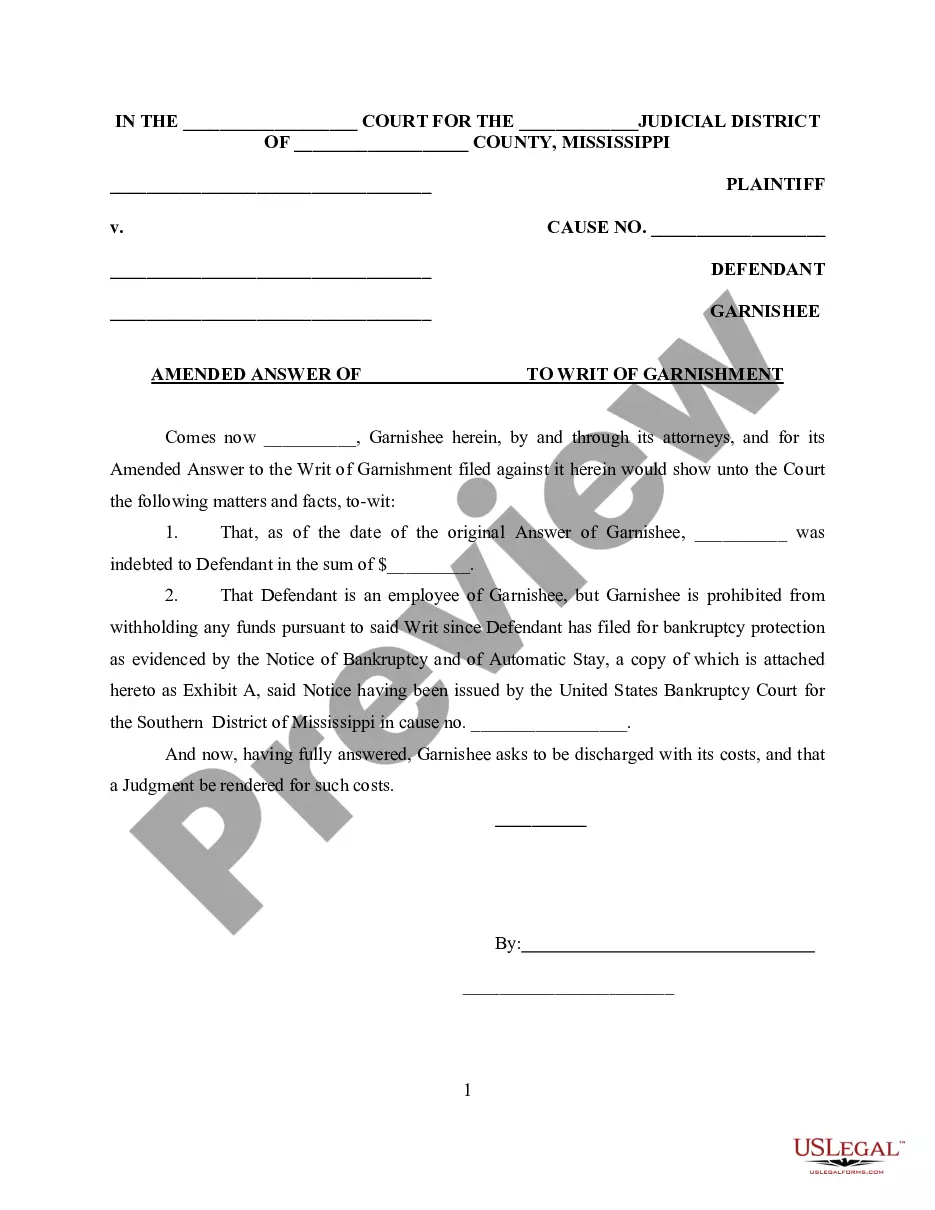

This form is an Amended Answer for a Garnishment proceeding initiated as part of a bankruptcy case.

Mississippi Amended Answer to Garnishment Re Bankruptcy

Description

How to fill out Mississippi Amended Answer To Garnishment Re Bankruptcy?

Obtain a printable Mississippi Amended Answer to Garnishment Re Bankruptcy within just several mouse clicks in the most comprehensive catalogue of legal e-documents. Find, download and print out professionally drafted and certified samples on the US Legal Forms website. US Legal Forms has been the #1 supplier of reasonably priced legal and tax forms for US citizens and residents on-line starting from 1997.

Users who already have a subscription, must log in into their US Legal Forms account, download the Mississippi Amended Answer to Garnishment Re Bankruptcy and find it saved in the My Forms tab. Users who don’t have a subscription are required to follow the steps listed below:

- Make sure your form meets your state’s requirements.

- If available, look through form’s description to find out more.

- If readily available, preview the shape to see more content.

- When you’re confident the form meets your requirements, simply click Buy Now.

- Create a personal account.

- Pick a plan.

- Pay out via PayPal or visa or mastercard.

- Download the form in Word or PDF format.

As soon as you have downloaded your Mississippi Amended Answer to Garnishment Re Bankruptcy, it is possible to fill it out in any online editor or print it out and complete it manually. Use US Legal Forms to get access to 85,000 professionally-drafted, state-specific files.

Form popularity

FAQ

If you review your three credit reports and you find information about your judgment, you can file a credit dispute to have it removed. The fastest and easiest way to file a dispute is to do it online with each credit reporting agency directly. You can also file your disputes by mail and over the phone.

You can stop a garnishment by paying the debt in full. You can stop a wage garnishment by asking the court to order installment payments in your case. Read Getting an Installment Payment Plan to learn more. Objecting to a garnishment will stop it until the objection is decided.

If it's already started, you can try to challenge the judgment or negotiate with the creditor. But, they're in the driver's seat, and if they don't allow you to stop a garnishment by agreeing to make voluntary payments, you can't really force them to. You can, however, stop the garnishment by filing a bankruptcy case.

If you are served with a garnishment summons, do not ignore these documents because they do not directly involve a debt that you owe. Instead, you should immediately freeze any payments to the debtor, retain the necessary property, and provide the required written disclosure.

In general terms, to attempt to have a wage garnishment ended, modified or reversed, you have the following options. First, you could attempt to negotiate a monthly payment agreement with the creditor/collector.Third, you could file an appeal with the court if you do not agree with the garnishment.

In most states, employers answer a writ of garnishment by filling out the paperwork attached to the judgment and returning it to the creditor or the creditor's attorney.

What you can do about wage garnishment.You have to be legally notified of the garnishment. You can file a dispute if the notice has inaccurate information or you believe you don't owe the debt. Some forms of income, such as Social Security and veterans benefits, are exempt from garnishment as income.

Respond to the Creditor's Demand Letter. Seek State-Specific Remedies. Get Debt Counseling. Object to the Garnishment. Attend the Objection Hearing (and Negotiate if Necessary) Challenge the Underlying Judgment. Continue Negotiating.