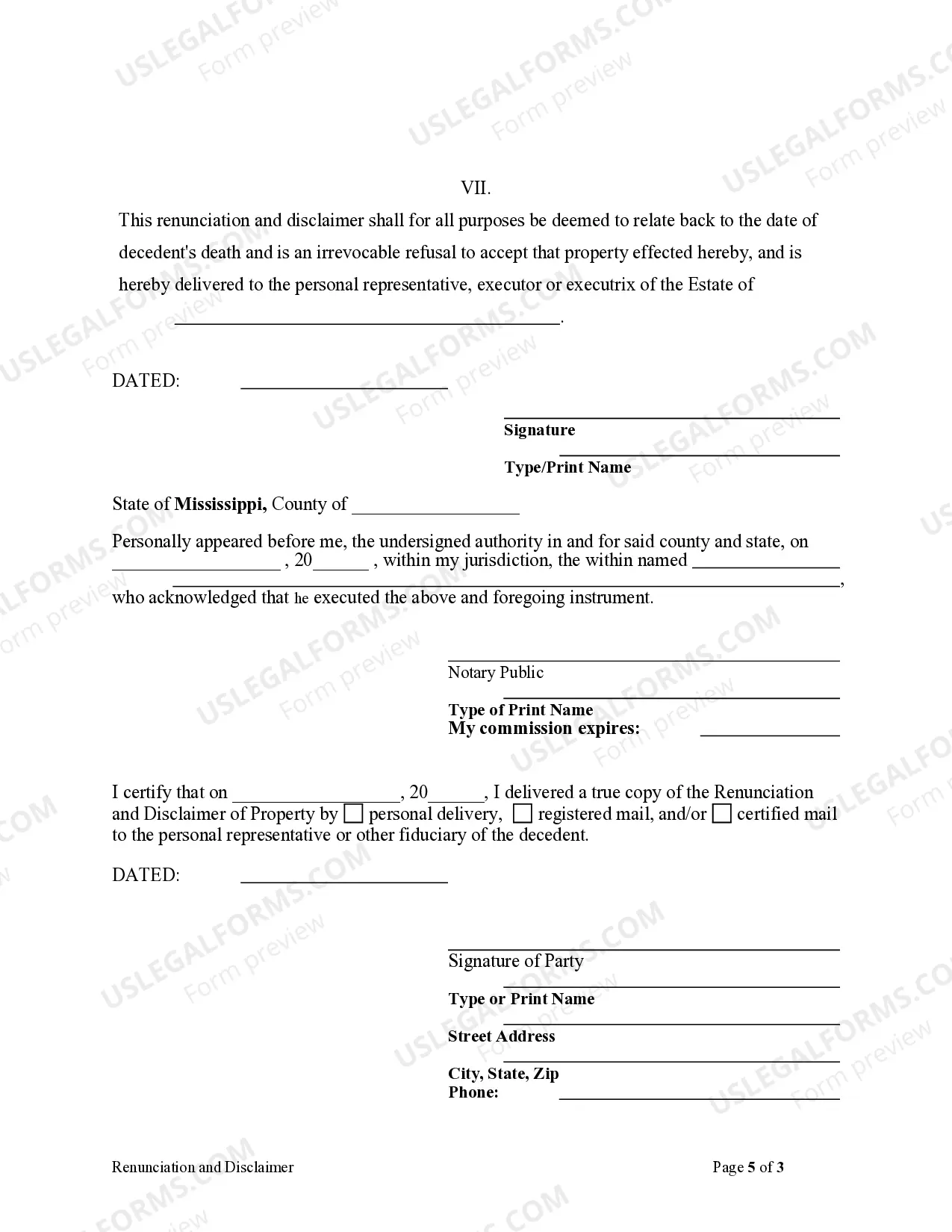

Mississippi Renunciation and Disclaimer of Property - IRA, Annuity or Bond

Description

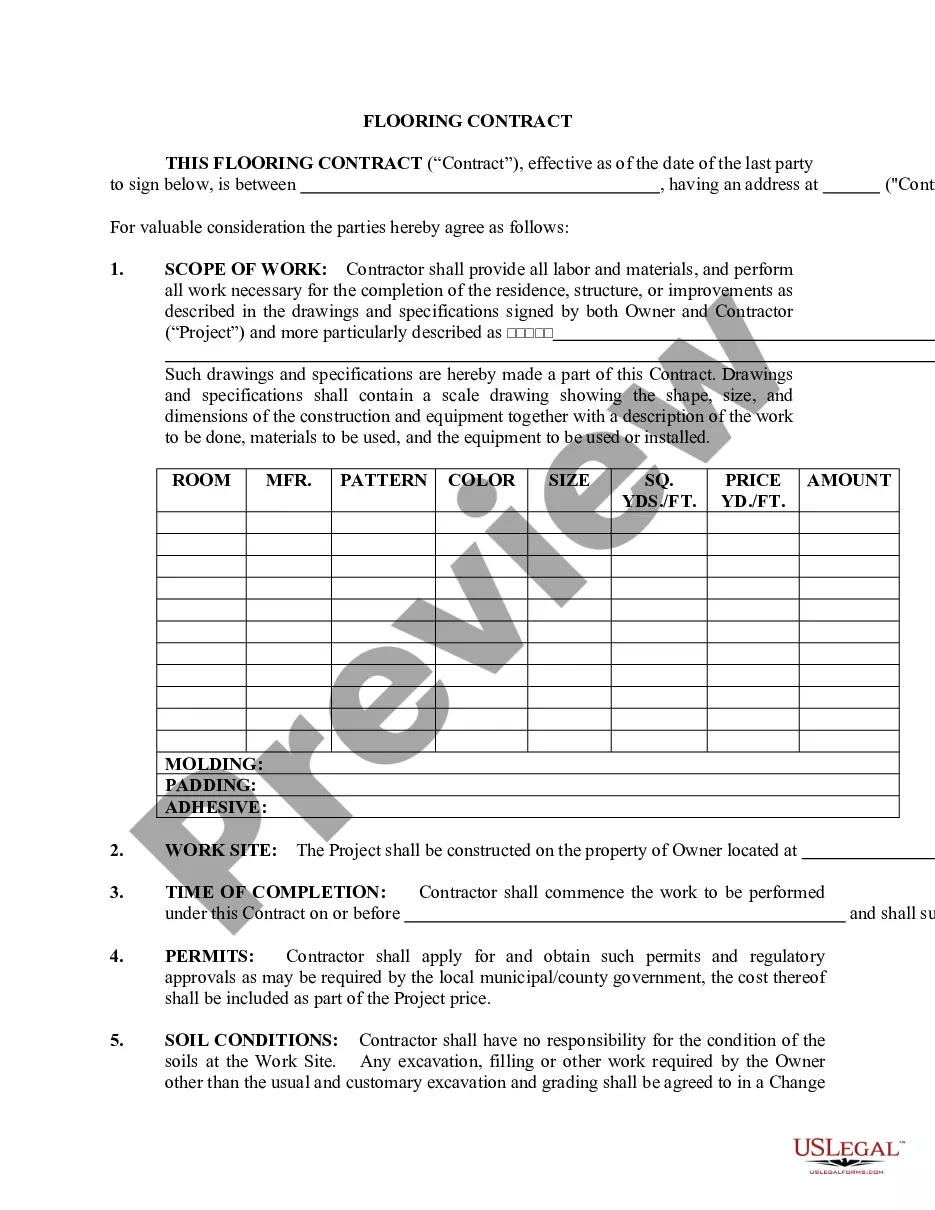

How to fill out Mississippi Renunciation And Disclaimer Of Property - IRA, Annuity Or Bond?

Get a printable Mississippi Renunciation and Disclaimer of Property - IRA, Annuity or Bond in only several clicks in the most comprehensive catalogue of legal e-files. Find, download and print professionally drafted and certified samples on the US Legal Forms website. US Legal Forms has been the #1 supplier of reasonably priced legal and tax templates for US citizens and residents on-line since 1997.

Customers who already have a subscription, must log in in to their US Legal Forms account, get the Mississippi Renunciation and Disclaimer of Property - IRA, Annuity or Bond see it saved in the My Forms tab. Customers who don’t have a subscription are required to follow the tips below:

- Make sure your form meets your state’s requirements.

- If provided, look through form’s description to learn more.

- If readily available, review the form to discover more content.

- As soon as you’re sure the template suits you, simply click Buy Now.

- Create a personal account.

- Choose a plan.

- through PayPal or credit card.

- Download the template in Word or PDF format.

Once you have downloaded your Mississippi Renunciation and Disclaimer of Property - IRA, Annuity or Bond, it is possible to fill it out in any web-based editor or print it out and complete it manually. Use US Legal Forms to to access 85,000 professionally-drafted, state-specific documents.

