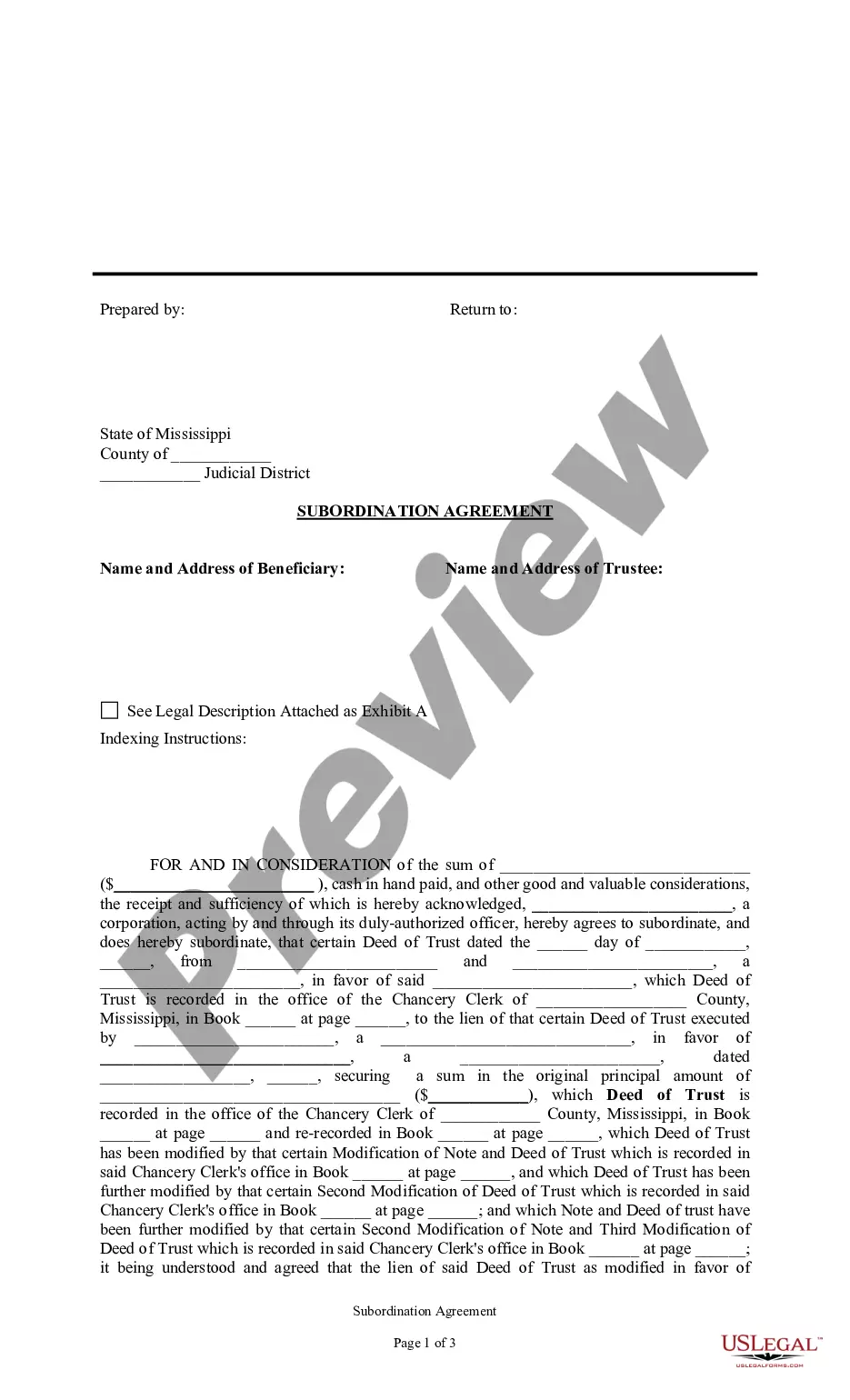

Mississippi Sample Subordination Agreement Re Deed of Trust

Description Deed Of Subordination

How to fill out Mississippi Sample Subordination Agreement Re Deed Of Trust?

Get a printable Mississippi Sample Subordination Agreement Re Deed of Trust within several clicks in the most complete catalogue of legal e-documents. Find, download and print professionally drafted and certified samples on the US Legal Forms website. US Legal Forms has been the Top provider of affordable legal and tax forms for US citizens and residents on-line since 1997.

Users who already have a subscription, need to log in straight into their US Legal Forms account, download the Mississippi Sample Subordination Agreement Re Deed of Trust and find it saved in the My Forms tab. Users who do not have a subscription are required to follow the tips below:

- Make certain your form meets your state’s requirements.

- If provided, read the form’s description to learn more.

- If offered, preview the shape to discover more content.

- Once you’re confident the template meets your requirements, click Buy Now.

- Create a personal account.

- Pick a plan.

- through PayPal or visa or mastercard.

- Download the form in Word or PDF format.

As soon as you’ve downloaded your Mississippi Sample Subordination Agreement Re Deed of Trust, you are able to fill it out in any web-based editor or print it out and complete it manually. Use US Legal Forms to to access 85,000 professionally-drafted, state-specific files.

Form popularity

FAQ

Yes. The deed is a fully legally binding document which can be produced in a court of law as long as it has been signed and executed correctly.

Some owners are put off using solicitors duke to the deed of trust cost. Individuals can write out their own, and use someone else as a witness. However, this may have errors or not be a legally binding document. The investment of getting a deed of trust when buying a property is often worth it in the long term.

Name of the trust. Address of the trust. Objects of the trust (Charitable or Religious) One settlor of the trust. Two trustees of the trust (minimum)

The person who owns the property usually signs a promissory note and a deed of trust. The deed of trust does not have to be recorded to be valid.

Can I make a declaration of trust myself? Some owners are put off using solicitors duke to the deed of trust cost. Individuals can write out their own, and use someone else as a witness. However, this may have errors or not be a legally binding document.

As you stated in your question, it is recorded among the land records, and your lender keeps the original. When you pay off the loan, the lender will return the deed of trust with the promissory note. This document is rather lengthy and quite legalistic.

Whether you have a deed of trust or a mortgage, they both serve to assure that a loan is repaid, either to a lender or an individual person. A mortgage only involves two parties the borrower and the lender. A deed of trust adds an additional party, a trustee, who holds the home's title until the loan is repaid.

Yes, there are key differences between the two. With a deed, you transfer the ownership of the property to one party. In contrast, a deed of trust does not mean the holder owns the property. In an arrangement involving a deed of trust, the borrower signs a contract with the lender with details regarding the loan.

The following states use Deed of Trusts: Alaska, Arizona, California, District of Columbia, Georgia, Mississippi, Missouri, Nevada, North Carolina, and Virginia.