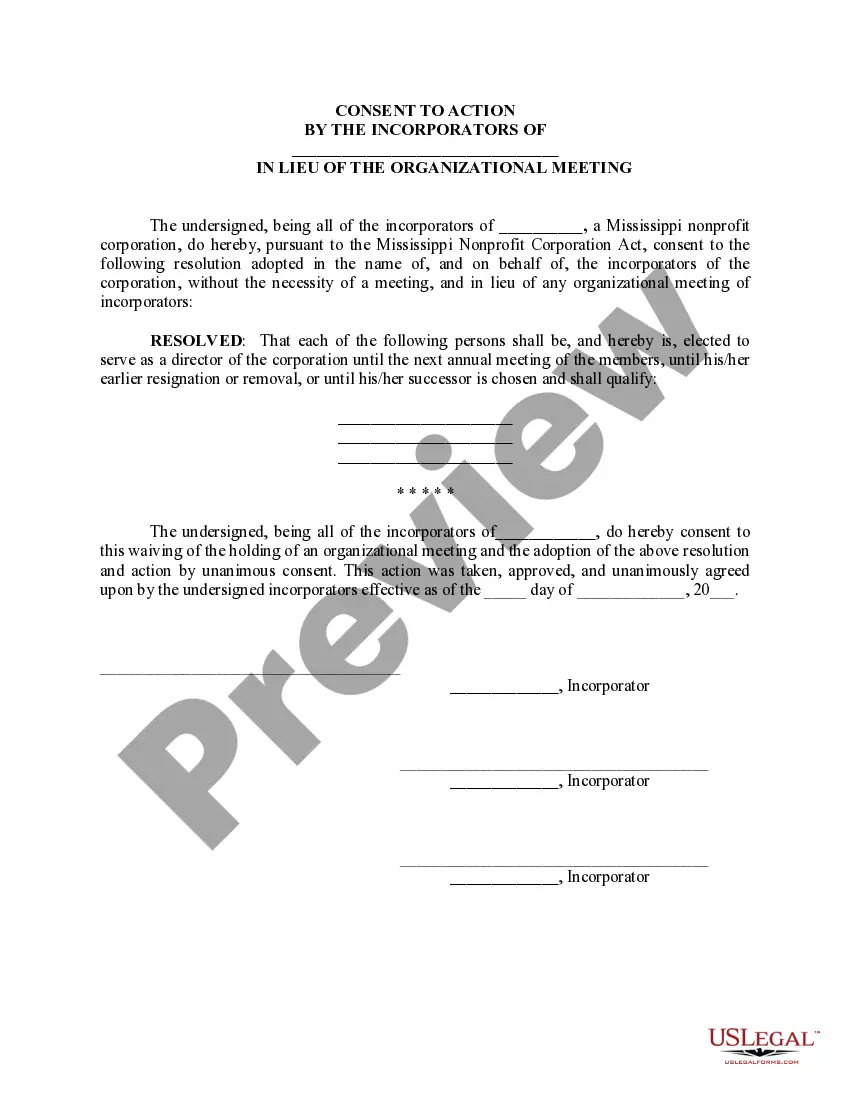

This form is a Consent to Action by the Incorporators of a Mississippi Nonprofit that consents to the election of directors without the necessity of and in lieu of an organizational meeting held for that purpose.

Incorporators Consent To Action Mississippi Nonprofit

Description

How to fill out Incorporators Consent To Action Mississippi Nonprofit?

Obtain a printable Incorporators Consent To Action Mississippi Nonprofit within just several mouse clicks from the most complete library of legal e-documents. Find, download and print out professionally drafted and certified samples on the US Legal Forms website. US Legal Forms continues to be the #1 provider of reasonably priced legal and tax forms for US citizens and residents online starting from 1997.

Users who have a subscription, need to log in in to their US Legal Forms account, download the Incorporators Consent To Action Mississippi Nonprofit see it stored in the My Forms tab. Customers who never have a subscription must follow the steps listed below:

- Make certain your template meets your state’s requirements.

- If available, look through form’s description to learn more.

- If accessible, review the shape to find out more content.

- When you are confident the form fits your needs, just click Buy Now.

- Create a personal account.

- Select a plan.

- Pay through PayPal or visa or mastercard.

- Download the form in Word or PDF format.

As soon as you’ve downloaded your Incorporators Consent To Action Mississippi Nonprofit, you can fill it out in any online editor or print it out and complete it by hand. Use US Legal Forms to to access 85,000 professionally-drafted, state-specific forms.

Form popularity

FAQ

Name Your Organization. Recruit Incorporators and Initial Directors. Appoint a Registered Agent. Prepare and File Articles of Incorporation. File Initial Report. Obtain an Employer Identification Number (EIN) Store Nonprofit Records. Establish Initial Governing Documents and Policies.

Definition: A business organization that serves some public purpose and therefore enjoys special treatment under the law. Unlike a for-profit business, a nonprofit may be eligible for certain benefits, such as sales, property and income tax exemptions at the state level.

Section 501(c)(4): civic leagues and social welfare organizations, homeowners associations, and volunteer fire companies. Section 501(c)(5): such as labor unions. Section 501(c)(6): such as chambers of commerce.

In the absence of a standard definition, let's consider a small organization as having 20 or fewer staff members and a large organization as having 100 or more.

Name Your Organization. Recruit Incorporators and Initial Directors. Appoint a Registered Agent. Prepare and File Articles of Incorporation. File Initial Report. Obtain an Employer Identification Number (EIN) Store Nonprofit Records. Establish Initial Governing Documents and Policies.

A nonprofit designation and tax-exempt status are given only to organizations that further religious, scientific, charitable, educational, literary, public safety or cruelty-prevention causes or purposes. Examples of nonprofit organizations include hospitals, universities, national charities, churches, and foundations.

Fiscal sponsorship is an arrangement in which one entity agrees to accept and manage funds for another.Having a fiscal sponsor, like ioby, can help you fundraise if you're not a 501(c)3 nonprofit. Better still, your donations can be tax deductible!

What is a nonprofit organization? A nonprofit organization is one that qualifies for tax-exempt status by the IRS because its mission and purpose are to further a social cause and provide a public benefit. Nonprofit organizations include hospitals, universities, national charities and foundations.

The highest-paid nonprofit leaders CEOs, Executive Directors, etc. all earn at least $900k per year, and into the tens of millions for the largest of hospitals and health systems.