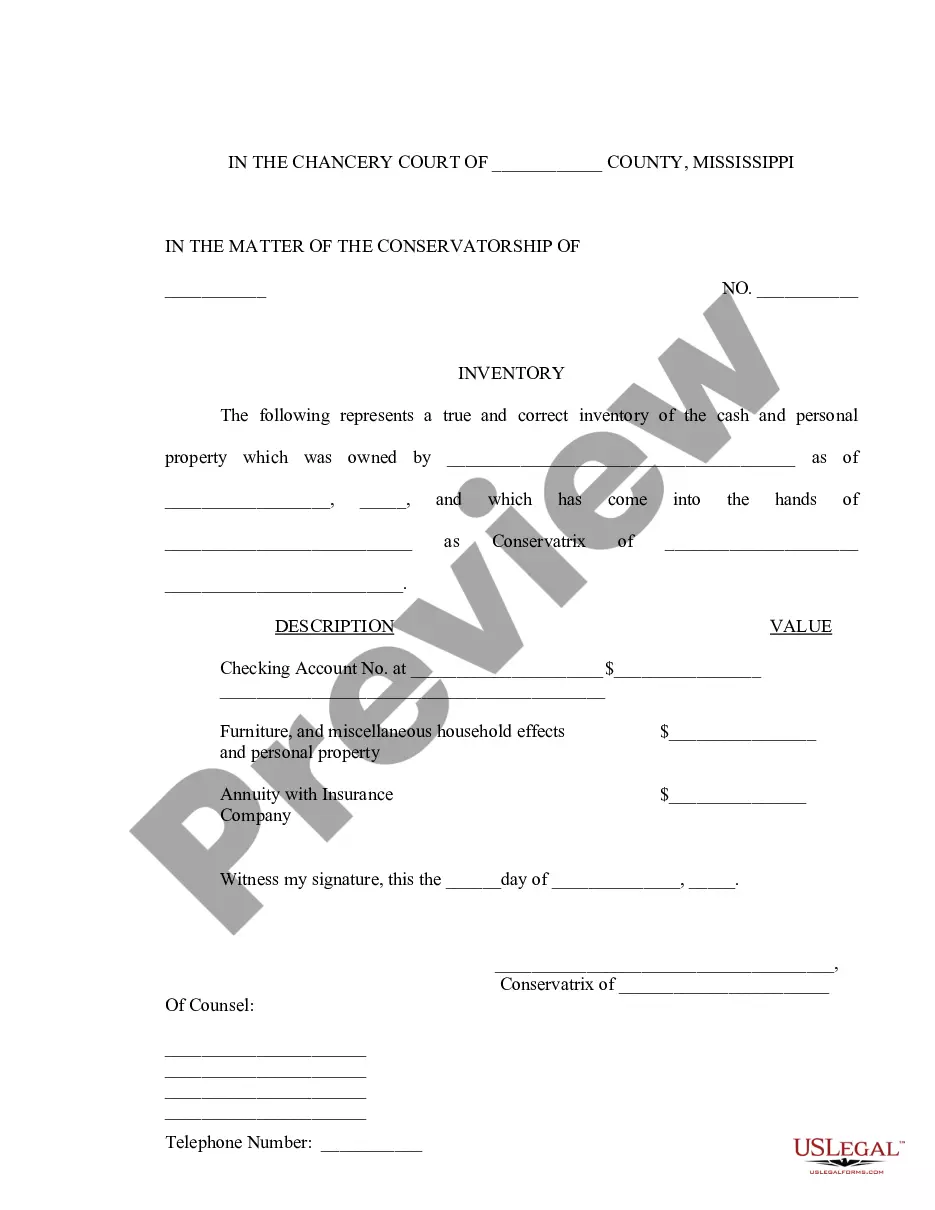

This form is an Inventory of Estate for Filing with the Probate Court as part of an annual inventory and accounting by the executor or administrator of an estate.

Mississippi Inventory of Estate for Filing

Description Ms Inventory Estate

How to fill out Inventory Estate Mississippi?

Obtain a printable Mississippi Inventory of Estate for Filing within several clicks from the most complete catalogue of legal e-forms. Find, download and print professionally drafted and certified samples on the US Legal Forms website. US Legal Forms has been the #1 provider of reasonably priced legal and tax templates for US citizens and residents on-line starting from 1997.

Customers who have already a subscription, must log in into their US Legal Forms account, download the Mississippi Inventory of Estate for Filing and find it saved in the My Forms tab. Users who do not have a subscription must follow the steps listed below:

- Make certain your template meets your state’s requirements.

- If provided, read the form’s description to find out more.

- If accessible, review the shape to find out more content.

- As soon as you are sure the template is right for you, click Buy Now.

- Create a personal account.

- Select a plan.

- Pay via PayPal or bank card.

- Download the form in Word or PDF format.

When you’ve downloaded your Mississippi Inventory of Estate for Filing, you are able to fill it out in any web-based editor or print it out and complete it manually. Use US Legal Forms to to access 85,000 professionally-drafted, state-specific files.

Inventory Filing Template Form popularity

Inventory Estate Blank Other Form Names

Ms Estate Buy FAQ

Real Estate, Bank Accounts, and Vehicles.Stocks and Bonds.Life Insurance and Retirement Plans.Wages and Business Interests.Intellectual Property.Debts and Judgments.

ANSWER: No one should remove items from a home of a person who has died until the executor or administrator of the estate gives approval.The executor also must account for the decedent's interest in real property, which includes things like land, commercial buildings, and homes.

Determine Your State's Laws Regarding Inventory Forms. Review the Instructions Provided. Identify Real Property. Identify Personal Property. Identify Bank Accounts. Identify Retirement Accounts. Identify Non-Probate Assets. File the Form With the Court.

In general, an estate inventory checklist will include financial assets that belonged to the deceased.You will need a certified copy of the death certificate to show the bank to find out the amounts held in each account. Probate inventory samples generally list savings bonds, annuities and certificates of deposit.

Your inventory should include the number of shares of each type of stock, the name of the corporation, and the name of the exchange on which the stock is traded. Meanwhile, you should note the total gross amount of a bond, the name of the entity that issued it, the interest rate on the bond, and its maturity date.

Most of the time, probate is required in Mississippi. Small estates may have a more informal version of probate, and there are other cases where probate isn't necessary. However, for most instances, probate is necessary to distribute the assets of the estate and transfer ownership to the heirs.

In the best of circumstances, the Mississippi probate process usually takes 4 to 6 months. This would only be possible if the estate was fairly simple, all interested parties are agreeable, and documents are signed and returned to the probate attorney in a timely manner.

In Mississippi, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

Net value of probate estate is $50,000 or less, or. Probate asset is bank account or accounts totaling no more than $12,500, or. Probate estate is $500 or less.