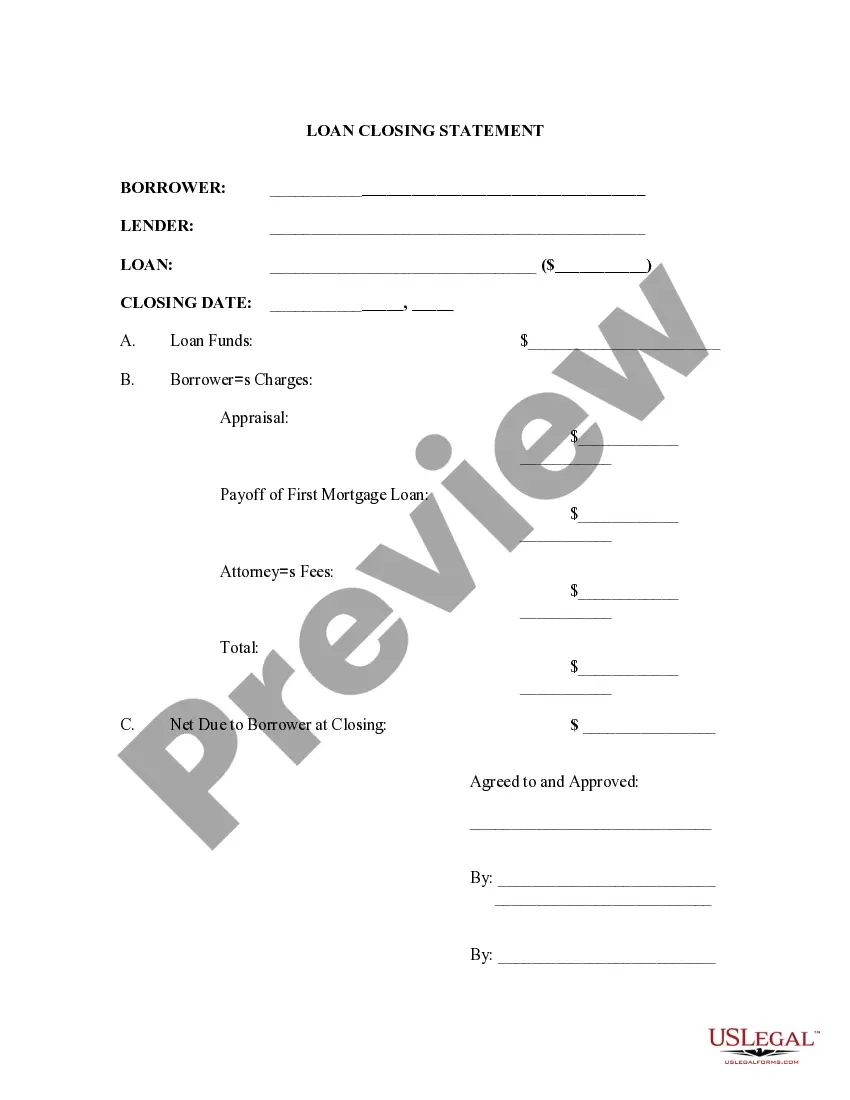

This form is a simple loan closing statement for real estate loans within the State of Mississippi.

Mississippi Simple Loan Closing Statement

Description

How to fill out Mississippi Simple Loan Closing Statement?

Get a printable Mississippi Simple Loan Closing Statement in only several mouse clicks from the most complete catalogue of legal e-files. Find, download and print professionally drafted and certified samples on the US Legal Forms website. US Legal Forms has been the #1 provider of affordable legal and tax forms for US citizens and residents on-line starting from 1997.

Users who have a subscription, must log in directly into their US Legal Forms account, get the Mississippi Simple Loan Closing Statement see it stored in the My Forms tab. Users who don’t have a subscription are required to follow the steps listed below:

- Make certain your template meets your state’s requirements.

- If available, read the form’s description to find out more.

- If readily available, review the shape to view more content.

- When you’re sure the form meets your requirements, just click Buy Now.

- Create a personal account.

- Choose a plan.

- via PayPal or credit card.

- Download the form in Word or PDF format.

Once you’ve downloaded your Mississippi Simple Loan Closing Statement, you are able to fill it out in any online editor or print it out and complete it manually. Use US Legal Forms to to access 85,000 professionally-drafted, state-specific files.

Form popularity

FAQ

The seller's closing statement is an itemized list of fees and credits that shows your net profits as the seller, and summarizes the finances of the entire transaction.

A mortgage closing statement lists all of the costs and fees associated with the loan as well as the total amount and payment schedule.A seller's closing disclosure is prepared by a settlement agent and lists all commissions and costs in addition to the net total to be paid to the seller.

While it's rare, the short answer is yes. After your loan has been deemed clear to close, your lender will update your credit and check your employment status one more time.Even if you left your job for another job with equal pay, your loan could still be denied, or delayed, depending on the type of loan you have.

It outlines the final terms and costs of the mortgage. It's one of the most important pieces of paperwork you'll receive, so check it over carefully. In August 2015, under the direction of the Consumer Financial Protection Bureau (CFPB), the Closing Disclosure Form replaced the HUD-1 settlement statement.

A loan settlement statement provides full disclosure of a loan's terms, but most importantly it details all of the fees and charges that a borrower must pay extraneously from a loan's interest.Generally, loan settlement statements can also be referred to as closing statements.

A settlement statement is also known as a HUD-1 form or a closing statement. Until 2015, when the rules changed, this form was provided twice. First, within three business days of applying for a mortgage loan, the borrower receives one in the mail with the person's estimated closing costs.

A closing statement, also called a HUD-1 statement or settlement sheet, is a form used in real estate transactions with an itemized list of all the costs to the buyer and seller.

A closing statement, also called a HUD-1 statement or settlement sheet, is a form used in real estate transactions with an itemized list of all the costs to the buyer and seller.

In your case, you should start by contacting the settlement agent for the purchase of the home. Depending on how long they retain their records, they should be able to supply you with a copy of your settlement documents.