment of subordinate mortgage in only several mouse clicks in the most extensive catalogue of legal e-files. Find, download and print professionally drafted and certified samples on the US Legal Forms website. US Legal Forms has been the #1 provider of reasonably priced legal and tax forms for US citizens and residents online starting from 1997.

Users who have a subscription, need to log in directly into their US Legal Forms account, down load the Mississippi Consent and acknowledgment of subordinate mortgage see it saved in the My Forms tab. Users who do not have a subscription are required to follow the tips below:

- Make certain your template meets your state’s requirements.

- If available, read the form’s description to find out more.

- If readily available, review the form to find out more content.

- As soon as you are confident the form meets your requirements, click on Buy Now.

- Create a personal account.

- Select a plan.

- through PayPal or visa or mastercard.

- Download the template in Word or PDF format.

As soon as you’ve downloaded your Mississippi Consent and acknowledgment of subordinate mortgage, it is possible to fill it out in any online editor or print it out and complete it manually. Use US Legal Forms to get access to 85,000 professionally-drafted, state-specific forms.

Form popularity

FAQ

When a Borrower wishes to refinance the property, they must request a subordination request to the Lender. The Lender will subordinate their loan only when there is no cash out as part of the refinance.

But as property values are going up and the demand for refinance isn't as much, it seems that the subordination process has gotten a little easier. Typically, it takes two to three weeks to get the resubordination paperwork through, and it is likely to set you back $200 to $300.

But as property values are going up and the demand for refinance isn't as much, it seems that the subordination process has gotten a little easier. Typically, it takes two to three weeks to get the resubordination paperwork through, and it is likely to set you back $200 to $300.

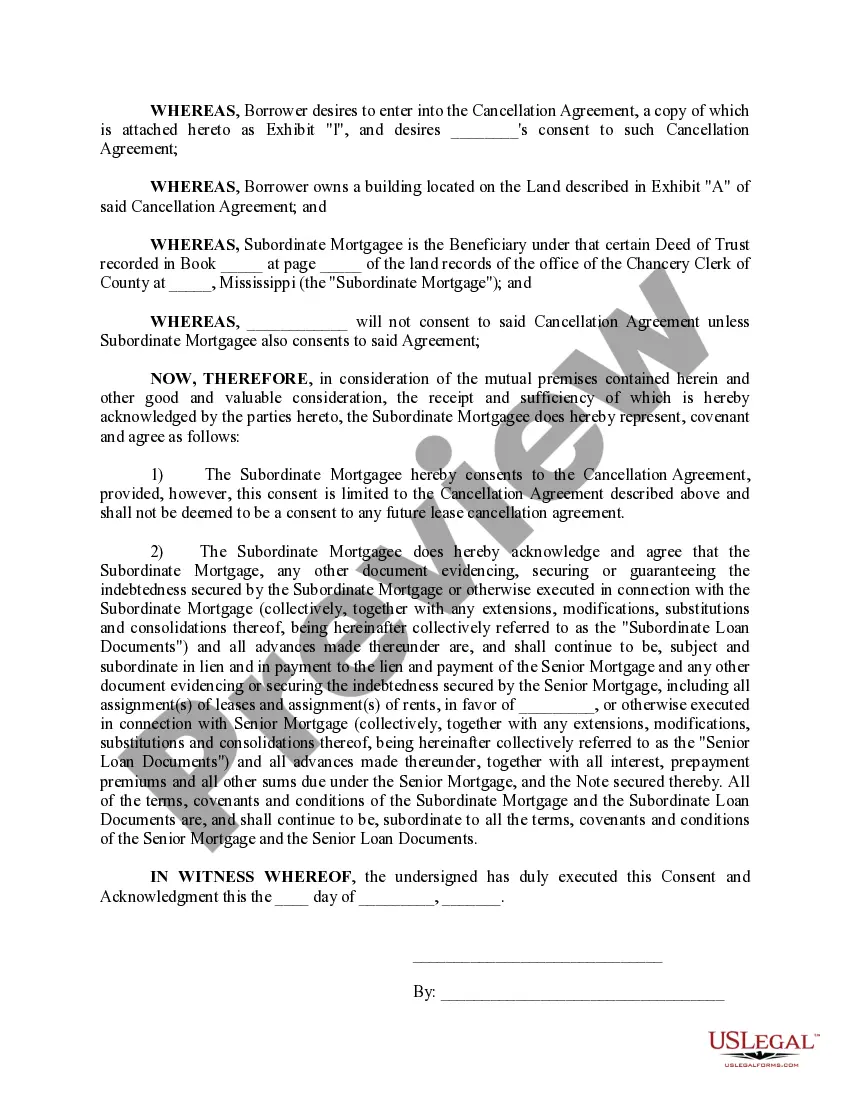

Subordination is the tenant's agreement that its interest under the lease will be subordinate to that of the lender.Attornment is the tenant's agreement to become the tenant of someone other than the original landlord and who has now taken title to the property.

Any subordinated promissory note definition covers all agreements made between a borrower and investors in which the repayment of any debts, in the event of a default, happens after all other debts owed by the borrower are repaid.

Subordination agreements are prepared by your lender. The process occurs internally if you only have one lender. When your mortgage and home equity line or loan have different lenders, both financial institutions work together to draft the necessary paperwork.

What is a Subordinate Mortgage? Subordinate mortgages are loans that have a lower priority status than any other recorded liens (or debts) against a property. When you get the loan you need to purchase your home, this loan is typically recorded as the first repayment priority on your deed after closing.

The signed agreement must be acknowledged by a notary and recorded in the official records of the county to be enforceable.

Subordination is the process of ranking home loans (mortgage, HELOC or home equity loan) by order of importance.Through subordination, lenders assign a lien position to these loans. Generally, your mortgage is assigned the first lien position while your HELOC becomes the second lien.