Form popularity

FAQ

Yes, a fiduciary can disclaim an interest in property if the will, trust or power of attorney gives the fiduciary that authority or if the appropriate probate court authorizes the disclaimer.The primary reason an executor or trustee might disclaim property passing to an estate or trust is to save death taxes.

A disclaimer trust is a clause typically included in a person's will that establishes a trust upon their death, subject to certain specifications. This allows certain assets to be moved into the trust by the surviving spouse without being subject to taxation.

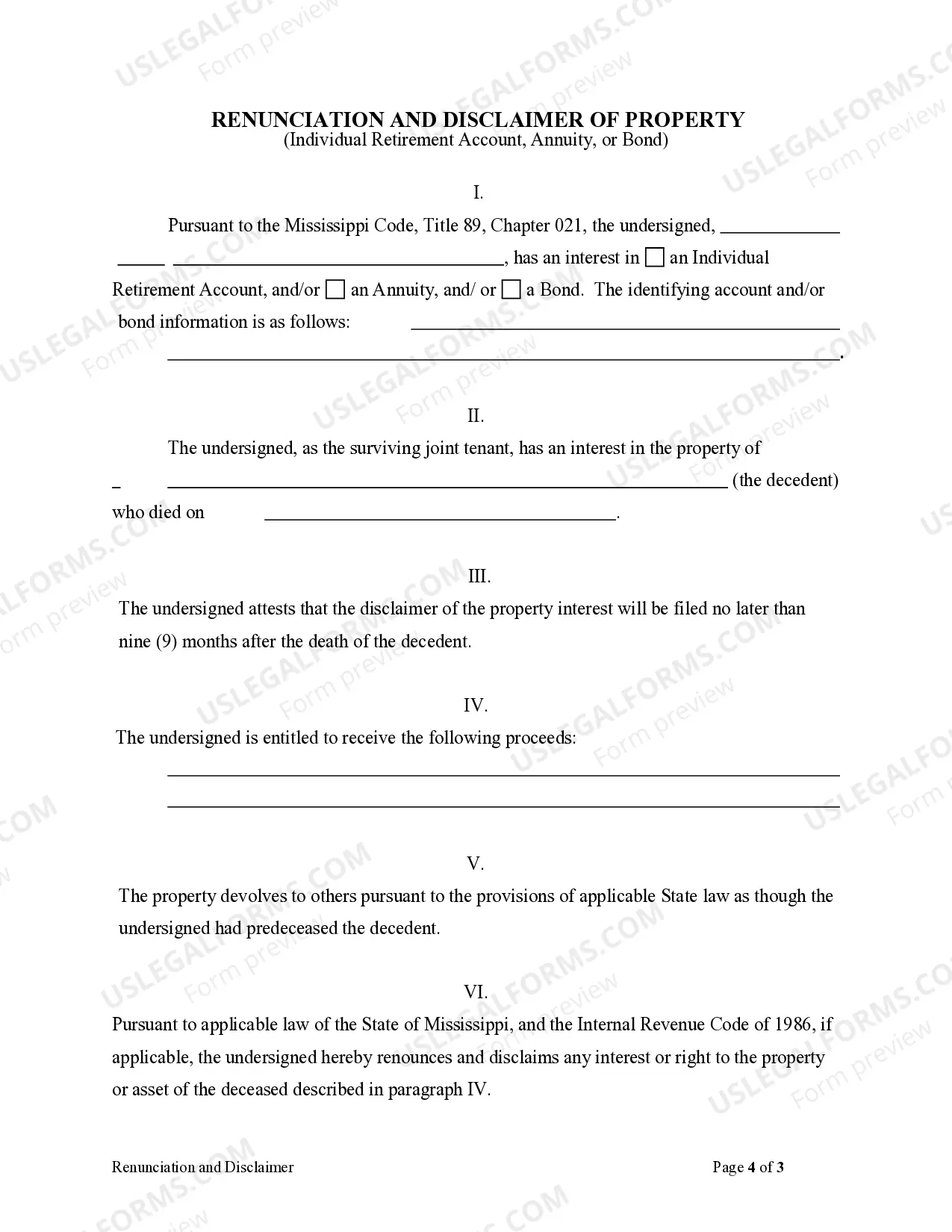

It must be in writing. It must be made within 9 months of the date of death of the decedent. The disclaimant cannot receive any benefits from the assets.

A qualified disclaimer is a part of the U.S. tax code that allows estate assets to pass to a beneficiary without being subject to income tax. Legally, the disclaimer portrays the transfer of assets as if the intended beneficiary never actually received them.

Inherited assets can be disclaimed.When one disclaims an asset, the asset passes as though the beneficiary had died prior to the date of the benefactor's passing. For instance, in the case of an IRA it is pretty simple. If you disclaim all or a part of the IRA, the funds pass on based on the beneficiary designation.

1a : a denial or disavowal of legal claim : relinquishment of or formal refusal to accept an interest or estate. b : a writing that embodies a legal disclaimer. 2a : denial, disavowal. b : repudiation.

Yes, a fiduciary can disclaim an interest in property if the will, trust or power of attorney gives the fiduciary that authority or if the appropriate probate court authorizes the disclaimer.The primary reason an executor or trustee might disclaim property passing to an estate or trust is to save death taxes.

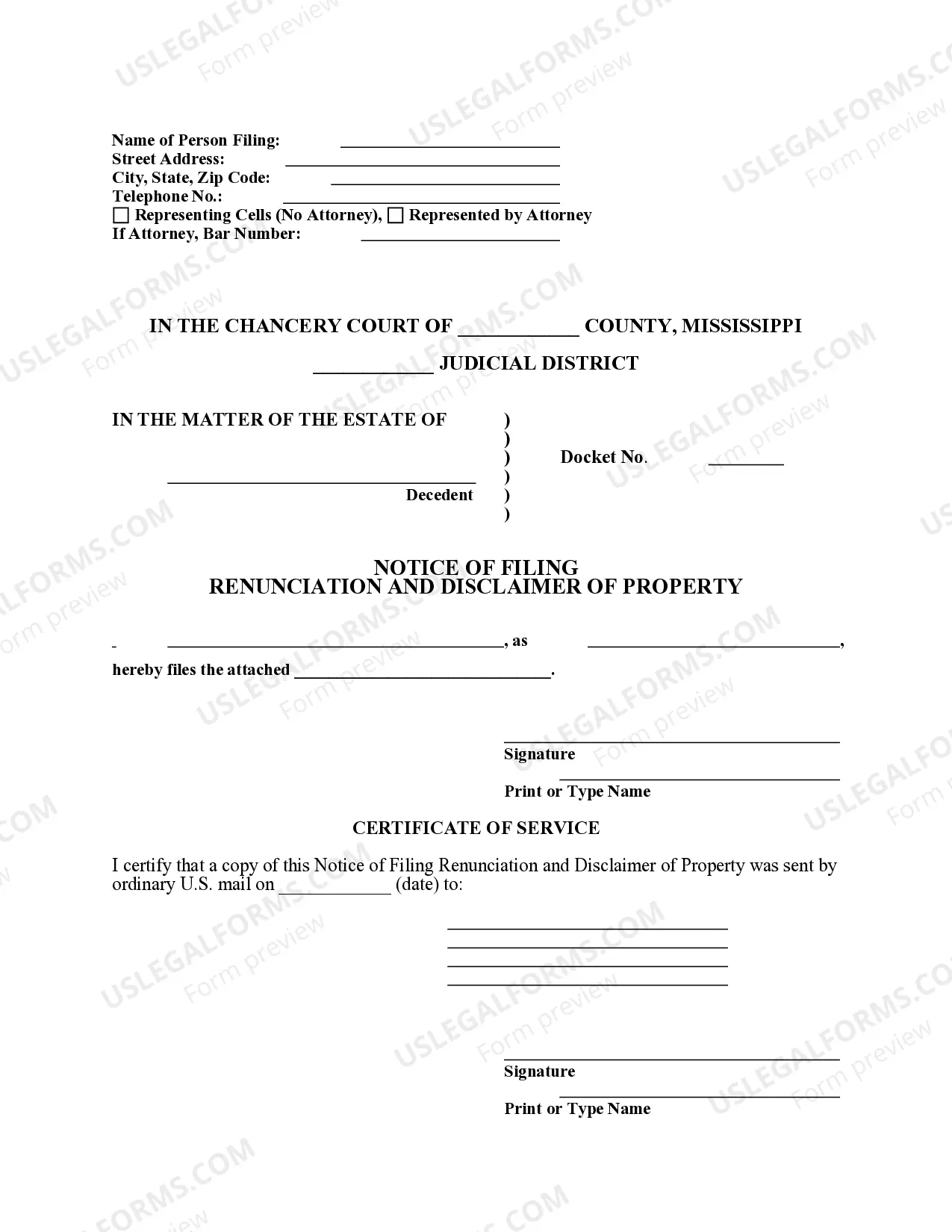

Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property. Do not accept any benefit from the property you're disclaiming.